New Zealand Tax Residency: What You Need to Know Before Moving Overseas or Returning Home

October 15, 2025

How to Create Standard Operating Procedures for Success

October 23, 20258 Proven Business Turnaround Strategies

Facing Tough Times? Revive Your Business Now

When performance dips, decisive action is key for your Auckland business. Don’t wait – effective business turnaround strategies are required. This guide gets straight to the point, outlining eight proven approaches to revive your company in 2025. We’ll cover essential tactics including cost reduction, market repositioning, financial restructuring, leadership changes, technology adoption, core business focus, strategic partnerships, and innovation. Implementing the right business turnaround strategies can help stabilize your operations, restore profitability, and set you up for future success. Discover how to navigate these challenges effectively right here.

Learn more: Why Your Business is Failing: Simple Accounting Missteps and How to Avoid Them

1. Cost Reduction and Efficiency Optimization Strategy

When a business in Auckland finds itself facing significant financial pressure, the most immediate and often necessary step is implementing a Cost Reduction and Efficiency Optimization strategy. This approach is a cornerstone of many successful business turnaround strategies. It involves a systematic, hard look at every dollar spent and every process followed, aiming to swiftly cut unnecessary expenses and streamline operations. The primary goal is immediate financial stabilization – stopping the bleeding of cash and preserving capital to create breathing room for more extensive, long-term recovery plans.

How It Works: Key Features in Action

This strategy isn’t just about randomly slashing budgets; it’s a targeted and analytical process. Key features typically include:

- Comprehensive Expense Audit and Analysis: This involves meticulously reviewing all company expenditures, from large contracts down to petty cash. Every expense line is scrutinised to determine its necessity and contribution to value. Are you overspending on subscriptions? Are travel costs essential? Is there waste in material usage?

- Workforce Restructuring and Rightsizing: Often one of the most difficult aspects, this involves evaluating staffing levels, roles, and overall structure to ensure alignment with current business needs and revenue. It might involve redundancies, role consolidations, or changes in work arrangements (e.g., shifting from full-time to contract for certain non-core roles).

- Process Reengineering to Eliminate Waste: Examining core operational processes (like production, service delivery, sales cycles, administration) to identify bottlenecks, redundancies, and inefficiencies. This could lead to adopting leaner methodologies, automating tasks, or simplifying workflows to do more with less.

- Renegotiation of Supplier Contracts: Approaching key suppliers, landlords, lenders, and other partners to negotiate better payment terms, lower prices, or more favourable conditions. Strong, long-term relationships can sometimes yield flexibility during tough times.

- Non-core Asset Divestiture: Selling off assets (like underutilised equipment, property, or even non-essential business units) that are not critical to the company’s core operations generates immediate cash and reduces ongoing holding costs (maintenance, insurance, etc.).

Why This Strategy Deserves Its Place

Cost reduction is often the first response in a turnaround because it directly addresses the most urgent problem: negative cash flow. Its benefits are tangible and relatively quick:

- Provides Quick Improvement to Cash Flow: Reducing outflows has an immediate positive impact on the company’s bank balance.

- Creates Immediate Financial Stability: It stops the financial situation from worsening rapidly, buying crucial time.

- Shows Results Quickly: Improvements can often be seen in financial statements within one or two quarters, boosting confidence.

- Relatively Straightforward (Conceptually): While implementation can be tough, the concept of spending less is easier to grasp and initiate compared to complex market repositioning.

- Signals Decisive Action: Taking clear steps to cut costs signals to stakeholders (banks, investors, employees) that leadership is actively addressing the crisis.

Real-World Examples of Success

While these are large corporations, the principles apply universally:

- IBM (1990s): Under Louis Gerstner, IBM implemented massive cost cuts ($8.9 billion), including workforce reductions and operational streamlining, as a crucial part of pulling the company back from the brink.

- Nissan (Late 1990s/Early 2000s): Carlos Ghosn, famously dubbed ‘Le Cost Killer’, led Nissan’s revival through aggressive cost-cutting ($10 billion), including closing factories and slashing supplier costs, alongside strategic reforms.

Actionable Tips for Auckland Small Businesses

For smaller businesses in Auckland navigating tight margins, implementing this strategy requires careful consideration:

- Differentiate ‘Good Costs’ vs. ‘Bad Costs’: Don’t just cut everywhere. Protect spending that directly drives revenue, customer value, or essential quality (e.g., key marketing spend, critical materials). Focus cuts on overheads, waste, and ‘nice-to-haves’ that don’t contribute to the bottom line.

- Communicate Transparently: Be open and honest with your team about why these measures are necessary. Explain the situation and the plan. Lack of communication breeds fear and rumours, damaging morale more than the cuts themselves.

- Involve Your Employees: Your team on the ground often knows where inefficiencies lie. Ask for their ideas on saving money and improving processes – it fosters buy-in and can uncover hidden opportunities.

- Use Zero-Based Budgeting (ZBB): Instead of just trimming last year’s budget, start from zero. Make every department or function justify every single expense for the upcoming period. This forces a critical evaluation of all spending.

- Monitor Key Metrics Closely: Track Key Performance Indicators (KPIs) related to operations, sales, and customer satisfaction. Ensure your cost-cutting measures aren’t inadvertently harming critical functions or driving customers away.

See more: 8 Financial KPIs for Small Business Success

Potential Downsides (Pros and Cons)

While effective, this strategy isn’t without risks:

- Pros: As highlighted above – quick cash flow relief, immediate stability, fast results, clear signal of action.

- Cons:

- Can severely damage employee morale and trust if handled insensitively or without clear communication.

- Cutting too deeply or in the wrong areas can cripple long-term capabilities (e.g., R&D, essential skills).

- It often addresses the symptoms (lack of cash) rather than the root causes (poor strategy, market shifts, weak product).

