Top 8 Accounting Advice Tips for Small Business Success

June 1, 2025

Everything You Need to Know About Shareholder Current Accounts in New Zealand

June 5, 2025Understanding Free Tax Advice in NZ

Running a small business comes with its set of challenges—taxes being one of the most daunting. Fortunately, New Zealand offers an array of free tax advice services to help small business owners navigate these choppy waters. Let’s explore what qualifies as free tax advice and resources in NZ and where you can find it.

Free Tax Advice in NZ

In NZ, free tax advice is often provided by government agencies and typically covers basic queries and general guidance around tax obligations. While these resources can be helpful for understanding the fundamentals, it’s important to recognise their limitations.

General advice doesn’t take into account your unique financial situation, business structure, or long-term goals. Relying solely on broad information can lead to missed opportunities, compliance issues, or costly mistakes. For tailored strategies and accurate decision-making, personalised tax advice from a qualified professional is essential.

Types of Organizations Offering Free NZ Tax Advice

Various entities offer free tax assistance:

- Inland Revenue Department (IRD): This is the government body responsible for tax collection and administration in New Zealand. They offer workshops, seminars, and online resources.

- Other Government Organizations: The organisations focus on educating business owners about tax requirements and aiding them with basic tax filings. A good example is business.govt.nz

- Business Associations: They might offer free tax seminars or webinars as part of their educational services.

- Chartered Accountants: Check out their blogs!

Taking advantage of these resources can help businesses avoid common pitfalls.

Accessibility of Free Business Tax Advice in NZ

IRD’s services are open to any New Zealand business, while non-profits may target particular business sizes or sectors. Generally, access is more readily available to micro and small businesses, especially those struggling with compliance or newly established.

Key Benefits of Professional Tax Guidance for Auckland Small Businesses

While the availability of Free Tax Advice in NZ is beneficial, professional tax guidance offers deeper insights tailored to a business’s unique needs. Here’s how small businesses in Auckland can benefit:

Maximizing Tax Deductions and Credits

A professional can identify deductions and credits that a business may be eligible for but might overlook. For example, small businesses can claim deductions on office supplies, vehicle expenses, and even part of their home utilities if they’re working from home. A tax expert knows the intricacies and ensures every penny counts.

Learn more: What expenses are tax-deductible in NZ?

Avoiding Costly Tax Compliance Mistakes

Misunderstanding tax laws can lead to costly mistakes. Professionals help ensure that filings are correct and timely, which reduces the risk of penalties and audits. It’s about peace of mind—knowing your business is compliant keeps stress at bay.

Strategic Tax Planning for Business Growth

Winning at taxes isn’t just about compliance; it’s about strategic planning for future growth. Experts advise on restructuring debts, timing capital purchases, or even altering business structures to optimize tax savings. This strategic approach can fuel business expansion.

Understanding GST Requirements and Benefits

Goods and Services Tax (GST) is a critical aspect for businesses in NZ. Professionals can help understand registration requirements, filing frequencies, and input tax credits. Proper handling of GST can prevent legal issues and improve cash flow.

Learn more: Mastering Claiming GST: A Complete Guide

Where to Access Free Tax Advice in NZ

Finding the right resources makes all the difference. Here’s where Auckland businesses can find free tax advice:

IRD’s Free Business Tax Guidance Services

The IRD offers comprehensive guidance services, from workshops to one-on-one consultations. They have extensive online resources accessible 24/7, ensuring businesses can find answers when needed.

Online Resources and Tax Calculators

Many online platforms provide tax calculators, allowing businesses to estimate their tax obligations throughout the year. Websites like the IRD’s official page and other reputable business advice platforms offer these resources at zero cost.

Common Tax Challenges Facing NZ Small Businesses

Even with the best advice, small businesses in Auckland face unique tax challenges. Let’s tackle these issues head-on:

Managing Provisional Tax Payments

Provisional tax can be confusing and burdensome, requiring you to pay income tax in advance. Misjudging provisional tax can affect cash flow significantly, but with the right guidance, businesses can better predict and manage payments.

Learn more: Your Guide to Understanding What is Provisional Tax in NZ

Employee Tax Obligations and PAYE

If you have employees, you’re responsible for PAYE (Pay as You Earn) tax. Getting it wrong can lead to serious issues. It’s crucial to understand how to calculate PAYE correctly and meet filing deadlines to avoid fines.

Learn more: Understanding PAYE: A Guide for New Zealand Employers

Business Structure Tax Implications

Whether your business is structured as a sole trader, partnership, or company, each comes with distinct tax implications. The right structure can save money; the wrong one can increase liability. Consulting an expert ensures alignment with business goals.

