Where Do Retained Earnings Go? A Practical Guide for NZ Business Owners

August 21, 2025

Ditch the Card Machine: How Xero Tap to Pay Turns Your Phone into a Payment Terminal

August 29, 2025The Science of Strategic Service Pricing

Pricing a service isn’t as straightforward as pricing a product. You can’t just calculate the cost of materials and add a markup. Services require a deeper understanding of customer psychology and the intangible nature of what’s being offered. For example, a consultant’s value isn’t solely their time, but also their accumulated experience and expertise.

This requires a more strategic approach.

Intangibility and Perceived Value

One of the biggest challenges in service pricing is intangibility. Unlike a product, a service can’t be physically examined, making it harder for customers to assess value. The perceived value often relies heavily on the provider’s reputation, expertise, and the promised results. Therefore, clear communication is paramount to a successful pricing strategy.

Perishability and Heterogeneity: Unique Challenges

Perishability and heterogeneity also play significant roles in service pricing. Services are consumed immediately and can’t be stored like products, meaning capacity management becomes a crucial element of the pricing model. Moreover, services are rarely identical. Each interaction is unique. This requires flexible pricing strategies that accommodate customization and varied service levels. A simple example is a haircut. The price can vary based on the stylist’s experience, the complexity of the cut, or even the salon’s location.