- If cuts negatively impact product quality or customer service, it can accelerate decline (a ‘death spiral’).

- Maintaining momentum can be hard; initial easy cuts are made, but deeper, sustained efficiency requires ongoing effort.

When and Why to Use This Approach

This strategy is most critical when a business is facing an immediate liquidity crisis, rapidly burning through cash, or needing to demonstrate swift corrective action to lenders or investors. It’s often the essential first phase in a broader turnaround effort, creating the necessary financial stability to allow for the implementation of longer-term strategic changes like market repositioning, product innovation, or operational transformation. For many Auckland businesses feeling the pinch, a focused cost and efficiency drive is a vital first step back towards profitability and health, making it a fundamental component of effective business turnaround strategies.

Okay, here is the detailed section for item #2, Strategic Repositioning and Market Refocus, formatted in Markdown as requested.

2. Strategic Repositioning and Market Refocus

When a business is facing significant challenges, sometimes tweaking operations or cutting costs isn’t enough. Deeper issues might be at play – maybe the market has shifted, customer needs have evolved, or competitors have changed the game. This is where Strategic Repositioning and Market Refocus comes in as a powerful business turnaround strategy. It’s about fundamentally rethinking where your business competes and how it wins, rather than just improving how you currently operate. This involves making deliberate choices about which products or services to offer, which customer segments to target, and what unique value you bring to them. It tackles the core strategic direction of your company.

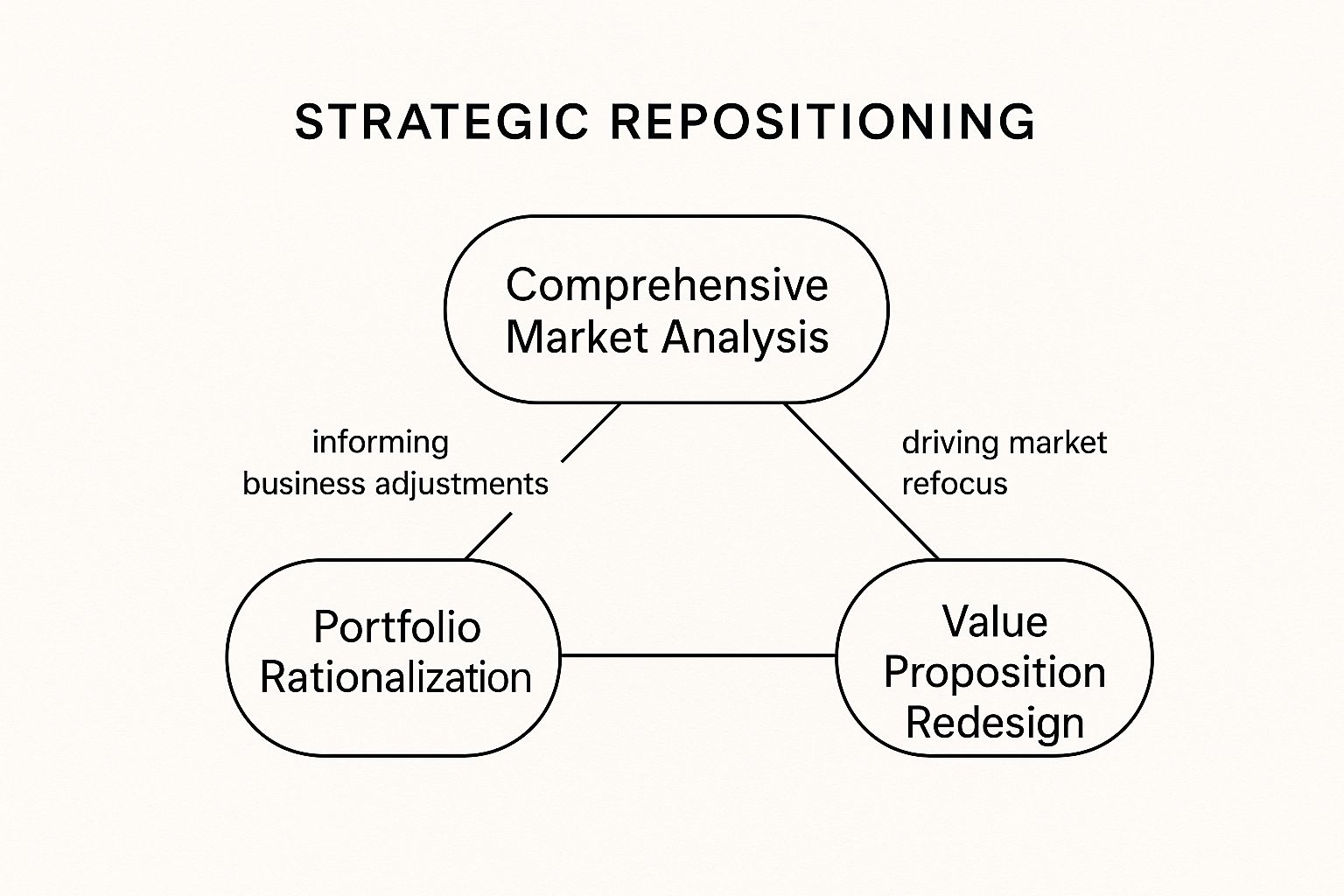

To help visualize the key elements involved in this approach, here’s a concept map illustrating the interconnected components of Strategic Repositioning:

This concept map places ‘Strategic Repositioning’ at the very centre, highlighting it as the core objective. Branching out from this central idea are the essential activities and considerations that drive the process: ‘Market Analysis’, ‘Customer Segmentation’, ‘Portfolio Rationalization’, ‘Value Proposition Redesign’, ‘Brand Repositioning’, and ‘Resource Reallocation’. The connecting lines show how these elements are interdependent; for instance, thorough ‘Market Analysis’ and understanding ‘Customer Segmentation’ are crucial inputs for deciding which products to keep (‘Portfolio Rationalization’) and how to craft a compelling ‘Value Proposition Redesign’. Similarly, redesigning the value proposition necessitates changes in ‘Brand Repositioning’ and requires shifting company efforts via ‘Resource Reallocation’. The key insight from this visual is that successful repositioning isn’t about tackling one area in isolation; it demands a holistic and coordinated effort across multiple strategic fronts to effectively move the business to a more favourable market position.

