What is the Average Profit Margin for Small Business? Insights & Tips

July 21, 2025

10 Ways a Personal Budget Can Transform Your Financial Future

July 30, 2025Why Most Small Businesses Get Financial Reporting Wrong

Many small business owners see financial reporting as a chore, something only for tax season or loan applications. This reactive approach can hurt a business’s long-term health and potential. Proper financial reporting should be the foundation of any successful small business. It’s more than just compliance; it’s a powerful tool for making smart decisions. Understanding your finances can determine whether your business thrives or just survives.

The Pitfalls of Neglecting Financial Reports

One of the biggest mistakes small businesses make is not regularly reviewing and analyzing their financial reports. This can cause missed growth opportunities, hidden cash flow issues, and difficulty getting funding.

Imagine a business owner who only checks their bank balance and assumes all is well. They might not notice rising expenses cutting into their profits. They might miss a chance to invest in a new product because they don’t realize how much capital they have.

Inaccurate or incomplete financial reporting can also make it hard to secure loans or attract investors. Lenders and investors need to see clear, consistent, and reliable financial data to assess risk and potential returns. Without this, they might offer less favorable terms or not invest at all.

Transforming Reporting Into a Competitive Advantage

Small businesses can transform financial reporting from a burden into a competitive advantage by being proactive. Regularly reviewing key financial statements, like the income statement, balance sheet, and cash flow statement, provides valuable insights.

These reports help identify trends, improve pricing strategies, and inform decisions about investments and expansion. This proactive approach helps businesses anticipate challenges, seize opportunities, and achieve sustainable growth.

The Financial Reports Every Small Business Actually Needs

Forget complicated spreadsheets and confusing jargon. This section simplifies the essential financial reports that empower smart business decisions. We’ll explain the four core financial statements: the income statement, balance sheet, cash flow statement, and equity statement, showing how each helps you understand your business’s financial health.

Understanding the Core Four

- Income Statement (Profit & Loss): This report shows your business’s profitability over a specific period. It summarizes your revenues and expenses, revealing whether you made a profit or a loss. It’s like a business’s report card, showing its performance during a specific term. Learn more: How to Read Profit and Loss Statements: Quick Guide

- Balance Sheet (Snapshot): This statement provides a snapshot of your business’s financial position at a specific point in time. It shows what your business owns (assets), what it owes (liabilities), and the owner’s investment (equity). Think of it as checking your business’s vital signs at a doctor’s appointment. Learn more: Understanding the Balance Sheet and Why It’s Important

- Cash Flow Statement (Movement of Money): This report tracks cash moving into and out of your business during a specific period. It shows cash flow from operating activities, investing activities, and financing activities. This statement is like tracking your business’s daily calorie intake and expenditure, showing where your money goes.

- Equity Statement (Changes in Ownership): This statement tracks changes in the owner’s investment over time. It details how profits, losses, and owner contributions or withdrawals affect the business’s equity. It’s similar to tracking changes in a property’s value.

