Understanding Dividends and Imputation Credits: A Guide for New Zealand Business Owners

August 9, 2025

Building Business Resilience: How to Thrive During Economic Uncertainty

August 11, 2025How to Collect Unpaid Invoices Proven Strategies

Late payments can significantly impact your business’s financial health. More than just a delayed payment, they disrupt your operational cash flow. This can affect your ability to meet immediate obligations like payroll, rent, and inventory purchases. Consistently late payments might force you to rely on short-term loans, leading to more interest expenses and straining your resources. This makes it harder to invest in growth and long-term success.

Hidden Costs Beyond the Invoice Amount

Unpaid invoices create hidden costs beyond the obvious loss of revenue. Chasing payments is a major administrative burden, involving numerous phone calls, emails, and follow-ups. This consumes valuable employee time and resources. Late payments also force you to postpone critical investments in marketing, equipment upgrades, and hiring, hindering your growth potential. These missed opportunities represent a significant, often overlooked, cost.

Quantifying the Cost of Late Payments

Smart businesses track key metrics to quantify the true cost of late payments. These include Days Sales Outstanding (DSO) (the average time to collect payments), the percentage of overdue invoices, and associated administrative costs. Calculating the cost of collections reveals how much money is spent chasing late payments. This data helps prioritize collection efforts, focusing on high-value invoices and persistent late payers, ultimately improving cash flow management. The financial burden of handling late invoices is substantial. Small to medium-sized businesses in the U.S. spend roughly 14 hours per week on this, while small businesses in Australia can lose between $6,000 and $30,000 annually due to unpaid invoices. In the UK, 25.2% of invoices are not paid on time. This highlights the importance of efficient invoice management.

Creating an Invoicing System That Actually Gets You Paid

Getting paid on time starts long before an invoice is due. It begins with a solid, well-thought-out invoicing system. This proactive strategy not only streamlines your accounts receivable but also encourages prompt payments, minimizing the need for chasing clients later.

The Psychology of Prompt Payments

Effective invoicing leverages the psychology behind getting paid quickly. Clear, concise, and professional invoices are more likely to be paid. Make sure your invoices have all the important information: accurate contact details, unique invoice numbers, detailed service descriptions, the total due, and clear payment terms. This eliminates confusion and makes it easier for clients to process payment. A well-designed invoice also reflects well on your business, building trust and professionalism.

Crafting Effective Payment Terms

Your payment terms are key to a successful invoicing system. They should balance protecting your cash flow with maintaining good client relationships. Consider offering early payment discounts as an incentive. For example, a 2% discount for payments within 10 days can significantly speed up payments. Clearly stating penalties for late payments, such as late fees, is also important. This sets clear expectations and encourages timely payment.

The Power of Clear Communication

The language on your invoices makes a difference. Use polite but firm language that clearly states the amount owed and the due date. Phrases like “Please remit payment by [date]” are more effective than vague requests. Personalize your invoices by addressing the client by name and referencing the specific project. This personal touch can improve your chances of prompt payment.

Templates and Best Practices

Standardized invoice templates can simplify your invoicing process. These templates should include all essential details and match your brand’s look and feel. Using accounting software like Xero can automate the process further, from generating invoices to sending reminders and tracking payments. This reduces manual work and errors, freeing you to focus on other parts of your business. Ultimately, a proactive, well-designed invoicing system is your first defense against late payments.

Learn more: Is Xero Right for My Business?

Leveraging Technology To Automate Your Collections Process

Manually chasing late payments is a tedious and inefficient process. Thankfully, technology offers solutions to automate your collections, freeing up time and improving cash flow. This shift towards automation helps businesses collect unpaid invoices more effectively while still maintaining a personal touch.

Automating Payment Reminders

One of the easiest ways to automate your collections is by setting up automatic payment reminders. These reminders can be scheduled a few days before the due date, on the due date itself, and at regular intervals afterward. This consistent communication keeps your invoices front and center for clients, reducing the likelihood of late payments. Plus, automated reminders liberate your team from manual follow-up.