Why Use Strategic Repositioning?

This strategy earns its place high on the list of business turnaround strategies because it addresses the fundamental reasons a business might be struggling, rather than just papering over the cracks. You should consider this approach when:

- Your core market is shrinking or has become saturated.

- Customer preferences have fundamentally changed, making your current offerings less relevant.

- New competitors have emerged with different business models or superior value propositions.

- Your brand image no longer resonates with your desired target audience.

- You identify significant, untapped opportunities in adjacent markets or segments.

It’s about proactively moving your business towards areas where it can build a sustainable competitive advantage and find new paths for growth.

Key Features and How It Works

Strategic Repositioning involves several key activities:

- Comprehensive Market Analysis and Customer Segmentation: Deeply understanding the current market landscape, identifying trends, analysing competitors, and pinpointing specific customer groups (including potentially new ones here in Auckland or beyond) whose needs are unmet or poorly served.

- Portfolio Rationalization: Objectively evaluating your existing products and services. This often means making tough decisions to prune or divest underperforming offerings, even those with a long history, to free up resources.

- Value Proposition Redesign: Clearly defining (or redefining) the unique benefit and value you offer to your target customers. Why should they choose you over alternatives? This needs to be compelling and differentiated.

- Brand Repositioning and Messaging Alignment: Adjusting your brand identity, image, and communication to reflect the new strategic direction and resonate with the target market. Consistency across all touchpoints (website, social media, customer service, storefront etc.) is crucial.

- Resource Reallocation: Intentionally shifting financial resources, personnel, and management attention away from legacy areas and towards the products, services, and markets identified as having higher potential.

Benefits (Pros)

- Addresses Fundamental Issues: Gets to the root cause of decline, not just the symptoms.

- Sustainable Competitive Advantage: Can carve out a unique, defensible position in the market.

- New Growth Avenues: Often uncovers entirely new markets or customer segments.

- Renewed Purpose: Can re-energize employees, management, and other stakeholders around a clear, exciting new direction.

- Improved Margins: Moving to less contested market spaces or offering higher perceived value can potentially allow for premium pricing.

Challenges (Cons)

- Time-Consuming: Takes significantly longer to plan and implement than simple cost-cutting measures.

- Requires Deep Analysis: Needs thorough market research and strategic thinking, which can be resource-intensive for a small Auckland business.

- Difficult Decisions: May involve letting go of familiar products, long-standing customers, or even staff aligned with the old strategy.

- Requires Investment: Often necessitates upfront investment in research, product development, marketing, or retraining precisely when cash flow might be tightest.

- Higher Execution Risk: Complex changes across multiple business functions carry a greater risk of mistakes or failure compared to simpler operational tweaks.

Actionable Tips for Auckland Small Businesses

- Start with Your Customers: Talk directly to your current and potential Auckland customers. What are their real needs, frustrations, and aspirations? Look for unmet needs.

- Analyse Your Competitors Closely: Don’t just look at direct competitors. Who else is solving the same customer problem, even in different ways? Where are the gaps they aren’t filling?

- Create a Clear Migration Path: Plan how you will transition from your current position to the desired future state. How will you support existing customers while developing the new focus?

- Define Success Metrics: Establish Key Performance Indicators (KPIs) specifically related to your repositioning goals (e.g., penetration in a new segment, sales mix shift, brand perception scores).

- Communicate Consistently: Ensure your new messaging is clear, compelling, and consistently applied everywhere – from your website homepage to how your team answers the phone.

- Be Bold, Be Decisive: Repositioning often requires tough choices. Be prepared to prune legacy offerings that no longer fit the future strategy, even if it’s emotionally difficult.

Examples of Success

Several well-known companies owe their survival and success to strategic repositioning:

- Apple: Shifted focus from primarily niche computers to become a dominant force in consumer electronics (iPod, iPhone, iPad) and services under Steve Jobs.

- Netflix: Boldly pivoted from a DVD-by-mail service to a streaming giant and now a major producer of original content.

- Adobe: Transitioned from selling perpetual software licenses in boxes to a subscription-based cloud model (Creative Cloud), transforming its revenue stream and customer relationships.

These examples, while large-scale, illustrate the core principle: fundamentally changing market position and value proposition can reignite growth and ensure long-term relevance. This principle is just as applicable, albeit on a different scale, for a small business in Auckland looking to secure its future. Strategic repositioning, though challenging, is one of the most impactful business turnaround strategies available when fundamental change is needed.

Okay, here is the detailed section for item #3, Financial Restructuring and Debt Management, written according to your specifications and targeted at small businesses in Auckland.

3. Financial Restructuring and Debt Management

When a business in Auckland is facing serious financial headwinds – maybe struggling to pay bills, facing pressure from the bank, or seeing cash flow dry up – Financial Restructuring and Debt Management becomes a critical business turnaround strategy. It’s essentially about rebuilding your company’s financial foundations to stop it from sinking and give it a chance to recover and thrive.

What is Financial Restructuring and How Does It Work?

At its core, this strategy focuses on overhauling your company’s financial obligations (what you owe) and its capital structure (how the business is funded – through debt or owner’s equity). The main goal is to create financial stability and breathing room so you can focus on fixing the underlying operational issues in your business.

Think of it like performing essential surgery on your company’s finances. It directly addresses problems like:

- Too much debt: More debt than the business can realistically handle or afford.

