How Smarter Financial Reporting Drives Faster Business Growth in New Zealand

July 19, 2025

What is the Average Profit Margin for Small Business? Insights & Tips

July 21, 2025Understanding Where Your Money Really Goes

Let’s be honest, many businesses unknowingly lose money. Hidden costs can quietly drain budgets every month, impacting overall profitability. This section explores how successful business owners identify these hidden drains and take back control of their finances. To effectively reduce expenses, you first need to understand where your money is actually going. For a comprehensive guide to identifying cost-cutting opportunities, see these Business Cost Cutting Ideas.

Conduct a Thorough Expense Audit

A crucial first step is conducting a comprehensive expense audit. This involves carefully reviewing every single expense, from recurring subscriptions to one-time purchases. This review process can often reveal surprising spending patterns. For example, you might find unused software subscriptions or discover inefficient procedures. These seemingly small expenses can add up significantly over time.

Categorize Your Expenses

After auditing your expenses, categorize them for clearer analysis. Common categories include operating expenses, marketing costs, and payroll. This categorization gives you a better understanding of your spending distribution. It also helps identify areas with disproportionately high costs. This knowledge is key for targeted cost reduction.

Establish Key Performance Indicators (KPIs)

Next, establish relevant Key Performance Indicators (KPIs). These metrics provide valuable data to track your progress and identify areas for improvement. For example, consider tracking your customer acquisition cost (CAC) or employee productivity. Regularly monitoring KPIs provides useful insights into the effectiveness of your cost reduction strategies. This data-driven approach enables you to make necessary adjustments to maximize your savings. You might be interested in: How to master business growth strategies.

Go Beyond Traditional Expense Tracking

Traditional expense tracking methods often fall short. They usually focus on recording expenses without analyzing their underlying causes or finding potential savings. Simply knowing what you’re spending isn’t enough. You need to understand why. A deep understanding of your spending habits is essential for reducing business expenses. This requires regular review of your categorized expenses and KPIs to identify trends and improvement areas.

