Wiri Business Owners: Why Your Next Accountant Should Be Just Down the Road in Manukau

September 25, 2025

How Easy Is It to Switch Accountants? A Simple 2-Step Guide for Kiwi Businesses

September 26, 2025The Real Cost of Late Payments: Beyond the Bottom Line

Late payments aren’t just an accounting headache—they ripple through your entire operation. When invoices arrive late, small teams juggle urgent tasks with debt collection while leadership scrambles to cover payroll or keep vendor relationships in good standing. Even profitable projects can stall, eroding growth momentum and shifting focus from strategic planning to day-to-day firefighting.

Operational Ripples And Cash Flow Strain

Invisible costs of late payments often go untracked but quickly add up:

- Opportunity Cost: Time spent chasing invoices means fewer hours on revenue-generating activities.

- Team Morale: Repeated stress over cash flow spikes turnover and burnout.

- Vendor Relationships: Delayed outflows force you to push back or renegotiate your own bills.

- Growth Bottlenecks: Unpredictable income forces you to postpone hiring or new investments.

| Region | Overdue Rate | Typical Annual Loss |

|---|---|---|

| United States | 55% | – |

| United Kingdom | 58% | – |

| Major Asia | 60% | – |

| Australia | 80% | $6K–$30K |

Psychological Triggers Behind Payment Delays

Human factors play a big role in whether clients settle invoices on time. Forgetfulness accounts for nearly one-third of late payments, while unclear billing expectations leave clients unsure about amounts or deadlines. Financial stress can also push routine payments to the back burner—this is why clarity up front is crucial to how to get clients to pay on time.

Quantifying Hidden Costs

When you can measure team downtime, forecast cash-flow gaps, and evaluate vendor impacts, payment collection shifts from reactive frustration into a strategic advantage. That insight lets you justify investing in better invoicing tools or revised contract terms. Recognizing these hidden strains paves the way to stronger payment policies and more consistent, on-time cash inflows.

The Hidden Impact of Payment Delays on Your Business

Even a few late invoices can trigger a chain reaction well beyond your balance sheet. When client payments drift past their due date, growth initiatives stall, vendor talks get tense, and your team spends hours chasing paperwork instead of closing deals.

In this bar chart, administrative hours clearly demand the most urgent attention, while vendor penalties and strategic delays also create notable financial strain.

Quantifying Cascading Consequences

To put these figures into everyday terms, consider how each category compounds:

- Opportunity Cost: Time on AR tasks takes your team away from revenue-driving projects.

- Team Morale: Repeated delays increase stress and lower productivity.

- Vendor Relationships: Missing your own payments risks late fees or supply holds.

- Strategic Delays: Postponed investments and hires slow your competitive edge.

Before diving into solutions, let’s look at a detailed breakdown:

Table: The Hidden Costs of Late Payments

This table breaks down the various direct and indirect costs businesses face when dealing with late-paying clients

| Cost Category | Financial Impact | Business Consequences |

|---|---|---|

| Administrative Hours | 208 hrs/year (~$12 K) | Less focus on value-adding activities |

| Opportunity Cost | $15 K | Fewer resources for marketing and product updates |

| Vendor Penalties | $8 K | Higher supplier rates or reduced credit terms |

| Strategic Delays | $20 K | Deferred hiring, stalled expansion |

Key Insight: Administrative hours on follow-ups represent the biggest hidden drain, but every category erodes cash flow and growth.

Turning Insight Into Action

Armed with these numbers, you can take targeted steps to improve cash flow and client habits:

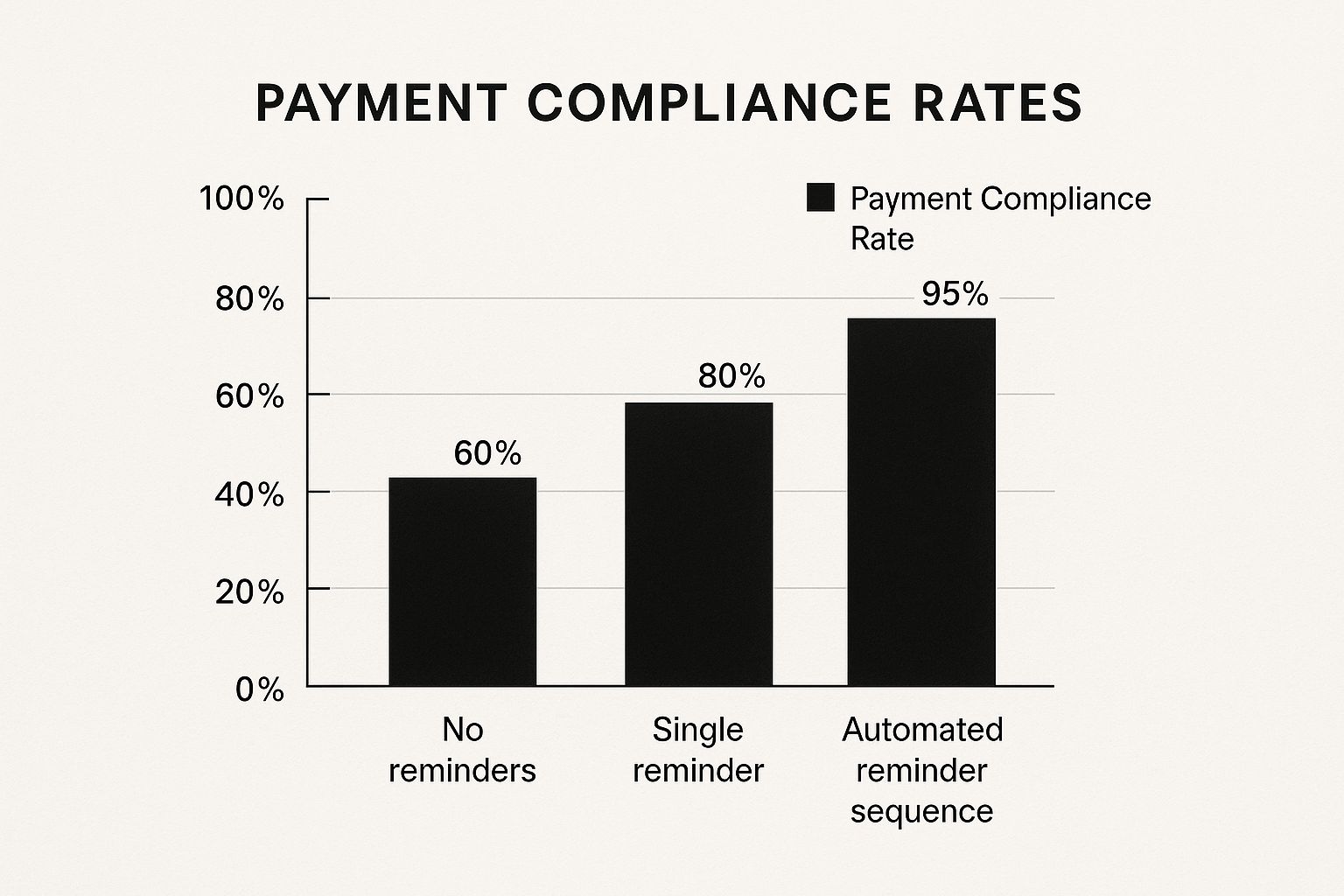

- Implement an automated reminder cadence tied to invoice dates

- Track AR hours and set monthly efficiency goals

- Negotiate early-payment incentives or enforce modest late fees

- Review vendor contracts to guard against your own delays

By measuring these hidden impacts and acting on them, you turn payment collection into a strategic priority—keeping your business on solid ground.

Understanding The New Payment Landscape

Evolving Client Payment Behaviors

As economic pressures rise, evolving payment behaviors are changing how clients settle invoices. Traditional collection methods—friendly phone calls, paper statements and occasional reminders—often miss the mark.

Clients now juggle multiple online portals and subscription services, so invoices can slip through the cracks. This means how to get clients to pay on time starts with matching your process to their daily routines.

By aligning reminders with the channels clients use—email, portal notifications or SMS—you boost the chance of a timely payment. Industries follow distinct patterns, and spotting these helps you anticipate delays rather than just react.

Anticipating Payment Issues Early

By mapping approval workflows and credit habits, you can flag high-risk invoices before due dates arrive. You might set alerts when an invoice crosses key milestones or falls in a high-delay sector.

With these early warnings, you can adjust payment terms, offer incentives for on-time settlement or prioritize follow-ups. Next, we’ll translate these insights into payment terms and invoicing practices designed to keep your cash flow on track without damaging client relationships.