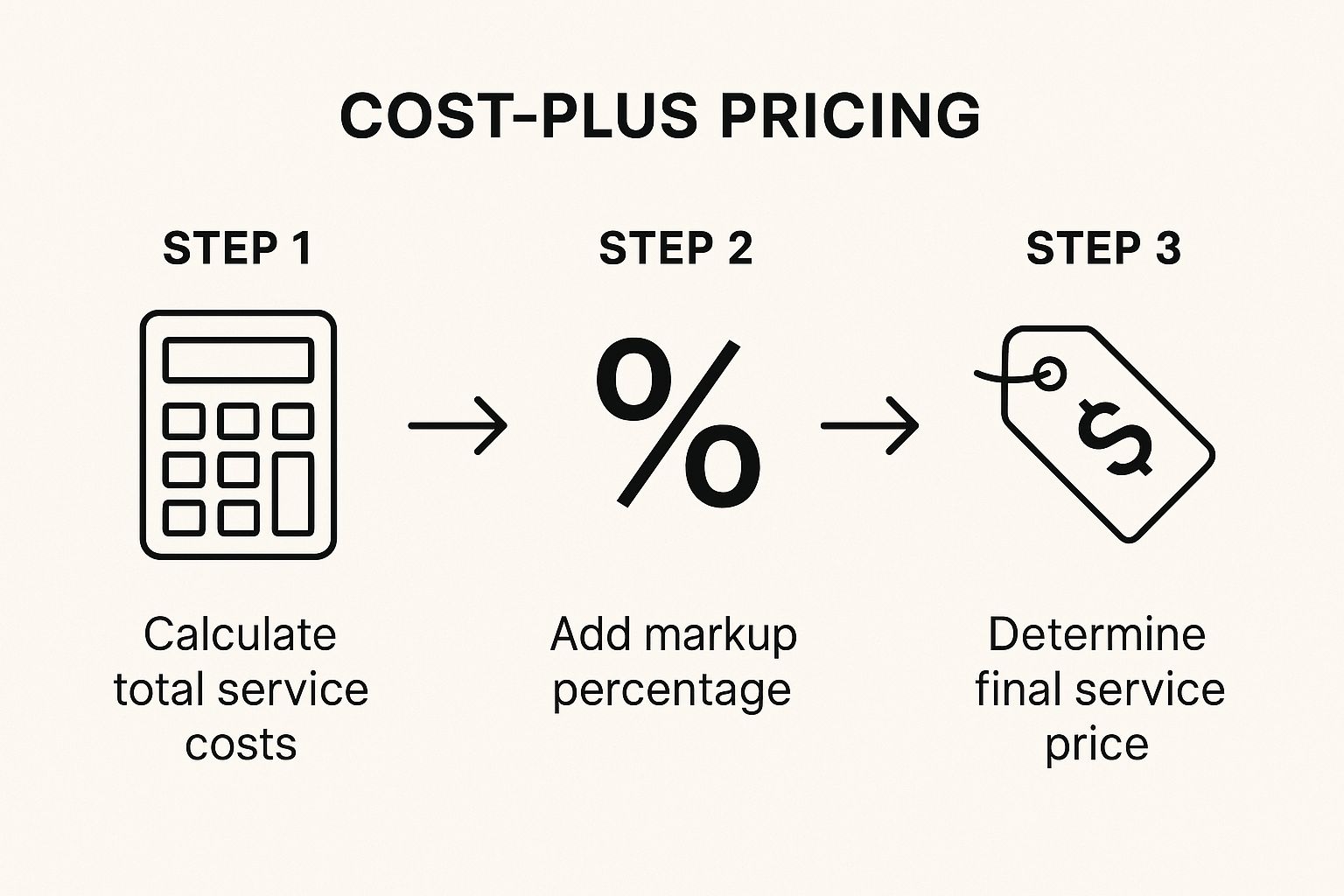

Moving Beyond Cost-Plus Pricing

Traditional cost-plus pricing—simply adding a markup to costs—often isn’t effective for services. A value-based approach, focused on the benefits delivered to the client, proves far more successful. This requires a deep understanding of your target audience and what they are willing to pay for the value you deliver. For instance, a business coach might price their services based on the potential increase in the client’s profits, rather than an hourly rate. This shift highlights the importance of clearly communicating the return on investment (ROI) of your service.

To further illustrate these differences, let’s look at a comparison table.

The following table outlines key pricing considerations for services versus products, along with their strategic implications:

| Factor | Service Pricing | Product Pricing | Strategic Implications |

|---|---|---|---|

| Tangibility | Intangible | Tangible | Building trust and demonstrating value is crucial for service providers. |

| Cost Basis | Primarily labor, expertise, overhead | Materials, manufacturing, distribution | Cost calculation is more complex for services. |

| Value Perception | Subjective, based on perceived benefits | More objective, based on features and comparable products | Effective communication of value is essential in service pricing. |

| Pricing Strategy | Value-based, hourly rates, project-based fees | Cost-plus, competitive pricing, premium pricing | Flexibility is key in service pricing to accommodate client needs. |

| Inventory | No physical inventory | Physical inventory management is crucial | Capacity management and scheduling are important for service providers. |

This table highlights the fundamental differences between pricing services and products. The intangible nature of services requires a more nuanced approach focused on perceived value, while product pricing can rely on more tangible factors.

Understanding these differences is critical for developing effective pricing strategies that drive profitability and customer satisfaction.

Mastering Value-Based Pricing That Actually Works

Value-based pricing is a hot topic, but many businesses struggle to implement it successfully. The key is shifting your mindset from internal costs to the client’s perceived value. This means figuring out the real, tangible benefits you offer. Let’s explore how successful service businesses achieve this.

Quantifying Your Value Contribution

Many service providers, especially those moving away from hourly billing, find it hard to quantify value. But, top service businesses have successfully made this transition. For example, instead of charging by the hour for logo design, a branding agency might base its pricing on the expected boost in brand awareness and customer engagement. This directly links price to the client’s desired results.

Understanding what your customer segments truly value is crucial. This goes beyond basic market research and involves in-depth client conversations. By understanding their pain points, goals, and definition of success, you can tailor your services and pricing to meet their needs.

Building a Value-Based Pricing Model

Once you understand client value, you can create pricing tiers that reflect different value perceptions. This might mean offering packages with varying service levels, features, or support. Think about software subscriptions – a basic plan offers core features, while a premium plan includes extra tools and dedicated support. This lets clients choose the option that fits their budget and needs.

Remember, value isn’t always easy to measure. Calculating the tangible ROI (like increased sales or cost savings) is important, but communicating intangible benefits is also key. This could involve showcasing your expertise, commitment to client success, or the peace of mind you provide.

Shifting the Focus From Cost to Outcomes

Finally, focus your proposals on outcomes, not costs. Clearly explain the value you offer and how your services will help clients reach their objectives. For example, a marketing agency might highlight projected increases in leads and conversions, rather than just the cost of services. This shifts the conversation from price to value, justifying your pricing strategy. By linking your services to client success, you can effectively implement value-based pricing that resonates with your target audience.