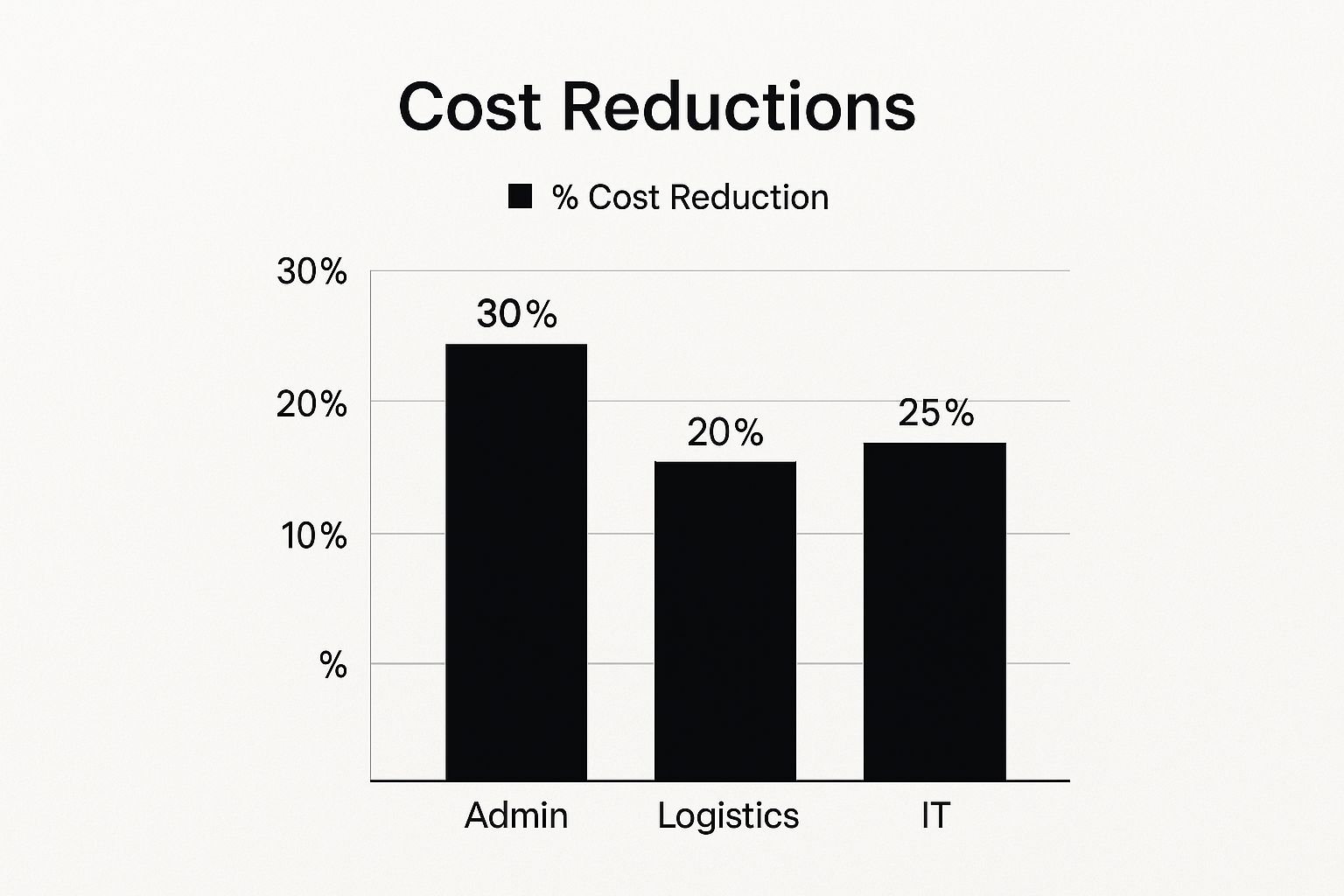

Automation That Actually Saves You Money

The infographic above shows how different parts of a business can save money through automation. Admin tasks have the highest potential savings, followed by IT and logistics. This highlights how important strategic automation is for your profits.

Knowing where your money goes is essential, but actively reducing expenses is the next critical step. Automation is a powerful way to do this. It’s not about replacing your team with robots. It’s about working smarter, not harder. Automating repetitive tasks frees up your team for more strategic work that adds value.

Automating Expense Reports

Expense management is a great example of effective automation. The old way of handling expense reports – employees collecting receipts, manually filling out forms, and finance teams reviewing every single entry – is slow and prone to errors. Automating expense reporting streamlines this whole process. It significantly reduces manual errors and processing times.

Recent research shows that finance teams can reduce processing costs by up to 60% and processing time by 80% by automating expense reports. Studies in 2024 found automation led to 50% fewer late or incorrect reimbursements. This boosts employee satisfaction and reduces administrative overhead. Cloud-based and mobile solutions are also growing: in countries like the US, UK, and Germany, 54% of expense reports are submitted via mobile apps, cutting down on paper, admin staff, and processing time. Find more statistics here.

Automating Invoice Processing

Invoice processing is another area ready for automation. Manually inputting invoice data is slow and error-prone, which can cause late payments, problems with vendors, and missed early payment discounts. Automating this process solves these issues. It results in faster processing, fewer errors, and better vendor relationships. This translates to real cost savings, especially for businesses that process many invoices.

The table below, “Automation vs Manual Processing Cost Comparison,” illustrates the potential cost savings and efficiencies gained through automating expense and invoice processing.

| Process | Manual Cost | Automated Cost | Time Savings | Accuracy Improvement |

|---|---|---|---|---|

| Expense Report Processing | $50 per report | $20 per report | 80% | 50% |

| Invoice Processing | $25 per invoice | $5 per invoice | 75% | 40% |

This table highlights the substantial differences in cost and time between manual and automated processing. The significant improvements in accuracy also contribute to a more efficient and reliable financial workflow.

Choosing The Right Automation Tools

Choosing the right tools is crucial for maximizing your return on investment (ROI). Think about your business’s specific needs and select tools that fit your workflow. Don’t just follow the latest trends. Carefully analyze your processes and identify areas where automation will truly make a difference. This strategic approach will ensure your automation efforts produce tangible results and contribute to your cost reduction goals. Prioritize automation that directly improves your bottom line. Look for tools that reduce invoice processing times and free up employee time. Remember, saving time saves money.

Smart Data-Driven Expense Control That Works

Modern expense control requires more than just static spreadsheets. It needs a dynamic, real-time understanding of your spending. This helps you see patterns and potential issues before they affect your profits. Smart businesses are using data analytics to gain this important visibility and build effective control systems.

Setting Up Effective Tracking Systems

Start by implementing tracking systems that offer useful information without overwhelming you. Concentrate on key areas like vendor spending, operational costs, and marketing ROI.

For example, track your cost per lead and customer acquisition cost to fine-tune your marketing budget. Also, keep an eye on vendor invoices for price hikes and potential savings.