Designing Payment Terms That Actually Get Respected

Establishing clear payment terms is the first step in getting clients to pay on time. Using precise wording sets expectations and cuts down on misunderstandings. For example, saying “Payment due within 30 days of invoice date” leaves no room for debate. Well-defined terms also show professionalism and help protect your cash flow without damaging client relationships.

Payment Deadline Psychology

Human behavior responds better to specific dates than vague requests. Consider these options:

- Due on the 20th of next month: Ties payment to a calendar event

- Due 7 days after invoice: Time pressure!

- Milestone-based billing: Releases funds at agreed project stages

The table below compares clear, enforceable payment terms versus vague, problematic ones.

Effective vs. Ineffective Payment Terms

This comparison table shows examples of clear, enforceable payment terms versus vague, problematic ones

| Payment Term Element | Effective Example | Ineffective Example | Why It Matters |

|---|---|---|---|

| Due Date | “Net 30 from invoice date” | “Pay ASAP” | A fixed deadline reduces back-and-forth |

| Late Fee | “5% fee after 5 days overdue” | “Subject to penalties” | Specific penalties encourage prompt action |

| Early Discount | “2% discount if paid within 10 days” | “Possible discount for early pay” | A clear window creates urgency |

| Payment Method | “Bank transfer or credit card only” | “Multiple options available” | Clear instructions avoid processing delays |

This table shows that precise terms drive faster payments and fewer disputes.

Late Fees That Actually Motivate

A late fee isn’t about punishment—it’s about covering your time. To make fees effective:

- State the exact percentage or flat fee

- Explain when the fee applies (e.g., five days past due)

- Highlight it in both the engagement letter and invoices

By treating late fees as a cost-recovery tool, clients see them as fair and are less likely to argue.

Early Payment Incentives

Offering a 2% discount for payments within 10 days taps into the same urgency as a retail sale. Companies using this tactic often see 25–30% of invoices paid early. Best practices include:

- Displaying the incentive next to the total amount

- Using bold text for the discount period

- Automating reminders that mention the early-pay window

These simple steps reward prompt payment and improve your overall cash flow.

Incorporate these examples into your next contract to balance client goodwill with financial security. For more tips on how to get clients to pay on time and maintain positive relationships, visit Business Like NZ Ltd.

Transforming Your Invoicing System for Faster Payments

Getting invoices paid promptly often comes down to a few practical tweaks. If your current setup leaves gaps, payments may drag out. By refining when you send invoices, clarifying their design, updating delivery options and adding automation, you can reduce average payment time by 20% or more.

Identifying Common Bottlenecks

Many businesses miss simple issues that delay payments:

- Sending invoices late in the month can clash with clients’ closing cycles

- Unclear due dates often cause confusion and slow responses

- Manual follow-ups take hours and tend to slip down the priority list

Fixing these points in order creates a smoother route to on-time payments.

Optimizing Invoice Timing

Aligning invoices with your clients’ schedules helps cash flow:

- Send invoices on the first business day after a project milestone

- Match clients’ month-end or mid-month pay runs

- Pick a consistent weekday for recurring billing

With a steady schedule, clients know exactly when to expect your invoice.

Designing Clear, Compelling Invoices

A clean layout leaves no room for excuses:

- Highlight due dates and total amounts

- Itemize services with concise descriptions

- Add a direct payment link or QR code

Clients spend less time deciphering details and more time clicking “Pay.”

Streamlining Delivery Methods

Choose channels your clients already use:

- Email invoices with embedded payment buttons

- Use a client portal to centralize documents

- Send SMS reminders with secure links

For example, firms using portal notifications see a 15% drop in overdue invoices in one quarter.

Leveraging Automation Tools

Automation removes manual delays:

- Trigger email reminders at 7, 14 and 21 days past invoice date

- Automatically apply late fees when invoices pass due thresholds

- Sync payments instantly with your accounting software

Templates keep the tone friendly while you stay on schedule.

| Feature | Manual Invoicing | Automated Invoicing |

|---|---|---|

| Average Processing Time | 5–7 business days | 1–2 business days |

| Late-Fee Enforcement | 40% consistency | 100% consistency |

| Error Rate | 8% | 1% |

| Follow-Up Effort (hrs) | 10 hrs/month | 1 hr/month |

Key Takeaway: Redesigning your invoicing workflow—from precise timing and clear design to strategic delivery and automation—creates a frictionless payment experience. Implement these steps today and discover a reliable way to get clients to pay on time. For tailored advice, visit Business Like NZ Ltd.