- Bad loan terms: High interest rates, unsuitable repayment schedules, or restrictive conditions (covenants) from lenders.

- Not enough cash: Difficulty meeting day-to-day expenses like payroll, supplier payments, or rent (liquidity constraints).

- Inefficient finances: Money tied up in non-performing assets or poorly structured funding.

The process typically involves several key actions, often happening simultaneously:

- Debt Restructuring and Renegotiation: This is a cornerstone. It means actively negotiating with your creditors (banks, lenders, potentially major suppliers, even the IRD) to change the terms of your debts. This could involve extending repayment periods, reducing interest rates, converting some debt into equity (ownership), or sometimes even partial debt forgiveness.

- Balance Sheet Cleanup: Taking a hard look at your assets and liabilities. This might mean selling off non-essential assets to raise cash, writing down the value of assets that are no longer worth their booked value, and generally making sure your balance sheet accurately reflects the company’s current financial reality.

- Working Capital Optimization: Finding ways to improve your day-to-day cash flow. This could involve tightening up customer credit terms to get paid faster, negotiating better payment terms with suppliers, reducing inventory levels, or exploring options like invoice financing.

- Equity Recapitalization or New Investment: This might involve bringing in new money by selling shares (equity) in the company. This injects vital cash but often means existing owners dilute their ownership percentage. Sometimes, existing owners might need to contribute more capital themselves.

- Cash Management Systems Implementation: Putting rigorous systems in place to track every dollar coming in and going out. This often includes detailed cash flow forecasting, especially a rolling 13-week cash flow forecast, which becomes a critical management tool.

- Potential Insolvency Protection (Formal Processes): In severe cases, this strategy might involve using formal insolvency procedures available under New Zealand law, such as Voluntary Administration or proposing a Creditor Compromise. These legal frameworks can provide protection from creditors while a restructuring plan is developed and implemented, aiming to save the business or maximise returns for creditors compared to liquidation. (This is conceptually similar to Chapter 11 bankruptcy in the US).

Why This Strategy is Crucial

Financial restructuring deserves its place high on any list of business turnaround strategies because it directly confronts the immediate threat of insolvency – the inability to pay debts as they fall due. Without addressing crippling debt or severe cash shortages, even the best operational improvements might be too little, too late. It buys precious time and creates the financial stability needed for other turnaround efforts (like improving sales or cutting operational costs) to work.

When and Why to Use This Approach

You should seriously consider financial restructuring when your Auckland business experiences signs of severe financial distress:

- Consistently struggling to make loan payments or meet payroll.

- Facing demands from creditors or legal threats due to unpaid bills.

- Violating loan covenants (conditions set by your bank).

- Experiencing a rapid depletion of cash reserves with no clear path to replenishment.

- When forecasts show that upcoming obligations cannot be met.

The “why” is straightforward: survival and sustainability. It aims to prevent business failure, stabilise finances, reduce the pressure from debt, improve cash flow, and ultimately create a viable financial structure that can support the business long-term.

Benefits (Pros)

- Prevents Immediate Collapse: Can stop the business from failing due to inability to pay debts.

- Creates Breathing Room: Frees up cash and management focus for operational fixes.

- Reduces Financial Burden: Lower interest payments and extended repayment terms can significantly improve cash flow.

- Addresses Root Causes: Fixes fundamental problems in how the business is funded.

- Improves Financial Discipline: Often leads to better financial controls, reporting, and forecasting.

Downsides (Cons)

- Ownership Dilution: Bringing in new equity investors usually means existing owners end up with a smaller share.

- Damaged Relationships: Negotiations can be tough and may strain relationships with banks, lenders, and suppliers.

- Negative Perception: Restructuring, especially if public, can worry customers, employees, and the market.

- Requires Expertise: You’ll almost certainly need specialised (and potentially expensive) legal and financial advisors familiar with restructuring and NZ insolvency law.

- Loss of Control: New investors or creditors may impose conditions or demand more oversight.

Examples of Success (Illustrative)

While many famous examples are large international corporations, the principles apply universally:

- General Motors (2009): Used bankruptcy protection to shed massive debt and unprofitable brands, emerging as a leaner company.

- Marvel Entertainment (1996): Went through bankruptcy and restructuring, cleaning up its finances, which paved the way for its later success and acquisition by Disney.

- Tesco (post-2014): After an accounting scandal, undertook significant balance sheet restructuring, asset sales, and debt reduction to regain stability.

For a smaller Auckland business, success might look like renegotiating a major bank loan, securing a new payment plan with the IRD, and implementing tight cash controls that allow the business to trade through a difficult period and return to profitability.

Actionable Tips for Auckland Small Businesses

If you think your business needs financial restructuring:

- Get Expert Help Early: Don’t wait until it’s too late. Engage with accountants and lawyers in Auckland who have specific experience in business turnaround, restructuring, and insolvency.

- Communicate Proactively: Talk to your bank and key creditors before you start missing payments. Open communication can build goodwill and make negotiations easier.

- Master Your Cash Flow: Develop detailed cash flow forecasts (daily, weekly, and the crucial 13-week rolling forecast). Know exactly where your cash is coming from and going to. Base decisions on this data.

- Explore Funding Options: Look into options like asset-based lending (borrowing against invoices or inventory) if traditional bank lending is tight.

- Implement Rigorous Controls: Get serious about financial discipline. Monitor key financial metrics closely, approve expenses carefully, and ensure your reporting is accurate and timely.

- Be Realistic: Understand the potential downsides (like dilution or loss of some control) and be prepared to make difficult decisions.

In summary, Financial Restructuring and Debt Management is a complex but powerful business turnaround strategy. For Auckland businesses facing severe financial difficulties, it can be the key to survival, providing the stability needed to implement broader operational changes and build a sustainable future. It requires expert guidance, transparent communication, and decisive action.