The Power of Predictive Analytics

Predictive analytics elevates expense control. By examining past spending, these tools can predict potential overspending weeks ahead of time. This gives you time to adjust budgets and avoid surprises.

For example, if your software costs are projected to go over budget, you can explore cheaper options like open-source software or renegotiate current contracts. This proactive approach allows for better financial management. A global trend in cost reduction is the move towards data-driven and policy-driven expense management. In 2025, 71% of finance leaders reported difficulties with expense compliance and fraud prevention when using manual tracking. By using AI-powered analytics and real-time tracking, companies can spot wasteful spending before it’s processed, saving an average of 8-12% on total expenses. Find more detailed statistics here.

Implementing Policy-Driven Controls

Policy-driven controls automate expense approvals and flagging. These controls, often part of expense management software, automatically flag suspicious expenses based on pre-set rules.

For example, set a limit on employee meal reimbursements. The system will automatically flag anything over that limit for review, ensuring compliance with company policies. Automated tools like Whatsapp Chatbot can also help streamline tasks and reduce costs.

Utilizing Key Performance Indicators (KPIs) and Data Visualization

Understanding the right KPIs is crucial for effective expense management. Focus on metrics that directly affect profitability, such as operating expense ratio and gross profit margin.

Data visualization tools can make this data easy to understand. Clear visuals, like dashboards and charts, help everyone see spending patterns and contribute to cost-saving efforts. This shared understanding empowers the whole organization to participate in expense reduction, promoting long-term cost optimization and financial health.

Vendor Relationships That Save You Serious Money

Your vendor relationships are more than just transactions. They’re key opportunities to save significant amounts of money. This means thinking strategically about how you manage these relationships to improve your bottom line. By learning from procurement experts, you can renegotiate contracts and get better deals without negatively impacting valuable business partnerships.

Renegotiating Contracts for Mutual Benefit

Renegotiating your existing contracts doesn’t have to be confrontational. It can be a win-win for both you and your vendors. Don’t hesitate to revisit the terms of your agreements. For example, you could negotiate a lower price per unit if you commit to a longer-term contract or increase your order volume. This shows your vendor you value the partnership while also getting you a better price. Open communication is crucial during renegotiations. Explain your needs clearly and make sure you listen to your vendor’s perspective as well. This collaborative approach can help both parties reach a mutually beneficial outcome.

Consolidating Suppliers: Streamlining and Saving

Many companies work with numerous suppliers for the same products or services. This can create administrative headaches and cause you to miss out on savings. Supplier consolidation, meaning reducing the number of vendors you work with, can greatly reduce these costs. Working with fewer vendors means less paperwork, easier relationship management, and potentially bigger discounts due to increased order volume. However, it’s important to strike a balance. Avoid consolidating to the point where you depend too heavily on a single supplier. This can be risky if that relationship ends.

Competitive Bidding and Improved Service Quality

Implementing competitive bidding is another excellent strategy for saving money. This means requesting quotes from multiple vendors for the same product or service. This encourages competition and motivates vendors to offer their most competitive prices and best service. It also gives you a clearer picture of the current market and helps you identify potential new vendors to work with. This process shouldn’t feel like a battle. Instead, present it as a chance for vendors to demonstrate their value. Transparency can build trust and create stronger vendor relationships.

Vendor Audits: Uncovering Hidden Costs

Regular vendor audits can uncover hidden costs and redundancies. These audits involve a detailed review of vendor contracts, invoices, and performance. Focus on finding areas where you’re overpaying or paying for duplicate services. For example, you might discover you’re paying for software features you don’t use. Or you might notice you’re being charged different rates by different vendors for the exact same product. These audits are a valuable tool for identifying cost savings and strengthening vendor relationships. They help you address any issues proactively and ensure you are getting the best possible value from every vendor. These cost-saving strategies, when used effectively, will greatly benefit your company’s overall financial health and long-term sustainability.

Workforce Efficiency Without Burning Out Your Team

Payroll often represents a company’s largest expense. Finding ways to reduce these costs requires a careful approach. It’s important to avoid negatively impacting employee morale and productivity. This section explores how business leaders optimize workforce efficiency while improving employee satisfaction. This balance is essential for sustainable growth.

Flexible Staffing Models: Adapting To Demand

One effective strategy is using flexible staffing models. This means using a combination of full-time employees, part-time workers, and independent contractors. This approach helps meet changing business needs. For example, during busy periods, temporary staff can handle the increased workload. This avoids the commitment of hiring full-time employees. Flexible staffing allows businesses to control labor costs and adjust based on demand.