To help you implement value-based pricing, the following table outlines a practical framework.

This table, “Value-Based Pricing Implementation Framework,” provides a step-by-step process for service businesses, including key metrics to track.

| Implementation Step | Key Activities | Success Metrics | Common Pitfalls |

|---|---|---|---|

| Understand Client Value | Conduct client interviews, analyze customer data, perform competitive analysis | Increased client engagement, improved customer satisfaction scores | Relying on assumptions, overlooking intangible benefits |

| Quantify Your Value | Define key performance indicators (KPIs), develop a value calculator, track results | Measurable ROI, increased client lifetime value | Difficulty in measuring intangible benefits, focusing solely on cost reduction |

| Develop Pricing Tiers | Create service packages, define pricing levels, test pricing strategies | Increased sales conversions, improved average deal size | Pricing tiers too complex, not aligned with client value |

| Communicate Value Effectively | Craft compelling proposals, highlight client outcomes, train sales teams | Increased proposal acceptance rates, higher customer retention | Focusing on features instead of benefits, failing to address client pain points |

This framework highlights the crucial steps and metrics for implementing value-based pricing. By following these steps and tracking the relevant metrics, service businesses can effectively transition to a value-based pricing model and achieve sustainable growth.

Competitive Pricing Without Starting a Price War

In today’s competitive service market, standing out is essential. But achieving this doesn’t always mean offering the lowest price. It’s about strategic positioning. A thorough competitive analysis involves understanding your competitors’ strengths and weaknesses, not just their prices. This section explores how to price your services competitively while protecting your profits.

Differentiating Your Services

Even seemingly identical services offer opportunities for differentiation. Think of two accounting firms offering similar tax preparation. One might specialize in e-commerce businesses, while the other prioritizes excellent client communication. This specialization allows them to target specific clients and justify different price points.

Bundling services is another way to stand out. Packaging related services together provides more value and convenience, potentially increasing your average transaction value. This can also broaden your customer base.

Identifying Pricing Opportunities in Saturated Markets

Saturated markets are challenging, but they also hide opportunities. Analyzing your competitors’ pricing can reveal gaps and unmet needs. Maybe they’re overlooking a specific customer segment or not offering certain valuable services. These overlooked areas can be your chance to create a competitive advantage.

Maintaining Premium Positioning Despite Lower-Priced Alternatives

Facing lower-priced competitors requires a strong value proposition. Clearly communicate the unique benefits justifying your higher prices. This could be specialized expertise, faster turnaround times, or superior customer service.

Pricing architecture also reinforces premium positioning. Structuring your pricing tiers strategically creates a sense of exclusivity and value. For example, a premium package with extra features and personalized support attracts clients willing to pay more for a higher level of service. This approach allows you to compete effectively without getting into a price war.

Dynamic Pricing Strategies That Clients Accept

Dynamic pricing, the practice of adjusting prices based on real-time factors, can optimize revenue for service businesses. However, implementing it without alienating clients requires careful planning. This means going beyond simply raising prices during peak times and focusing on a system clients understand and accept.

Understanding the Need for Dynamic Pricing

Static pricing can mean missed revenue opportunities, especially in markets with fluctuating demand. Imagine a popular restaurant always packed on Friday nights but empty on Tuesdays. Dynamic pricing lets them maximize profits during peak demand while potentially attracting more customers during slower periods. This could mean offering discounts during off-peak times or charging more for premium services when demand is high.

The increasing complexity of the business world also makes dynamic pricing more relevant. The consumer goods industry, for example, faces volatile freight costs, sometimes reaching nearly four times higher than in 2023. This volatility impacts the pricing of related services, encouraging businesses to adopt more flexible pricing models.

Implementing Dynamic Pricing Effectively

Several strategies help businesses successfully implement dynamic pricing. Surge pricing, commonly used by ride-sharing services like Uber, adjusts prices during periods of high demand. This common approach requires clear communication to avoid customer frustration.

Time-based differentials offer a simpler, more predictable approach. Prices vary based on the time of day or week. This might involve discounted services during off-peak hours or higher rates during peak times. This predictable model offers clients more transparency.