Accounts Receivable Platforms

For more comprehensive automation, consider using accounts receivable (AR) platforms. These platforms integrate with your accounting software like Xero to manage the entire invoicing and collections process. They offer features like automated invoice generation, online payment processing, and detailed reporting on outstanding invoices. This streamlined approach minimizes errors, boosts efficiency, and provides valuable insights into your cash flow.

Implementing and Measuring Automation Success

Implementing automation doesn’t have to be a daunting task. Start small by identifying areas where automation can make the biggest difference, such as payment reminders. Then, gradually integrate more advanced tools like AR platforms as your business grows. Track key metrics like Days Sales Outstanding (DSO) and the percentage of overdue invoices to measure the effectiveness of your automation strategies. These metrics offer valuable insights into how well your strategies are working and can pinpoint areas for improvement. By strategically using technology, you can transform your collections process, free up valuable time and resources, and optimize your cash flow.

The Art of Payment Conversations That Get Results

Successfully collecting unpaid invoices often relies on good communication. This isn’t just about sending generic emails. It’s about understanding people and using strategies that keep clients happy and ensure timely payments. It’s about mastering productive payment conversations.

Crafting Messages That Motivate Action

The first step is creating messages that address potential payment issues before they arise. Instead of just stating the outstanding amount, focus on the value your services provided. For example, start by reminding the client of the positive results they achieved thanks to your work.

This positive reinforcement builds the client relationship and sets a collaborative tone. Also, use specific phrases to encourage prompt payment. Instead of a generic “Please pay your invoice,” try something like, “To ensure uninterrupted service, kindly remit payment by [date].”

This clear language, combined with a gentle reminder of the consequences of non-payment, is often effective. Automated tools can also help with these reminders, similar to the strategies used for abandoned cart emails.

Escalating Communications Effectively

As invoices age, your communication must adapt. Initial reminders can be friendly, but later messages should become more assertive. However, always maintain a respectful tone. This balance requires carefully choosing both your message and communication method.

Choosing the Right Communication Channels

Email is often sufficient for early reminders. For overdue invoices, a phone call can be more effective. This allows direct interaction and helps you understand the reason for the delay. If phone calls don’t work, consider a formal letter. This adds seriousness and shows you’re ready to take further steps.

Responding to Common Excuses

Be prepared for common excuses like lost invoices, processing delays, or service disputes. Have clear answers ready and offer solutions. For instance, if a client says they lost the invoice, quickly resend it with a friendly reminder of the payment terms. This shows you’re willing to work with them and resolves the issue efficiently.

Navigating Difficult Conversations

Sometimes, you’ll have tough conversations with important clients. Empathy and understanding are crucial here. Listen to their concerns and find solutions together. Perhaps a payment plan or a discount for prompt payment could work. By being flexible, you can preserve the relationship and still get paid.

Practical Scripts and Examples

Here’s a sample phone script for an overdue invoice:

- You: “Hi [Client Name], I’m calling about invoice [invoice number] for [amount], which is now overdue. I understand things get missed, so I wanted to see if I could help.”

- Client: “Oh, I apologize. I must have overlooked it. I’ll process it right away.”

This polite script acknowledges a possible oversight and encourages immediate action. Mastering these conversations can greatly improve your invoice collection rates and maintain strong client relationships, boosting your business’s overall health. This proactive approach, combined with consistent follow-up, is key to healthy cash flow.