Remote Work Cost Benefits: Rethinking The Office

Remote work offers significant cost savings. Businesses can reduce or eliminate expenses tied to office space. Utilities and other overhead costs can also be lowered. Remote work also expands the talent pool. Hiring skilled individuals from different locations, without geographical limitations, becomes possible. This wider search can lead to finding great talent at potentially lower salaries, depending on location. These cost advantages, along with greater employee flexibility, make remote work a powerful tool.

Process Improvements: Working Smarter, Not Harder

Identifying and removing operational bottlenecks is key to boosting workforce efficiency. Bottlenecks are points in a process that cause slowdowns or delays. They waste time and resources. A slow approval process, for instance, can delay projects and increase labor costs. By streamlining processes, you improve efficiency and reduce expenses. Importantly, this is achieved without adding extra burden on your team. Process optimization is fundamental to a healthy bottom line.

Lean Management Principles: Eliminating Waste

Lean management principles focus on minimizing waste. This includes wasted time, materials, and effort. Applying these principles to your workforce involves streamlining processes. It also means cutting out unnecessary tasks. Employees become empowered to identify and fix inefficiencies in their workflows. Cross-training programs, for example, create flexibility. This reduces reliance on specific individuals, ensuring smooth operation even when someone is absent. This builds a culture of continuous improvement. The result is greater efficiency and lower costs.

Leveraging Technology: Powering Up Productivity

Technology plays a critical role in workforce efficiency. Tools like project management software and communication platforms streamline workflows and improve teamwork. Automating repetitive tasks frees up employees. This allows them to focus on higher-value work that directly contributes to business growth. For example, project management software centralizes communication and tracks progress. This reduces time spent in meetings and responding to emails. Strategic technology use is crucial for optimizing productivity and minimizing wasted time.

To understand the financial impact of these strategies, let’s look at a breakdown:

The following table provides a detailed overview of how different efficiency strategies can impact a business’s bottom line.

Operational Efficiency Improvement Impact Analysis: Statistical breakdown showing the financial impact of various operational efficiency improvements on business expenses.

| Efficiency Strategy | Implementation Cost | Annual Savings | Payback Period | Long-term Benefits |

|---|---|---|---|---|

| Flexible Staffing Models | $5,000 (Software & Training) | $20,000 (Reduced Overtime & Benefits) | 3 months | Increased Agility & Scalability |

| Remote Work | $10,000 (IT Infrastructure) | $50,000 (Office Space & Utilities) | 6 months | Wider Talent Pool & Reduced Commute Costs |

| Process Improvements | $2,000 (Consultant Fees) | $15,000 (Reduced Errors & Rework) | 2 months | Improved Productivity & Customer Satisfaction |

| Lean Management | $3,000 (Training & Materials) | $25,000 (Waste Reduction & Increased Output) | 1 month | Continuous Improvement Culture & Reduced Operational Costs |

| Technology Adoption | $8,000 (Software & Hardware) | $30,000 (Automation & Improved Collaboration) | 3 months | Enhanced Communication & Data-Driven Decision Making |

This table highlights the potential return on investment (ROI) for each strategy. While implementation costs vary, the annual savings and relatively short payback periods demonstrate the financial benefits of investing in workforce efficiency. The long-term benefits, such as increased agility and a wider talent pool, further contribute to sustainable business growth.

Technology Costs That Actually Make Sense

Technology can be expensive. But smart tech decisions can lead to significant cost savings. This isn’t about cutting corners. It’s about using technology strategically to optimize spending and improve your bottom line. We’ll explore how businesses achieve this through cloud migration, software consolidation, and strong partnerships with tech providers.

Understanding The True Cost Of Technology

Many businesses focus only on the upfront cost of technology. But the true cost of ownership includes hidden expenses. Think maintenance, upgrades, and training. These often-overlooked costs can add up quickly. For example, investing in seemingly inexpensive software might require costly customization or integration with existing systems later on, negating any initial savings. Conduct a thorough assessment of all potential costs before making a purchase. This helps avoid unexpected expenses down the road.

Technology Audits: Finding Savings Opportunities

Regular technology audits can identify areas for improvement and potential cost reduction. These audits examine all your current technology: software, hardware, and services. The goal is to find redundant systems, underutilized software licenses, and opportunities for consolidation. For example, you might be paying for multiple project management tools when one would be sufficient. Or perhaps you have numerous unused software licenses you could cancel. These audits can uncover surprising savings.