Building Client Relationships That Prioritize Payment

Early dialogue sets the stage for getting clients to pay on time by aligning expectations before any work starts. Research shows that over 48% of invoices from small businesses arrive past due, often because payment terms were never clear. When clients feel informed and respected, they are 35% more likely to pay promptly. By investing in these conversations now, you reduce surprises later and improve your cash flow.

Setting Payment Expectations From Day One

To prevent confusion, outline payment details in your proposal:

- Onboarding Script: “Our standard payment term is Net 30. If there’s any question on timing, let’s address it now.”

- Contract Checklist: Emphasize due dates, accepted methods, and late-fee structures in bold.

- Kickoff Call: Review financial milestones alongside project milestones.

For example, adding “Payment due 15 days from invoice date” in your proposal creates a clear commitment. Clear terms also simplify your billing process and lessen the chance of disputes.

Communication Techniques That Balance Firmness And Respect

A friendly yet assertive tone strengthens trust and protects cash flow:

- “I” Statements: “I noticed the invoice is due tomorrow; can I answer any questions?”

- Regular Check-Ins: Send brief emails or calls around billing dates.

- Value Reminders: Lead with delivered results: “Our work on the XYZ campaign increased leads by 20%—just a heads-up that payment is due next week.”

Table: Reminder Styles and Effects

| Approach | Tone | Client Response |

|---|---|---|

| Soft Reminder | Friendly, brief | 50% acknowledgment rate |

| Firm Reminder | Direct, polite | 70% on-time payments |

| Value-Based Reminder | Proactive, kind | 80% faster payment |

These methods help you shift from collaborator to professional partner with minimal friction.

The Escalation Framework: When Clients Don’t Pay

When polite invoices and friendly reminders don’t secure payment, a clear escalation plan keeps your cash flowing without harming client relationships. Picture it like a traffic signal—green for gentle nudges, yellow for formal notices, and red for outside support. This framework guides you through each stage with consistent messaging to help clients pay on time.

Initial Reminder Sequence

Start with a 3-step reminder schedule before moving to formal notices:

- Day 1 (Green): Send a polite email that mentions the invoice date and asks if anything needs clarification.

- Day 7 (Green): Place a friendly phone call; a brief conversation often resolves the oversight.

- Day 14 (Yellow): Send a second email outlining the outstanding balance and mentioning the next steps.

These short, spaced reminders tap into basic psychology—people act before a small issue becomes a conflict. If this doesn’t work, move on to a formal notice.

Formal Collection Notice

At about 30 days overdue, issue a Formal Notice:

- Use firm but professional language and reference previous reminders.

- Set a clear due date (e.g., “Payment required within 7 days of this notice”).

- Attach the original invoice and any late-fee calculations.

Studies show demand letters can raise payment rates by 25%, as clients recognise the seriousness of the request.

| Stage | Timing | Tone | Action |

|---|---|---|---|

| Initial Reminder | 1–14 days overdue | Friendly, clarifying | Email, phone call |

| Formal Collection | 30 days overdue | Direct, professional | Written demand with late fees |

| Third-Party Escalation | 45+ days overdue | Neutral, procedural | Accountant, collection agency |

| Legal Action | 60+ days overdue | Formal, statutory | Statutory demand or small claims |

Engaging External Support

If an invoice hits 45 days overdue, bring in outside help:

- Ask your accounting professional to review the payment history.

- Hire a collection agency that focuses on preserving client goodwill.

- Offer a final payment plan—sometimes a small concession avoids larger legal fees.

External experts keep your team focused while maintaining an impartial tone in communications.

Legal Considerations And Relationship Balance

For debts over NZD 3,000, New Zealand law allows a statutory demand. But legal action can end a client relationship. To protect your finances and reputation:

- Warn clients before escalating to legal steps.

- Document every reminder and notice as evidence.

- Provide one last payment proposal before filing in small claims court.

Main Takeaway: A staged approach—from friendly reminders to formal demands and, if necessary, legal action—covers all bases and keeps your cash flow steady.

Ready to stop chasing payments and regain control? Contact Business Like NZ Ltd for expert advice on seven ways to increase your cashflow.