Okay, here is the detailed section for item #4, “Leadership and Cultural Transformation,” formatted in Markdown and tailored for small businesses in Auckland seeking advice on business turnaround strategies.

4. Leadership and Cultural Transformation

Sometimes, the challenges facing a struggling business run deeper than just finances or operations. The very way the company is led, how decisions are made, and the underlying ‘personality’ or culture of the workplace can be the root cause of decline. This is where Leadership and Cultural Transformation comes in as a powerful, albeit demanding, business turnaround strategy.

What is Leadership and Cultural Transformation?

This strategy focuses on fundamentally changing the organisation’s leadership approach, management practices, and cultural foundations. It’s about addressing dysfunctional behaviours, improving how work actually gets done (execution), and getting everyone aligned and pulling in the same, new direction. It recognises that sustainable turnarounds often require deep shifts in how your Auckland business operates daily – the habits, the unspoken rules, the attitudes, and the leadership styles. It’s less about tweaking processes and more about transforming the people-side of the business.

How Does It Work?

Implementing this involves several key steps:

- Assessment: Honestly evaluating the current leadership effectiveness and the existing company culture. What’s working? What’s toxic? What’s holding the business back?

- Vision & Values: Redefining or reinforcing the company’s core values and creating a clear vision for the desired future culture.

- Leadership Changes: This might involve coaching existing leaders, changing specific management roles, restructuring the leadership team, or even bringing in new leadership with different skills or perspectives.

- System Alignment: Redesigning systems like performance management, rewards, and recognition to actively support the desired new culture and behaviours.

- Communication & Engagement: Implementing robust communication strategies to explain the ‘why’ behind the changes, model new behaviours, and create channels for feedback and collaboration.

- Talent Management: Overhauling how you attract, develop, and retain talent to ensure you have people who align with the new culture and strategic direction.

Why This Deserves Its Place in the List

While operational or financial fixes can provide short-term relief, they often fail if the underlying leadership and cultural issues aren’t addressed. A toxic culture, poor leadership, or a lack of accountability can sabotage even the best strategic plans. Leadership and Cultural Transformation tackles the problem at its source, making it a crucial component of many successful business turnaround strategies, especially when issues are deep-seated or the business environment demands significant adaptation.

Key Features & Benefits (Pros):

- Addresses Root Causes: Gets to the heart of persistent problems rather than just treating symptoms.

- Sustainable Foundation: Creates lasting change and builds a healthier, more resilient organisation for the long term.

- Unlocks Potential: A positive, aligned culture can significantly boost employee morale, engagement, and discretionary effort.

- Improves Execution: When leaders and culture support the strategy, other turnaround initiatives (operational, financial) are far more likely to succeed.

- Attracts & Retains Talent: A healthy culture and strong leadership make your business a more attractive place to work, helping you secure the skills needed for revitalization.

Challenges & Considerations (Cons):

- Time-Intensive: This is not a quick fix. Meaningful cultural change often takes years to fully embed.

- Difficult to Measure Short-Term: Unlike cost cuts, the positive impact on the bottom line might not be immediately obvious.

- Requires Expertise: Effectively managing large-scale cultural change often requires specialised knowledge and skills.

- Potential Resistance: Change can be uncomfortable. Expect pushback, especially from long-serving employees or managers invested in the old ways.

- Temporary Instability: Changes in leadership or established norms can create uncertainty in the short term.

When and Why to Use This Approach for Your Auckland Business:

Consider focusing on Leadership and Cultural Transformation when you observe:

- Chronic Underperformance: Despite trying other fixes, the business consistently fails to meet goals.

- Low Morale & High Turnover: Your team seems disengaged, frustrated, or people are leaving frequently.

- Poor Execution: Good ideas and plans consistently fail to translate into effective action.

- Toxic Behaviours: Blame culture, lack of accountability, poor communication, or siloed thinking are common.

- Major Strategic Shift Needed: The market has changed dramatically, and the old ways of thinking and operating are no longer viable.

This approach is necessary because the “soft stuff” – leadership, culture, values – ultimately drives the “hard stuff” like results and profitability.

Examples of Success (Learning from the Greats):

While these are large global companies, the principles they applied are relevant:

- Microsoft: Under Satya Nadella, shifted from an internal-competing, ‘know-it-all’ culture to a collaborative, ‘learn-it-all’ culture, fuelling innovation and growth.

- Ford: Alan Mulally’s ‘One Ford’ plan unified a fragmented company culture, fostering collaboration and enabling a remarkable turnaround.

- Starbucks: Howard Schultz’s return saw a refocusing on core values, coffee quality, and partner (employee) experience to revitalize the brand.

Actionable Tips for Auckland Small Businesses:

- Start with Honesty: Conduct a candid assessment of your current leadership and culture. Use surveys, interviews, or facilitated discussions. What do your employees really think?

- Tackle Toxicity First: Identify and visibly address negative or undermining behaviours quickly. This sends a powerful signal that things are changing.

- Lead by Example: As the leader, you must embody the changes you want to see. Use symbolic actions (e.g., changing how meetings are run, celebrating desired behaviours) to reinforce the message.

- Align Rewards: Ensure your performance reviews, bonuses, and promotions actively recognise and reward the behaviours and values you want to encourage.

- Empower Your Managers: Your middle managers or team leaders are crucial. Invest in training and supporting them to be effective change agents.

- Communicate Relentlessly: Create regular opportunities for two-way communication. Explain the changes, listen to concerns, and celebrate small wins. Use team meetings, newsletters, and one-on-one chats.

Implementing Leadership and Cultural Transformation is a significant undertaking, requiring commitment, patience, and courage. However, for Auckland businesses facing deep-rooted challenges, it can be one of the most impactful and sustainable business turnaround strategies available, paving the way for renewed purpose, performance, and long-term success.