Cloud Migration: Cost-Effective Flexibility

Cloud migration involves moving your data and operations to cloud-based services like AWS or Azure. This can significantly reduce IT infrastructure costs. Cloud services often use a subscription model. This eliminates the need for expensive hardware and on-site maintenance. Cloud migration allows you to scale resources up or down as needed. This flexibility means you pay only for what you use, optimizing costs and improving resource allocation. Plus, cloud providers handle security and maintenance, freeing up your IT team for strategic projects.

Software Consolidation: Simplifying Your Tech Stack

Many businesses use a variety of software applications, often with overlapping functionality. Software consolidation streamlines these applications, reducing complexity and cost. By switching to a single platform that handles multiple functions, you eliminate multiple subscriptions. This simplifies your tech stack, lowers costs, and improves team collaboration. Choose solutions that integrate well with each other to maximize efficiency and streamline operations.

Negotiating Better Technology Contracts

Strong vendor relationships are key to negotiating better contracts. Don’t hesitate to renegotiate existing agreements. For example, committing to a longer contract term can often secure a lower price. Bundling services with a single provider can also lead to significant discounts. Use competitive bidding to get the best possible rates. Request quotes from multiple vendors and compare their offerings before making a decision. This encourages competition and ensures you get the most value for your money. These strategies can result in substantial long-term cost savings without sacrificing quality.

Building a Cost-Conscious Culture That Lasts

Real expense control isn’t a temporary solution; it’s about making smart spending a core value within your company. It’s about shifting the responsibility of financial health from just the finance team to every employee. This section explores how successful leaders create cultures where everyone contributes to a financially sound organization.

Engaging Employees in Expense Reduction

Getting your team on board is crucial. Clearly explain why reducing expenses matters. Connect it to company objectives, like job security and potential bonuses. Transparency builds trust and motivates everyone to participate. For example, showing how cost savings can fund exciting new projects or even prevent layoffs transforms expense reduction into a shared objective. This shared understanding creates a sense of ownership and encourages active involvement.

Establishing Accountability Systems

Accountability is essential. Implement clear expense policies and procedures, and make sure they are regularly reviewed and updated. This provides a framework for everyone to follow. Consider implementing a system where employees justify expenses exceeding a certain threshold. This encourages mindful spending. Assigning budget ownership to different departments is another effective method, promoting responsibility and cost awareness. Regular budget reviews and feedback further reinforce this accountability.

Maintaining Cost Discipline During Growth

Maintaining cost discipline is particularly important during periods of growth. When revenue is increasing, it’s easy to overspend. However, this can lead to wasteful habits. Regularly review your budget, compare it against actual spending, and identify any variances. For instance, if marketing expenses are outpacing revenue growth, it’s a good time to analyze the ROI of your marketing campaigns. Implementing regular budget reviews, even during periods of growth, helps maintain a cost-conscious mindset and ensures sustainable growth.

Designing Incentive Programs

Incentive programs can significantly motivate cost-saving behavior. Consider rewarding teams or individuals who find significant savings or implement effective cost-reduction strategies. These rewards could include bonuses, extra vacation time, or public acknowledgment. These incentives not only reward cost-saving efforts but also foster a culture of continuous improvement. This proactive approach encourages everyone to look for areas where expenses can be reduced, contributing to a stronger financial foundation.

Implementing Review Processes

Regular review processes are key for maintaining momentum. Monthly or quarterly budget reviews, combined with performance evaluations, keep cost reduction top of mind. These reviews provide an opportunity to discuss what’s working, what’s not, and how to improve. For example, teams can share successful cost-saving strategies and learn from each other’s experiences. This creates a collaborative environment and drives continuous improvement in expense management.

Communicating Cost Reduction Goals Effectively

How you communicate about cost reduction makes a difference. Frame the conversation positively, focusing on efficiency and smart spending instead of cuts and restrictions. This shift in perspective fosters a sense of shared purpose. For example, instead of announcing budget cuts, explain how optimizing expenses allows for investment in new opportunities or employee development. This positive framing encourages collaboration and inspires employees to actively participate in cost reduction initiatives, contributing to the long-term success of the company. Building this culture of cost consciousness takes time and consistent effort, but it’s an investment that yields a more resilient and profitable business.

Are you a small business in Auckland looking for advice on running a better business and improving your bottom line? Contact Business Like NZ Ltd today for expert guidance on financial freedom and building a thriving business.