Demand-responsive models are more complex, adjusting prices based on real-time demand and capacity utilization. This system needs robust technology and data analysis but offers significant potential for revenue optimization. This approach suits appointment-based businesses like salons or consultants.

Communicating Dynamic Pricing Transparently

Transparency and client communication are essential for dynamic pricing to work. Clearly explaining the reasons behind price changes builds trust and reduces resistance. For instance, a service provider might explain how peak pricing allows them to invest in better service quality. They could also highlight how off-peak discounts incentivize customers to use services during less busy times.

Using technology can also improve transparency. Real-time pricing displayed on websites or apps gives clients clear information upfront, offering more control and preventing unpleasant surprises.

Transitioning to Dynamic Pricing

A gradual introduction of dynamic pricing can ease the transition for existing clients. Start with small price adjustments and clearly communicate any changes. Incentives, such as loyalty programs or early booking discounts, can encourage clients to accept the new pricing model. This gives clients time to adjust to the changes.

By carefully selecting the right strategies and communicating them transparently, service businesses can effectively implement dynamic pricing. They can achieve sustainable revenue growth without compromising client trust.

The Psychology Behind Service Pricing That Converts

Dynamic pricing and competitive analysis are important factors to consider when setting prices. But truly effective pricing for services goes deeper, delving into the psychology of the customer. This means understanding how people perceive value and make decisions when they buy. This section explores proven tactics to increase your service conversion rates.

The Power of Anchor Pricing

Anchor pricing uses our tendency to rely heavily on the first piece of information we see. For example, if a consultant first shows a high-priced premium package, other lower-priced options seem more reasonable. This initial “anchor” price creates a reference point, changing how we see value. Retailers often use this effect. An initial higher price makes a sale price seem like a much better deal.

Utilizing Comparison Biases With Tiered Offerings

Presenting services in tiers activates comparison bias. Offering multiple packages, from basic to premium, encourages clients to compare them. This often leads them to a mid-tier option, even if they weren’t originally thinking about it. People tend to avoid extremes. They are drawn toward options that look like the “best value.”

Framing For Willingness to Pay

How you frame your pricing strongly affects how much a client is willing to pay. Highlighting the potential benefits of your service, instead of just the cost, is much more persuasive. For example, focusing on increased efficiency a client gains from a virtual assistant, rather than the hourly rate, frames the service as an investment.

Bundling and Unbundling for Reduced Price Sensitivity

Strategic bundling can make people less worried about the price. Combining related services into one package makes the overall value seem higher. It also makes it harder to compare individual prices. On the other hand, unbundling can work well when clients are very price-conscious. By separating services into smaller parts, you give them flexibility. Clients can choose exactly what they need. This also creates a lower starting price, which can lead to upselling later on.

Positioning Premium Offerings

Successfully positioning premium services helps maximize both conversions and average transaction value. Emphasizing the unique benefits of premium services, such as expert knowledge or priority support, justifies the higher cost. For instance, a premium accounting service might offer personalized financial planning. It could also give priority access to advisors. These additions appeal to clients who want personalized service.

Ethical Considerations

While understanding pricing psychology is valuable, it’s important to use these principles ethically. Avoid tactics that mislead clients or put pressure on them. Transparency and honesty build trust and long-term client relationships. Focus on genuine value and clear communication. This way, you can use psychology to create a successful pricing strategy while keeping your business practices ethical.

Implementing Your Pricing Strategy With Confidence

A well-crafted pricing strategy needs effective implementation. This means tackling the practical side of rolling out new prices and making sure your team understands and communicates them well. This section will guide you through implementing your chosen pricing strategy with confidence.

Communicating Price Changes to Existing Clients

Telling existing clients about price changes requires careful handling and a clear communication plan. A sudden, unexplained price increase can harm client relationships. Instead, present the change positively, highlighting improvements in service quality, new features, or other benefits that justify the new price. For example, explain how the increase lets you invest in better technology or hire skilled staff, ultimately benefiting the client.

Give plenty of notice before changing prices. This allows clients to adjust their budgets and avoids surprises. A timely email or personalized letter explaining the reasons behind the change helps maintain transparency and trust.