Visualizing Your Financials

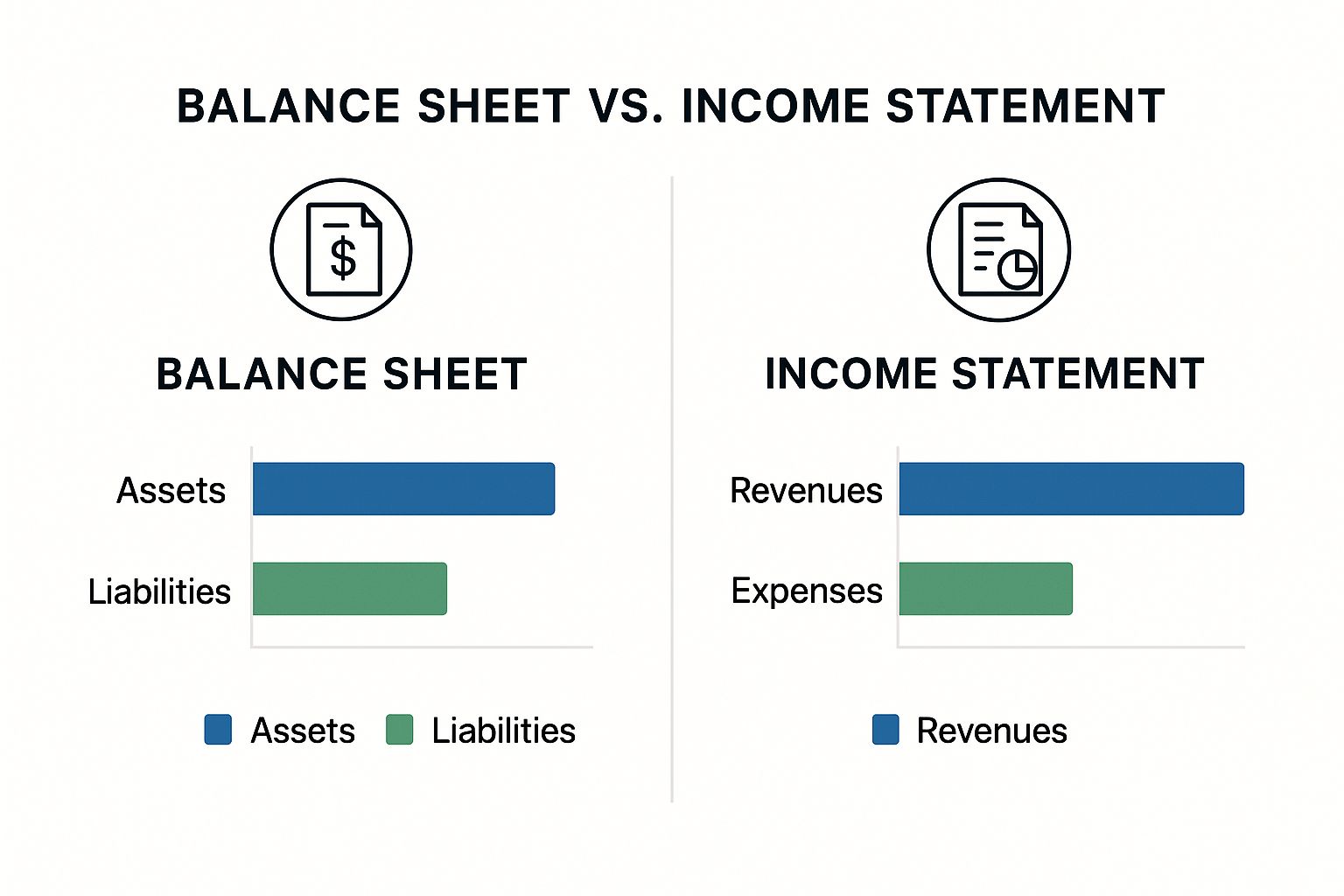

The infographic below compares the balance sheet and income statement, visualizing the relationship between assets and liabilities, and revenues and expenses.

This visualization highlights the core components of these two essential reports. By understanding these interconnected elements, you can get a more complete picture of your financial performance. For example, a healthy balance sheet with more assets than liabilities supports a strong income statement, contributing to positive cash flow. This, in turn, increases equity and builds a foundation for growth.

To further understand the role of each financial statement, let’s take a closer look at how they drive business decisions. The table below provides a more detailed comparison:

Core Financial Statements That Drive Business Growth: A comparison of essential financial statements every small business should maintain, with practical insights on how each drives strategic decision-making

| Financial Statement | What It Really Tells You | Key Metrics That Matter | Red Flags to Watch For | How Often to Review It |

|---|---|---|---|---|

| Income Statement | Profitability over a specific period | Revenue, expenses, net profit/loss | Decreasing revenue, increasing expenses, consistent losses | Monthly, quarterly, annually |

| Balance Sheet | Financial position at a specific point in time | Assets, liabilities, equity | High debt levels, insufficient liquid assets | Quarterly, annually |

| Cash Flow Statement | Cash inflows and outflows over a specific period | Cash from operating, investing, and financing activities | Negative cash flow from operations, inability to meet short-term obligations | Monthly, quarterly |

| Equity Statement | Changes in owner’s investment over time | Owner’s contributions, withdrawals, net income/loss | Significant decrease in equity | Annually |

These reports offer valuable insights into different aspects of your business’s financial health, enabling you to make informed decisions for growth.

Using Reports for Strategic Decision-Making

Financial reports are not just for compliance; they are vital tools for strategic business decisions. For instance, analyzing your income statement helps identify your most and least profitable products or services. This allows you to make informed decisions about pricing, marketing, and product development. The balance sheet shows whether you have enough assets to secure a loan or need to reduce debt. The cash flow statement is crucial for managing expenses and ensuring sufficient cash to meet obligations. These interconnected reports tell a comprehensive financial story, enabling you to proactively manage your business and make data-driven decisions for growth and success.

Overcoming the Real Financial Reporting Roadblocks

Let’s face it: limited time, tight budgets, and overall complexity can make small business financial reporting a real headache. Many business owners simply avoid it. This section offers practical solutions to these common challenges, based on real-world experiences.

Time Management: Streamlining the Process

One of the biggest hurdles is the perceived time commitment. The key is creating streamlined processes. Think of your financial reporting like an assembly line. Each step should flow seamlessly into the next.

- Automate where possible: Use accounting software like Xero to automate tasks like invoicing and expense tracking.