Learn more: Choosing the right Business Structure

Record Keeping and Documentation Requirements

Accurate record-keeping is non-negotiable. Businesses must keep financial records for at least seven years in NZ. This includes invoices, receipts, and tax correspondence. Efficient systems can save time and reduce stress during tax season.

Limitations of Free NZ Tax Advice

While free tax advice is great, it has its boundaries.

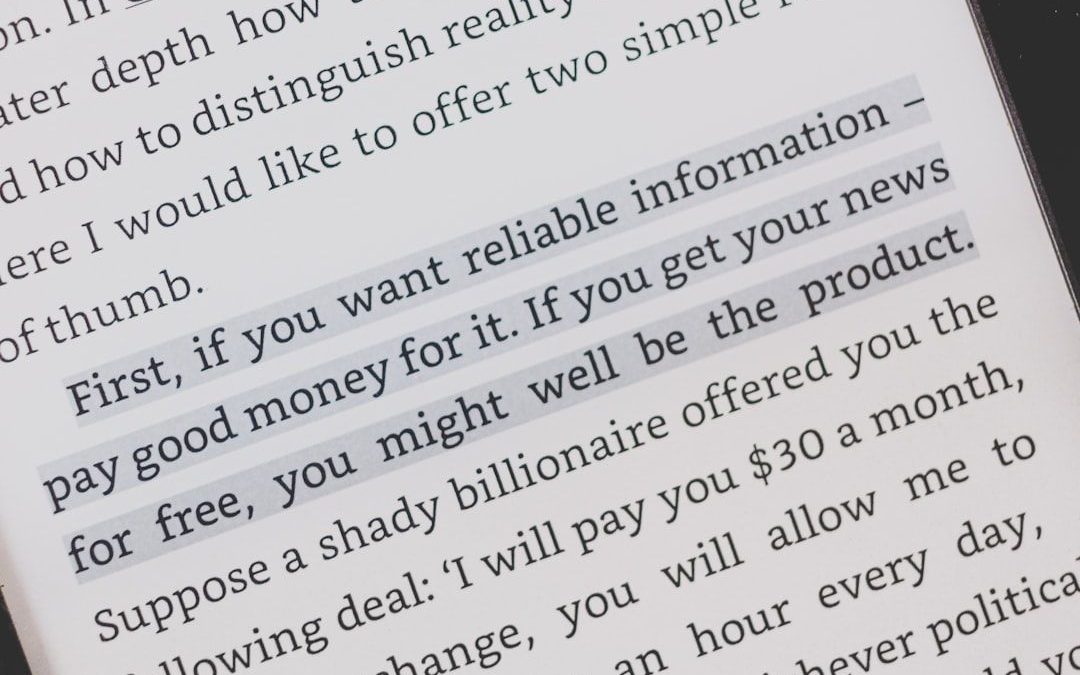

Lack of Personalization of Free NZ Tax Advice

Free NZ Tax Advice on a website lacks personalization. They typically offer general advice, not specific to your business circumstances. These services might not suit complex tax situations that require an in-depth approach and tailored solutions.

Specific Questions to Ask Your Tax Advisor

When seeking professional advice, come prepared with questions. Ask about changes in tax regulations, potential deductions, and strategies for improving tax efficiency. The more specific your questions, the more value you’ll derive from the session compared to searching the web for free NZ advice about tax.

Setting Clear Business Goals and Objectives

Aligning tax strategies with business goals is crucial. Define what you want—whether it’s growth, stability, or diversification. Setting clear objectives lets you and your advisor work in sync, optimizing tax strategies for long-term success.

Maximizing Long-Term Tax Benefits for Business Success

Focusing on long-term strategies can significantly impact your business’s financial health.

Building Relationships with Tax Professionals

Building a solid relationship with a tax expert ensures you get the best advice year-round. Continuity matters—they understand your business and can provide timely, relevant advice.

Implementing Ongoing Tax Strategies

Don’t wait until tax season to think taxes. Ongoing strategies, such as regular reviews and proactive planning, keep your business tax-fit. It’s about making taxes an integral part of business strategy.

Staying Updated with New Zealand Tax Law Changes

Tax laws evolve, impacting your business directly. Keeping abreast with changes allows your business to adapt and take advantage of new opportunities. Subscribe to newsletters or follow relevant authorities for updates.

Expansion Changes Your Tax Landscape—Don’t Rely on Free Tax Advice for your NZ Business

Why Personalised NZ Tax Advice Matters

- Maximise deductions and credits

- Stay compliant with changing regulations

- Avoid penalties and audits

- Plan for long-term financial success