5. Digital Transformation and Technology Modernization

In today’s fast-paced market, falling behind technologically can quickly lead to business decline. Digital Transformation and Technology Modernization is a powerful business turnaround strategy focused on fundamentally changing how your business operates and delivers value by leveraging modern digital technologies and IT infrastructure. It’s about more than just buying new software; it’s a strategic overhaul designed to revitalise your business model, streamline operations, significantly improve how you interact with customers, and carve out new competitive advantages, particularly crucial when facing financial difficulties or market shifts.

This approach recognises that outdated systems, inefficient manual processes, and a poor online presence are often significant contributors to a business’s struggles. By strategically adopting technology, you can address these root causes and build a more resilient and future-proof operation. It’s a core component of many successful business turnaround strategies because technology now underpins almost every aspect of business success.

How It Works: Key Features

Implementing this strategy involves several key actions, tailored to your specific business needs:

- Legacy System Replacement or Modernization: Updating or replacing outdated software and hardware that hinders efficiency, security, or customer experience. This could mean moving from old server-based accounting software to a cloud-based system.

- Data Analytics and Business Intelligence: Implementing tools and processes to collect, analyze, and interpret business data. This allows for better, data-driven decision-making regarding sales, marketing, operations, and customer behaviour.

- Digital Customer Experience Enhancement: Improving customer interactions across all digital touchpoints. This includes having a user-friendly website, offering online ordering or booking, providing digital customer support (like chatbots or online portals), and engaging through social media.

- Process Automation and Workflow Digitization: Using technology to automate repetitive manual tasks (like invoicing, data entry, or report generation) and digitizing paper-based workflows, freeing up staff time and reducing errors.

- Adoption of Cloud-Based Infrastructure and Applications: Moving IT infrastructure (servers, storage) and software applications (like CRM, project management, office suites) to the cloud for greater flexibility, scalability, accessibility, and often lower costs.

- Development of Digital Products and Services: Creating new, technology-enabled offerings or adding digital features to existing ones to open up new revenue streams or enhance value.

Why Consider Digital Transformation in a Turnaround?

This strategy earns its place because technological backwardness is increasingly a direct path to obsolescence. When should you prioritize this?

- If your systems are outdated and inefficient: Causing delays, errors, and high maintenance costs.

- If your customer experience lags competitors: You lack online ordering, easy digital communication, or a modern web presence.

- If you lack data for decision-making: You’re guessing rather than using insights from your operations or customers.

- If manual processes are bogging you down: Staff spend too much time on repetitive tasks instead of value-adding activities.

- If digitally savvy competitors are stealing market share: They offer convenience or services you can’t match due to technology limitations.

Pros and Cons

Pros:

- Can unlock entirely new revenue streams and business models.

- Often leads to significant operational cost savings and efficiency gains.

- Improves strategic decision-making through better data insights.

- Vastly enhances customer satisfaction, engagement, and loyalty.

- Can transform cost structures through automation and scalable cloud solutions.

- Positions your Auckland business to adapt to future technological shifts.

Cons:

- Requires potentially significant upfront investment when cash flow is already tight.

- Can face resistance from employees uncomfortable with new technologies.

- Carries execution risk – large projects can be complex and prone to delays or failure if not managed well.

- May require hiring new talent or significant retraining of existing staff.

- The full benefits and return on investment may take time to become apparent.

Examples of Success

Many globally recognized companies revitalized their fortunes through technology:

- Domino’s Pizza: Transformed from a struggling pizza chain into a tech powerhouse by focusing on its digital ordering platform, making it incredibly easy for customers to order online and via apps.

- Microsoft: Under Satya Nadella, pivoted from a reliance on packaged software (Windows, Office) to a “cloud-first, mobile-first” strategy, emphasizing Azure cloud services and Office 365 subscriptions, leading to massive growth.

These examples show how technology can be central to effective business turnaround strategies, fundamentally altering how companies compete and operate.

Actionable Tips for Auckland Small Businesses

Embarking on digital transformation can feel daunting, especially for smaller businesses. Here’s how to approach it:

- Start with the Customer: Focus initial efforts on improvements that directly impact the customer experience and can deliver visible results quickly (e.g., a better website, easier online booking).

- Be Agile: Instead of planning massive, multi-year projects (waterfall), adopt agile methods. Work in smaller sprints, test, learn, and adapt as you go. This reduces risk and allows for flexibility.

- Buy vs. Build Wisely: Carefully evaluate whether to buy off-the-shelf software (often faster and cheaper for common needs) or build custom solutions (for unique competitive advantages). For most Auckland SMEs, ‘buying’ or subscribing to existing SaaS solutions is often more practical initially.

- Prioritize Data Security: From day one, implement strong data governance policies and security measures to protect your business and customer information, especially given New Zealand’s privacy laws.

- Invest in Your People: Provide training and support to help your existing team develop the necessary digital skills. Foster a culture that embraces technological change.

- Measure Everything: Establish clear Key Performance Indicators (KPIs) to track the progress and impact of your digital initiatives (e.g., website conversion rates, process completion times, customer satisfaction scores, cost savings).

Influential Concepts

The importance of digital transformation has been highlighted by tech leaders like Satya Nadella (Microsoft), Marc Benioff (Salesforce), and Jeff Bezos (Amazon), as well as methodologies like Eric Ries’ Lean Startup principles and frameworks developed by research firms like Gartner.

In conclusion, while potentially challenging to implement during tough times, Digital Transformation and Technology Modernization is often not just beneficial but essential for long-term survival and success. It’s a proactive business turnaround strategy that tackles operational inefficiencies and changing customer expectations head-on, rebuilding the business on a stronger, more modern foundation.