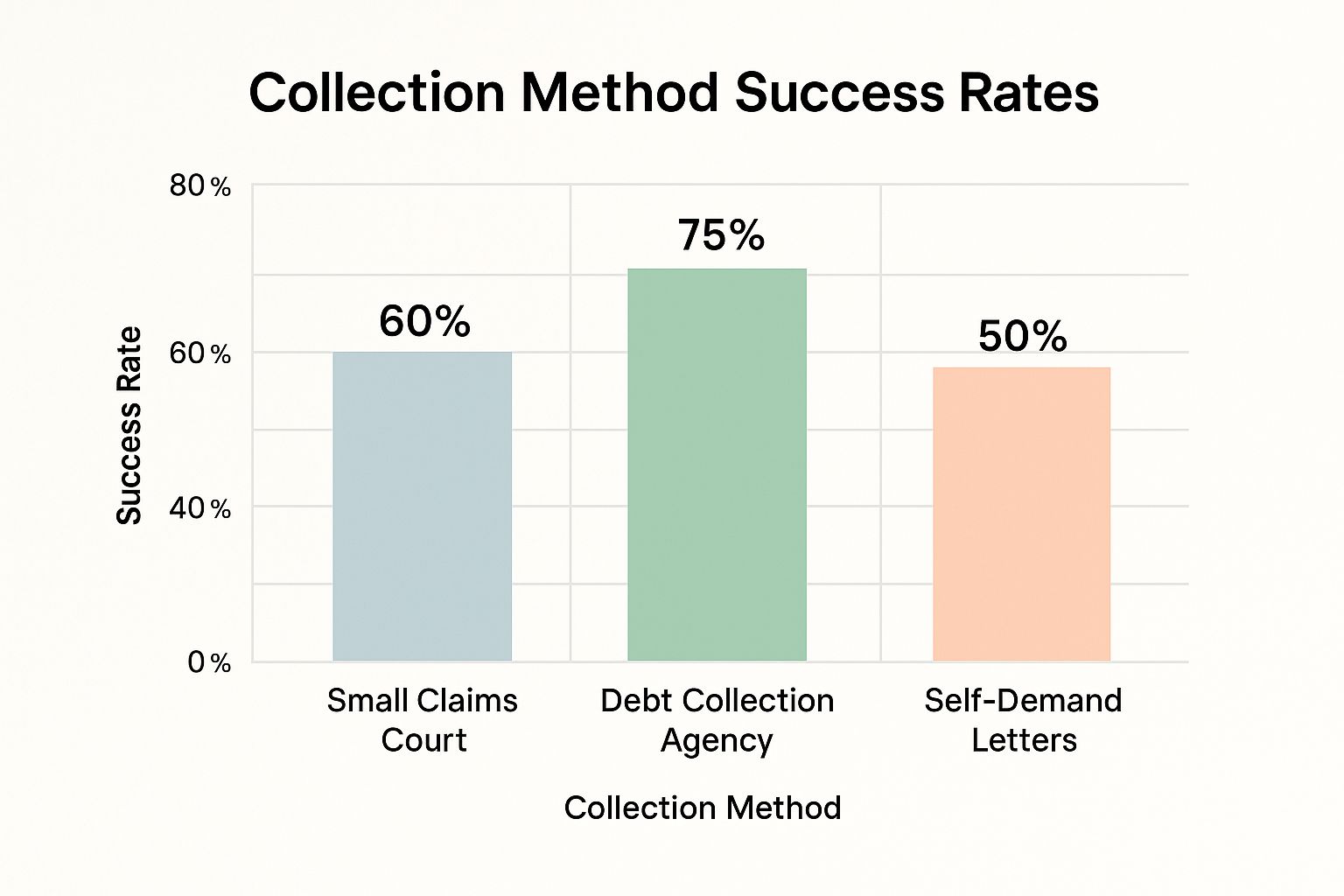

When to Escalate: Legal Options That Protect Your Business

This infographic shows the success rates of different collection methods. Debt collection agencies have the highest success rate at 75%. Small claims court follows at 60%, and self-demand letters come in at 50%. This highlights how important it is to choose the right approach for your specific situation.

Sometimes, friendly reminders and conversations just aren’t enough to get paid. When that happens, escalating to legal action might be necessary to protect your business’s finances. This means understanding the legal options available and when to use them.