Handling Objections and Training Your Team

Prepare your team to confidently address client questions about pricing. This means developing clear scripts and providing thorough training. If a client questions a higher price, your team should be able to explain the value proposition and how the service provides a positive return on investment. This reinforces your service’s value and demonstrates confidence in your pricing.

Consistency in how your team presents pricing is key. Develop internal guidelines and training to ensure everyone communicates pricing clearly and confidently. This creates a united front and prevents confusion that could undermine your strategy. For instance, a training module on pricing could be included in onboarding for new staff, with regular refreshers to maintain consistent messaging.

Creating Effective Pricing Pages and Proposals

Your pricing page is often the first place potential clients look to evaluate your services. Keep it clear, concise, and compelling. Anticipate common questions and answer them upfront. A table comparing different pricing tiers can help clients quickly understand their options and choose the best fit. This improves their experience and encourages conversions.

Similarly, create proposals that highlight the value you offer, not just the cost. Focus on client outcomes and how your services will help them achieve their goals. A professional template reinforces your brand and emphasizes value over price. This justifies your pricing and positions your services as an investment.

Maintaining Pricing Discipline and Flexibility

Internal guidelines are important for consistent pricing while allowing for flexibility. These guidelines should define acceptable discounts, special offers, and negotiation limits. This ensures consistency and prevents underselling. However, allow some flexibility for specific client needs or unique project requirements. This balance helps maintain profitability while building strong client relationships.

By following these steps, you can confidently implement your pricing strategy and build a foundation for long-term success. A strong implementation plan strengthens client relationships, maximizes revenue, and positions your business for sustainable growth. This careful approach paves the way for a robust and rewarding pricing system.

Measuring What Matters in Service Pricing

Strategic pricing isn’t something you set up once and then forget about. It needs regular adjustments based on relevant data. This means going beyond simple revenue figures and understanding the key performance indicators (KPIs) that truly reflect the success of your pricing strategy.

KPIs Beyond Revenue: A Deeper Dive

Revenue is important, of course, but it only tells part of the story. Other KPIs give you a more complete picture of how well your pricing strategy is working. For example, customer lifetime value (CLTV) shows the total revenue you can expect from a single customer throughout their entire relationship with your business. A higher CLTV usually means your pricing strategy is attracting and keeping valuable customers.

Customer churn rate is another key metric. This is the percentage of customers who cancel their service within a given period. A high churn rate, especially after a price change, can be a warning sign of pricing problems. You should also keep an eye on your average deal size. This tells you the average revenue generated per customer transaction. An increasing average deal size suggests that clients are seeing value in, and purchasing, higher-priced services, which reflects well on your pricing strategy.

Testing and Validation: Minimizing Risk

Leading service businesses don’t just guess when it comes to changing prices; they test. A/B testing, where you compare two different pricing options, lets you see how changes affect conversion rates and sales. You might, for instance, test two different pricing tiers for a new consulting package and see which one generates more sign-ups. This data-driven approach helps you make informed decisions and minimize potential risks.

Client Feedback: Understanding Perceptions

Direct feedback from your clients is incredibly valuable. It gives you insight into what they think about your pricing. Surveys, feedback forms, or even informal conversations can reveal whether they feel your prices are fair and reflect the value you offer. This understanding can help you adjust your pricing strategy to better meet client expectations. For example, if you consistently hear that a particular service is overpriced, that’s a clear sign to review your pricing structure.

Pricing and Profitability: A Critical Link

It’s crucial to analyze how pricing and profitability connect. This involves understanding your costs and how different price points impact your profit margins. Building a profitability model can help you visualize this relationship, allowing you to find the sweet spot where you maximize revenue while still maintaining healthy profits. This data-driven approach ensures your pricing decisions support your overall business goals.

Building a Data-Informed Pricing Culture

Building a culture that values data is essential for continually improving your pricing. Regularly review and adjust your pricing strategy. Create a framework for checking pricing performance against your KPIs. Keep track of what your competitors are doing with their pricing to gain market insights. Continuously refining your approach helps you adapt to market changes and evolving customer needs. This proactive approach ensures your pricing strategy stays competitive and effective over the long term.

Ready to take control of your business finances and develop a winning pricing strategy? Business Like NZ Ltd can help. We offer expert advice and support for small to medium businesses in Auckland.