6. Core Business Revitalization

What it is: Sometimes, the best path forward in a business turnaround isn’t a radical reinvention, but a determined return to basics. Core Business Revitalization is a powerful business turnaround strategy that focuses on strengthening the fundamental operations and value proposition of your existing business. Instead of chasing entirely new markets or products, you double down on what your company was originally built to do, fixing the issues that led to decline and making your core offering stronger than ever.

Why it’s on the list: This strategy deserves its place because it’s often the most logical and achievable first step in a turnaround. Many businesses falter not because their core idea is bad, but because execution has slipped – quality declined, customer service suffered, or operations became inefficient. Revitalizing the core addresses these foundational problems directly.

How it Works: This approach involves a deep, honest look inside your business. It’s about recommitting to your core competencies while systematically identifying and fixing weaknesses. Key focus areas often include:

- Product/Service Quality Improvement: Addressing defects, enhancing features based on customer feedback, ensuring consistency, and improving overall performance.

- Customer Experience Enhancement: Mapping the customer journey, identifying pain points, improving service interactions, streamlining processes (like ordering or support), and building stronger relationships.

- Sales and Marketing Effectiveness: Refining your messaging to highlight core strengths, targeting your ideal customers more effectively, improving sales processes, and potentially optimizing your pricing strategy.

- Operational Excellence: Streamlining internal processes, reducing waste, improving efficiency, investing in necessary training, and potentially upgrading key equipment or technology that supports the core business.

- Supply Chain and Distribution: Ensuring reliable sourcing, optimizing inventory levels, and improving the efficiency of how your product or service reaches the customer.

The goal is to restore competitive strength and profitability within your existing markets by being better at what you fundamentally do.

When and Why to Use This Approach:

Core Business Revitalization is often the right choice when:

- Your underlying market is still viable and not in terminal decline.

- Your brand still holds some recognition or goodwill with customers.

- The company’s problems stem primarily from internal issues (e.g., operational inefficiencies, quality control failures, poor customer service) rather than a fundamental market shift.

- You have existing assets, skills, and market knowledge that can be leveraged.

- You need a potentially faster and less resource-intensive path to stability compared to a complete strategic pivot.

For many small businesses in Auckland facing challenges, getting back to basics and fixing operational flaws is a critical and effective step before considering more drastic changes. It’s about rebuilding a solid foundation.

Pros:

- Leverages existing assets, capabilities, and market knowledge – you’re working with what you know.

- Typically requires less investment than launching entirely new ventures or entering new markets.

- Builds on established customer relationships and existing brand recognition.

- Often yields noticeable improvements and potential financial results more quickly than radical shifts.

- Generally faces less internal resistance from your team, as it focuses on improving familiar territory.

Cons:

- May not be sufficient if your core market is undergoing a fundamental, irreversible shift (e.g., Blockbuster sticking to DVDs when streaming emerged).

- Limited growth potential if your core market is stagnant or shrinking structurally.

- Operational improvements can sometimes be quickly matched or copied by competitors.

- It can sometimes be difficult to generate internal or external excitement around a ‘back to basics’ message compared to a bold new direction.

- Risks perpetuating strategic blind spots if the leadership doesn’t also challenge underlying assumptions about the market.

Examples of Success:

- Starbucks (2008-2010): Under Howard Schultz’s return, Starbucks refocused intensely on coffee quality, barista training, and the in-store ‘experience,’ closing underperforming stores and moving away from distractions that diluted its core brand.

- Lego (Early 2000s): Facing potential bankruptcy after over-diversifying, Lego drastically simplified its product lines, shed non-core businesses (like theme parks initially), and refocused innovation around its core asset: the plastic brick system.

- Apple (1997): Upon returning, Steve Jobs famously slashed Apple’s sprawling and confusing product line to focus on just a few core products where Apple could truly excel, emphasizing design and user experience.

Actionable Tips for Auckland Small Businesses:

- Start with Your Customers: Conduct thorough research (surveys, interviews, feedback forms) to truly understand their current experience, pain points, and what they value most about your core offering.

- Benchmark Your Performance: Honestly compare your product quality, service levels, and pricing against your key competitors. Where are the gaps?

- Prioritise Quality: Systematically address any core product or service quality issues before launching major new marketing campaigns. You need substance behind the message.

- Create Feedback Loops: Implement simple, regular ways to capture the ‘voice of the customer’ and use that feedback to drive continuous improvement.

- Remove Friction: Map out your customer journey (from finding you online to purchasing and after-sales support) and actively look for and remove steps that cause frustration or delay.

- Focus Your Team: Create small, cross-functional teams (even if it’s just a couple of people) dedicated to tackling specific improvement areas (e.g., improving website checkout, reducing service response times).

In essence, Core Business Revitalization is a disciplined business turnaround strategy focused on excellence in execution. For many struggling businesses, fixing the core is the most critical step towards recovery and renewed success.

7. Mergers, Acquisitions, and Strategic Partnerships

When internal improvements aren’t enough or happening too slowly to save a struggling business, looking outwards can be a powerful move. Mergers, Acquisitions, and Strategic Partnerships represent a category of business turnaround strategies that leverage external relationships to fundamentally reshape and revitalise a company. Instead of solely relying on fixing internal operations (organic growth), this approach involves buying other companies, selling off parts of your own, or teaming up with others to achieve a faster, more dramatic turnaround.

This strategy earns its place on this list because it offers the potential for rapid, transformative change that might be impossible through internal efforts alone, especially when facing severe distress or needing capabilities the business simply doesn’t possess. It acknowledges that sometimes the quickest path to recovery involves joining forces, acquiring necessary assets, or shedding burdens.

How It Works & Key Features:

This isn’t a single action but a range of options involving other organisations:

- Strategic Acquisitions: Buying another business (whole or in part) that complements your own. This could be to acquire new technology, talented staff, intellectual property, a strong customer base, or access to new markets quickly.

