Your Guide to NZ GST Due Dates

January 28, 2026

Rental Property Expenses tax deductible NZ: Quick guide

January 31, 2026Understanding Your Financial Position Balance Sheet

A financial position balance sheet is simply a snapshot of your business’s financial health on a single day. In one neat summary, it shows you exactly what your business owns (assets), what it owes (liabilities), and what’s left over for you, the owner (equity). It’s a fundamental report for understanding where you stand and making smarter decisions.

What a Balance Sheet Really Shows You

Think of your financial position balance sheet like a photograph. It captures everything about your business at one specific moment in time. It’s not about tracking performance over a month or a quarter – for that, you’d need a profit and loss statement. Instead, the balance sheet gives you a static but powerful overview of your company’s value on a particular date.

The whole report hinges on one simple, unbreakable rule:

Assets = Liabilities + Equity

Picture an old-fashioned set of balancing scales. On one side sits everything your business owns—its assets. On the other, you have all the money it owes to others (liabilities) plus the owner’s stake (equity). For the books to be balanced, and for your business to be financially sound, these two sides must always be equal.

This isn’t just a document you tick off for the IRD once a year. For Kiwi business owners and property investors, it’s an essential tool for:

- Securing a business loan from the bank.

- Tracking how your net worth is growing over time.

- Making clear-headed decisions about taking on debt or making new investments.

Struggling to get your head around the numbers? Business Like NZ Ltd offers affordable, down-to-earth support from chartered accountants who help Auckland businesses and property investors get financially organised.

The Three Building Blocks of Your Balance Sheet

Every balance sheet, whether for a small cafe in Ponsonby or a large firm on Queen Street, is built from three essential parts: assets, liabilities, and equity. Getting your head around these three is the first step to truly understanding the story your numbers are telling.

Let’s break it down in simple terms:

- Assets: These are all the resources your business owns that have value. Think cash in the bank, the company ute, equipment, or even invoices your customers owe you.

- Liabilities: This is simply everything your business owes to other people or organisations. This could be a loan from the bank, money owed to suppliers, or your upcoming GST payment to the IRD.

- Equity: After you subtract all your liabilities from your assets, what’s left is the equity. It’s the owner’s stake in the business, calculated as Assets – Liabilities.

What Your Auckland Business Owns vs Owes

To make this crystal clear, it helps to see some real-world examples of assets and liabilities and what they mean for a typical Kiwi business.

The table below gives you a simplified look at the two sides of the coin.

| Category | Example | What It Means for Your Business |

|---|---|---|

| Current Asset | Cash in Bank | Your available funds for day-to-day operations. For a local cafe, this is the money to pay for milk and coffee beans. |

| Non-Current Asset | Company Ute | A long-term resource used to generate income. A builder’s ute is essential for getting to job sites for years to come. |

| Current Liability | Supplier Invoice | A short-term debt you need to pay soon, like a 30-day invoice from your main supplier. |

| Non-Current Liability | Business Loan | A long-term debt paid off over several years, such as a mortgage on an investment property or a loan for a fit-out. |

The reason a balance sheet always balances comes down to the mechanics of the double-entry bookkeeping system, where every transaction has an equal and opposite effect. For instance, if you buy a $40,000 work vehicle (an asset) with a bank loan (a liability), your assets go up by $40k and your liabilities go up by $40k, keeping the equation perfectly balanced.

Getting these categories right is non-negotiable for an accurate picture of your financial health. If you’re ever staring at a transaction and wondering where it fits, our team at Business Like NZ Ltd provides affordable, down-to-earth advice for Auckland businesses and property investors.

How to Read the Story Your Balance Sheet Tells

Think of your financial position balance sheet as more than just a list of numbers. It’s a story, a narrative that lays out your business’s stability and overall game plan. Whether you’re a seasoned property investor or running a local Auckland cafe, learning to read this story is absolutely crucial for making smart decisions.