- Set aside dedicated time: Schedule regular blocks of time specifically for financial reporting. Even 30 minutes a week can make a difference. This prevents last-minute scrambling.

- Delegate effectively: If possible, assign tasks to a bookkeeper or virtual assistant.

Budget Constraints: Affordable Tools and Resources

Many small businesses operate on tight budgets. The good news is that affordable tools and resources can simplify financial reporting.

- Free or low-cost accounting software: Explore options like Xero or Wave, which cater specifically to small businesses.

- Free online templates and resources: Utilize readily available templates for creating financial statements and budgets. A simple search can yield numerous results.

Complexity: Simplifying Financial Concepts

Financial jargon and complex concepts can make reporting seem daunting. Breaking these down into manageable pieces is essential.

- Focus on the essentials: Start with the basic financial statements—income statement, balance sheet, and cash flow statement. Understand the purpose of each.

- Seek guidance from mentors or advisors: Connect with seasoned business owners or financial advisors for personalized support. Their experience can be invaluable.

- Utilize free online resources: Many online tutorials and articles explain financial concepts in plain language.

Addressing Common Issues

Beyond time, budget, and complexity, other issues can hinder effective reporting. These include inconsistent record-keeping and mixing personal and business finances.

- Establish consistent routines: Create and maintain a system for tracking income and expenses. Accurate documentation is key.

- Separate business and personal accounts: This simplifies tracking business performance and makes tax preparation significantly easier.

- Prepare for economic turbulence: Adapting reporting strategies during challenging economic times is crucial. This might involve revisiting budgets, exploring alternative funding, or adjusting business operations.

By addressing these common roadblocks, small businesses can transform financial reporting from a dreaded chore into a valuable tool for growth and success. This proactive approach enables better financial management, informed decision-making, and a more resilient business overall.

Turning Financial Reports Into Growth Engines

Small business financial reporting is much more than a legal requirement. It’s a powerful tool for growth. Your financial reports offer a wealth of information beyond simply tracking income and expenses. This information can be used to make strategic decisions that drive your business forward. Successful entrepreneurs understand this and use their reports to gain actionable intelligence, enabling them to make data-driven decisions with confidence.

Uncovering Profitability Patterns and Expense Leaks

Analyzing profitability across different product lines or services is key to leveraging financial reports. You might discover, for example, that one product generates significantly higher profit margins than others. This insight can inform decisions about resource allocation, marketing strategies, and even product development.

Carefully examining your expense reports can also help you pinpoint and eliminate unnecessary costs. This could involve renegotiating contracts with suppliers, streamlining operations, or identifying areas where automation can reduce manual labor.

Recognizing Expansion Opportunities and Benchmarking Performance

Financial reports can also reveal hidden expansion opportunities. Consistently growing demand for a particular product or service, for example, could indicate a market ripe for expansion. This might involve increasing production, targeting new customer segments, or exploring new geographic markets.

Competitive benchmarking, comparing your financial performance to industry averages, provides valuable context. It helps you understand your position in the market, identify areas where you excel, and pinpoint weaknesses that need improvement. This is especially useful in fast-paced industries where staying on top of market trends is crucial.

Creating Custom Dashboards for Critical Metrics

To get the most out of your financial reporting, consider creating custom dashboards. These dashboards should highlight your most critical metrics, providing a quick overview of your key performance indicators (KPIs). This allows you to monitor progress, identify potential problems, and make timely adjustments.

Your dashboard might track metrics like revenue growth, profit margins, customer acquisition cost, and cash flow. Focusing on these essential data points allows you to quickly assess your business’s overall health and make strategic decisions based on real-time insights. This proactive approach empowers you to identify and address potential issues before they escalate, leading to greater financial control and sustained growth. This personalized approach ensures you’re focusing on the data most relevant to your specific business goals.

The Tech Stack That Actually Simplifies Small Business Financial Reporting

Picking the right financial tools can feel like navigating a maze. So many options promise to transform your business, but which ones actually deliver? This section explores the core technologies that truly simplify small business financial reporting, based on practical advice from business owners and financial experts.

Accounting Software: The Foundation of Your Tech Stack

Accounting software is the bedrock of efficient financial reporting. These platforms automate essential tasks, minimizing manual data entry and reducing the risk of errors. They typically offer features like:

- Automated invoicing and billing: This streamlines the payment process and helps improve cash flow.

- Expense tracking: Categorize and monitor your expenses with ease, gaining valuable insights into your spending patterns.

- Financial report generation: Create key financial reports, such as income statements and balance sheets, in just a few clicks.

Popular accounting software options include Xero, which is known for its intuitive interface.

Financial Management Systems: Taking it to the Next Level

As your business grows, you might consider upgrading to a financial management system. These systems offer more advanced features than basic accounting software, such as:

- Budgeting and forecasting: Project your future financial performance and make informed decisions about investments and growth.