Indicators For Legal Action

Knowing when to take legal action is key. A clear sign is persistent non-payment, even after multiple attempts to contact the client. This could include ignored emails, unanswered calls, or broken promises to pay. Another indicator is a client disputing an invoice without a valid reason, especially if they refuse to discuss the issue.

Documentation And Maximizing Recovery

Keeping good records is essential for any legal action. Carefully document all invoices, payment terms, communication with the client, and any related paperwork about the goods or services you provided. This documentation strengthens your case and proves the debt exists. To maximize your recovery, consider negotiating a payment plan or settlement before going to court. This can save time and legal fees while still getting some of the money you’re owed.

Writing Off Bad Debt

Sometimes, writing off bad debt is the best financial move. This is usually true when pursuing legal action costs more than you could potentially recover. It’s also likely the best course of action if the client is unable to pay or has filed for bankruptcy. While writing off bad debt isn’t ideal, it’s sometimes necessary for your business’s financial health. Learn from these situations and put preventative measures in place, like stricter credit checks and better client screening. This will help reduce bad debt in the future. By understanding when and how to use legal options, you can collect unpaid invoices effectively, protect your business’s finances, and ensure long-term stability.

Building a Credit Policy That Prevents Payment Problems

Unpaid invoices can be a real headache. The best way to deal with them? Prevent them altogether. This means establishing a solid credit policy that minimizes the risk of payment issues. By looking at businesses with successful payment track records, we can learn how to create an effective policy.

Client Onboarding and Risk Assessment

A strong credit policy begins with thorough client onboarding. Gather essential information upfront to assess any potential payment risks.

You could also request references from other businesses they’ve worked with. This due diligence can highlight potential problems early in the relationship.

Establishing Appropriate Credit Limits

Setting appropriate credit limits is crucial for protecting your cash flow. Base these limits on the client’s creditworthiness and your business’s own risk tolerance. This prevents you from overextending credit to clients who might struggle to pay.

Consider factors like the client’s industry, payment history, and financial stability. Regularly reviewing and adjusting these limits is vital for managing risk.

Deposits: Balancing Protection and Client Relationships

Requiring deposits offers added security. This upfront payment acts as a cushion against non-payment and demonstrates the client’s commitment.

However, be careful how you present these requirements. You don’t want to discourage potential clients.

The Importance of Clear Contract Language

Well-written contracts are your best protection when payment disputes arise. Include clear language about payment terms, due dates, and penalties for late payment. This clarity minimizes misunderstandings. It also provides leverage if legal action becomes necessary.

Specific clauses about dispute resolution can also help streamline the process if disagreements occur.

Regular Credit Reviews: Strengthening Your Financial Position

Regularly review existing client credit arrangements. This helps you spot changes in a client’s financial situation that could impact their ability to pay.

This allows you to adjust credit limits or payment terms proactively, minimizing potential losses. Schedule these reviews at set intervals or trigger them by specific events, such as a significant change in a client’s order volume.

Flexibility With High-Value Clients

A consistent credit policy is important, but flexibility with key clients is often necessary. You might offer tailored payment terms or higher credit limits to retain their business.

Negotiating mutually beneficial agreements with these clients strengthens relationships while still safeguarding your finances. Finding the right balance between maintaining policy consistency and accommodating valuable clients is crucial for successful credit management.

By implementing these strategies, you create a strong foundation for preventing payment problems and maintaining healthy cash flow. Proactive credit management isn’t just about collecting payments; it’s about building strong client relationships built on trust and clear expectations. This contributes to the long-term financial health and growth of your business.

Are you a small business in Auckland looking for expert advice? Contact Business Like NZ Ltd today at https://businesslike.co.nz for expert guidance on accounting, taxation, and business advisory services. We’re dedicated to helping businesses like yours achieve financial freedom.