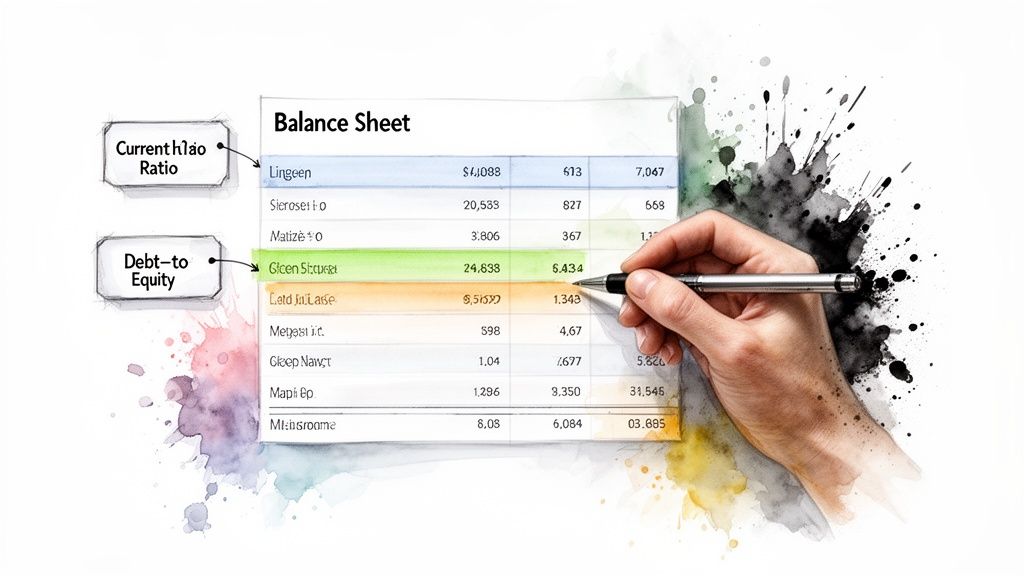

The real trick is to look at the relationships between the numbers, not just the grand totals. That’s where financial ratios come in – they’re brilliant tools for turning raw data into something you can actually use.

Two of the most helpful ratios are:

- Current Ratio (Current Assets ÷ Current Liabilities): This one’s a quick health check. It tells you if you have enough short-term assets (like cash) to cover your immediate bills. A ratio above 1:1 is generally a good sign you’re in a healthy spot.

- Debt-to-Equity Ratio (Total Liabilities ÷ Total Equity): This ratio shows how much of your business is financed by debt compared to your own investment. A high number here can be a red flag for lenders, signalling a higher level of risk.

We dive much deeper into this in our detailed guide on business accounting ratios, which covers all the essential ones every business owner should know.

Seeing Ratios in Action

Modern accounting software like Xero does a great job of laying this all out, making it easy to find what you need to do these calculations.

For a practical example, imagine an Auckland property investor has $50,000 in cash and receivables (current assets) and $40,000 in short-term bills (current liabilities). Their current ratio is $50,000 / $40,000 = 1.25. This tells a bank they have $1.25 available for every $1 of debt due soon, which looks healthy.

For a bit of perspective, even the government’s books tell a similar story. The New Zealand Government’s net worth stood at $189.1 billion as of 30 June 2025. This figure shows how fiscal pressures impact national assets and liabilities—a challenge that mirrors what many small and medium-sized businesses face every day. You can see the full breakdown in the government’s 2025 financial statements.

If you’re feeling a bit lost trying to read your own business’s story, don’t worry. At Business Like NZ Ltd, our friendly, down-to-earth chartered accountants are here to support Auckland’s businesses and property investors with affordable advice.

Common Balance Sheet Mistakes to Look Out For

Even with fantastic accounting software like Xero making life easier, it’s surprisingly easy for small errors to creep into your balance sheet. These little mistakes can paint a misleading picture of your financial position, giving you a false sense of security or a whole lot of unnecessary stress. Spotting these common trip-ups is the first step to getting your numbers right.

One of the most common blunders we see is misclassifying liabilities. For example, if you list a five-year business loan (which is a non-current liability) under your short-term payables, it can make your business look far less stable than it actually is. That’s not a good look, especially if you’re trying to secure a new loan.

Little Slips with Big Consequences

Here are a few other classic mistakes we often help Auckland business owners fix:

- Forgetting About Depreciation: It’s easy to do, but not accounting for the wear and tear on your assets – like a company van or expensive equipment – makes it look like you own more than you really do. This overstates your asset value and inflates your net worth on paper.

- Messy Owner’s Drawings: Using the business account for personal bits and pieces is fine, as long as you record it correctly. If you don’t track these as “owner’s drawings,” it can completely throw your equity section out of whack.