- Inventory management: Keep track of inventory levels, anticipate demand, and make smarter purchasing choices.

- Project accounting: Manage project budgets, track expenses, and analyze the profitability of individual projects.

Examples of financial management systems include NetSuite and SAP Business One. These solutions offer powerful functionality but typically involve a higher cost and a steeper learning curve.

Integrations: Multiplying Efficiency

A truly efficient tech stack seamlessly connects different tools. Integrating your accounting software with your CRM, for instance, can automate tasks like sales data entry. Connecting your payment gateway with your accounting platform automatically reconciles transactions, saving you valuable time. While these integrations might not be immediately apparent, they can significantly boost efficiency.

Selecting Tools That Scale With Your Business

Choosing the right tech stack requires careful consideration of both your current and future needs. Look for tools that address your immediate challenges while also offering the flexibility to scale as your business grows.

To help you choose the right software for your business, we’ve compiled a comparison of popular financial reporting tools:

| Software Solution | True Cost (Beyond Subscription) | What It’s Actually Good At | Business Types It Works Best For | Integration Capabilities | Learning Curve Reality |

|---|---|---|---|---|---|

| Xero | Potential add-on costs for payroll, advanced reporting | User-friendly interface, strong mobile app | Small businesses, freelancers | Extensive integrations with various apps | Relatively easy to learn |

| QuickBooks | Higher subscription tiers for more features | Robust features, industry-specific versions | Growing businesses, various industries | Wide range of integrations | Moderate learning curve |

| Wave | Limited features compared to paid options | Free version, basic accounting functionality | Very small businesses, freelancers | Fewer integrations | Simple to use, limited functionality |

| NetSuite | High implementation and customization costs | Advanced features, robust reporting and analytics | Larger businesses, complex needs | Comprehensive integrations | Steep learning curve |

| SAP Business One | Significant investment, requires specialized expertise | Enterprise-grade functionality, scalable solution | Medium to large businesses | Strong integration capabilities | Requires dedicated training and support |

This table provides a side-by-side comparison, allowing you to evaluate different solutions based on factors like cost, functionality, and suitability for your business. Implementing new technology always requires an investment of time and resources. Factor in the true cost, including training and ongoing support, before making your final decision. By strategically choosing the right tech stack and implementing it effectively, you can transform small business financial reporting from a tedious chore into a valuable asset for growth and success.

Compliance Without the Headaches: A Practical Approach

Running a small business can be challenging, and keeping up with regulatory requirements can sometimes feel overwhelming. This section aims to make compliance less stressful and more manageable. We’ll break down essential tax reporting, discuss industry-specific regulations, and offer practical tips for staying compliant without getting bogged down in paperwork.

Understanding Your Tax Reporting Obligations

Small businesses have various tax obligations that depend on their legal structure and industry. These can include income tax, sales tax, payroll tax, and self-employment tax. Understanding these requirements is the first step towards compliance. For instance, sole proprietors report business income and expenses on their personal income tax returns, while corporations file separate company tax returns.

Think of your tax obligations as important appointments. Just like you wouldn’t miss a critical meeting, you shouldn’t miss these deadlines. This proactive approach helps you avoid penalties and keeps your business in good legal standing.

Navigating Industry-Specific Requirements

Beyond general taxes, some industries have specific regulations. A restaurant, for example, must follow specific health and safety rules, while a construction company needs to adhere to building codes and licensing requirements. Understanding these industry-specific rules is crucial to avoid costly fines or legal trouble.

Practical Approaches for Maintaining Compliance

Staying compliant doesn’t have to be a daunting task. Successful businesses use routines and systems to simplify the process. Here are a few strategies:

- Create a compliance calendar: Use a visual tool like a spreadsheet or online calendar to track deadlines for tax filings, license renewals, and other compliance tasks.

- Establish clear documentation procedures: Keep organized records of financial transactions, invoices, receipts, and other important documents. This makes reporting easier and helps demonstrate compliance during audits. Cloud-based storage offers easy access and secure backups.

- Seek professional guidance when needed: Consult with a tax advisor, accountant, or legal professional for complex compliance issues. Their expertise can save you time and money in the long run.

Protecting Your Business From Compliance Pitfalls

By being proactive and organized, you can minimize the risk of errors and penalties. Regularly review your processes and seek expert advice when needed to protect your business and allow you to focus on growth and profitability. Remember, compliance isn’t just a chore; it’s a vital part of running a responsible and successful business.

Looking for expert advice on small business financial reporting and compliance in Auckland? Contact Business Like NZ Ltd at https://businesslike.co.nz. We offer accounting and advisory services to help your business thrive. Our goal is to create financial freedom for our clients, so you can focus on what truly matters – growing your business.