- Skipping Bank Reconciliations: This is a big one. You have to regularly check that the cash balance in your accounting software lines up perfectly with what your actual bank statement says.

A clean, accurate balance sheet is the bedrock of good financial decision-making. Tiny, consistent errors have a nasty habit of snowballing, leading you to make calls based on dodgy data.

A great way to keep your cash balances accurate and catch those common errors is by utilizing a bank reconciliation statement template.

If any of this sounds a bit too familiar, don’t worry – you’re definitely not alone. The team here at Business Like NZ Ltd is dedicated to providing affordable, down-to-earth accounting support for Auckland businesses and property investors, helping you get your numbers clean, reliable, and working for you.

An Action Plan to Strengthen Your Financial Position

Okay, so you’ve got your head around your financial position balance sheet. That’s the first step. But the real magic happens when you turn that knowledge into action to build a stronger, more resilient business.

For SMEs and property investors here in Auckland, this is all about taking the insights from your numbers and creating a simple, practical game plan. The aim is to actively improve your financial health, one smart move at a time.

Key Areas to Focus On

So, where do you start? Here are a few high-impact strategies you can get cracking on today:

- Boost Cash Flow: Get better at collecting what you’re owed. Simply sending invoices out the door faster and chasing up overdue accounts can make a massive difference to your cash cycle. Good cash flow is the lifeblood of any business, and we cover more strategies in our guide to working capital management.

- Manage Inventory Efficiently: Are you sitting on too much stock? Every item on the shelf is cash tied up that could be working harder for you elsewhere. For example, a retailer could analyse sales data to find that a particular product line isn’t moving and decide to run a clearance sale. This turns slow-moving stock back into cash.

- Restructure Your Debt: Take a hard look at your current loans. Is there a better interest rate out there? Could you negotiate more favourable terms? A property investor might find they can consolidate multiple high-interest loans into one mortgage with a lower rate, saving thousands a year.

It also helps to see the bigger picture. By August 2025, for instance, New Zealand banks had a total balance sheet hitting a record 746,219 NZD million. That tells us there’s plenty of liquidity in the financial system. You can explore more data like this over on Trading Economics.

If you’d like a guide on this journey, let’s have a chat. As affordable and down-to-earth chartered accountants, our team at Business Like NZ Ltd is passionate about supporting Auckland businesses and property investors to find real financial clarity and success.

A Few Common Questions Answered

Here are the answers to a few questions we often hear from Auckland business owners and property investors about their balance sheet.

How Often Should I Be Looking at My Balance Sheet?

For tax time, once a year is the minimum. But if you want to run a healthy Kiwi business, you should be looking at it monthly, or quarterly at the very least.

Think of it as a regular health check-up. These frequent check-ins help you spot trends, get a handle on your cash flow, and make smart decisions before a small hiccup becomes a major headache. Tools like Xero make this dead simple – you can pull a report in minutes and get a real-time pulse on your business.

What Does Negative Equity Actually Mean?

Negative equity is when your total liabilities are greater than your total assets. Put simply, your business owes more than it owns.

This is a serious red flag, particularly for an established business, and a clear sign of financial distress. While it can sometimes happen in the early days of a startup when you’re funding growth, it’s a critical signal to act fast. This is exactly the kind of situation where you want an experienced accountant in your corner.

The Balance Sheet is a snapshot showing your financial position on a single day. The Profit & Loss (P&L) statement is like a video, showing your performance over a period of time, such as a month or a year.

What’s the Difference Between a Balance Sheet and a P&L?

The two reports are a team; they work together to tell the full story. Your P&L statement shows whether you made a profit by adding up all your income and subtracting all your expenses over a specific period.

The balance sheet, on the other hand, shows what you own and what you owe on one specific day. The profit (or loss) from your P&L is what connects the two reports—it flows directly into the equity section of your balance sheet, linking your performance over time to your current financial position.

Getting your head around the financial position balance sheet can feel like a challenge, but you don’t have to go it alone. At Business Like NZ Ltd, we’re a team of affordable, down-to-earth chartered accountants passionate about supporting Auckland businesses and property investors. We’re here to make sense of the numbers and help you build a stronger financial future. Learn more about our services.