- Divestitures: Selling off non-core, unprofitable, or underperforming divisions or assets. This generates cash that can be reinvested into the core business, reduces complexity, and allows management to focus on areas with higher potential.

- Joint Ventures (JVs) & Strategic Alliances: Partnering with another company to pursue a specific project or goal. This allows sharing of risks, costs, resources, and expertise without the complexity of a full merger. Examples include joint marketing efforts or co-developing a new product.

- Licensing Agreements & Technology Partnerships: Gaining rights to use another company’s technology, brand, or intellectual property, or partnering to leverage complementary technologies. This can provide a shortcut to innovation.

- Supply Chain & Distribution Partnerships: Collaborating with suppliers or distributors to improve efficiency, reduce costs, or reach new customers more effectively.

- Reverse Mergers or Being Acquired: In some situations, the best turnaround path might involve merging with another entity where your business becomes part of a larger, stronger organisation, or being acquired outright by a company better positioned to leverage your assets.

Why and When to Use This Approach:

Consider this strategy when:

- Speed is Critical: Organic improvements are projected to be too slow to avert crisis or capture fleeting market opportunities.

- Capability Gaps Exist: Your business lacks crucial technology, expertise, market access, or brand recognition that can be quickly obtained through an external deal.

- Scale is Needed: Achieving economies of scale quickly is necessary to compete effectively or improve profitability (e.g., reducing costs per unit by combining operations).

- Market Consolidation: Your industry is consolidating, and partnering or acquiring is necessary for survival or to achieve a stronger competitive position.

- Non-Core Assets Drain Resources: Underperforming or non-strategic business units consume valuable cash and management attention that could be better used elsewhere.

- Financial Restructuring: As part of a larger financial restructuring, divesting assets can raise needed capital, or merging can create a more financially viable entity.

Pros:

- Rapid Transformation: Can instantly add new capabilities, technologies, or market presence.

- Immediate Scale & Synergies: Potential for quick cost savings through combined operations or increased purchasing power.

- Diversification: Quickly adds new revenue streams, reducing reliance on struggling core areas.

- Cash Injection & Focus (Divestiture): Selling units provides funds and sharpens management focus on core recovery efforts.

- Market Signalling: Decisive M&A action can signal confidence and strategic direction to investors, lenders, and customers.

- Resource Access: Partnerships can provide access to capital, expertise, or facilities when your own resources are constrained.

Cons:

- High Execution Risk: Deals are complex and can easily fail, especially when one or both parties are financially vulnerable.

- Integration Challenges: Merging operations, systems, and especially cultures is difficult and time-consuming, potentially disrupting the core business during a critical period.

- Financial Strain: Acquisitions often require significant capital outlay or taking on substantial debt, which can be risky for a company already in turnaround.

- Cultural Conflict: Clashes between the ways different companies operate can destroy expected value and lead to key talent departures.

- Management Distraction: The intense effort required for deal-making and integration can divert leadership focus from essential operational improvements.

- Loss of Control: Mergers, JVs, or being acquired often mean ceding some level of control or independence.

Examples of Success:

- Disney’s acquisition of Marvel (2009) and Lucasfilm (Star Wars, 2012): Under CEO Bob Iger, these acquisitions dramatically reinvigorated Disney’s content pipeline and franchise strength, driving significant growth.

- Google’s acquisition of Android (2005): A relatively small acquisition that positioned Google to dominate the emerging mobile operating system market.

- IBM’s divestiture of PC (2005) and low-end server businesses (2014): Under leaders like Lou Gerstner, IBM shed lower-margin hardware units to focus on higher-margin software and services, transforming its business model.

- Fiat’s alliance and eventual merger with Chrysler (starting 2009): Led by Sergio Marchionne, this bold move saved Chrysler from collapse and created a global automaker (FCA) with greater scale and reach.

Actionable Tips for Auckland Businesses:

- Prioritise Strategic Fit: Don’t just chase deals that look good financially. Ensure the target or partner truly aligns with your turnaround goals (e.g., provides the specific capability you lack).

- Assess Cultural Compatibility: Often overlooked, but critical. Before committing, evaluate whether the two organisations’ cultures can realistically integrate or work together effectively. Mismatches here often doom deals.

- Plan Integration Meticulously: Develop detailed post-merger integration (PMI) plans before the deal closes. Who does what? How will systems be merged? How will customers be managed?

- Consider Earnouts: When acquiring, using earnout structures (where part of the payment depends on future performance) can help align incentives with the selling party and reduce upfront risk.

- Communicate Clearly: Keep employees, customers, suppliers, and lenders informed throughout the process (as much as confidentiality allows) to manage uncertainty and maintain trust.

- Ensure Management Bandwidth: Be realistic about the time and effort required. Ensure you have dedicated resources for integration without neglecting the day-to-day running and fixing of your core operations.

This strategy, famously employed by turnaround leaders like Lou Gerstner at IBM, Bob Iger at Disney, and Sergio Marchionne at Fiat-Chrysler, and often guided by frameworks from firms like McKinsey & Company, is one of the most potent but also riskiest business turnaround strategies. For Auckland businesses facing significant challenges, carefully considering strategic external relationships can unlock pathways to recovery that might otherwise be out of reach.

Okay, here is the detailed section for item #8, formatted in Markdown and tailored for small businesses in Auckland seeking advice on business turnaround strategies.

8. Innovation and New Growth Engine Development

When your Auckland business is facing difficulties, much of the focus naturally goes towards fixing immediate problems – cutting costs, improving efficiency, and stabilising cash flow. These are crucial steps. However, a truly robust turnaround often requires looking beyond mere survival towards long-term, sustainable growth. This is where Innovation and New Growth Engine Development comes in as a vital component of effective business turnaround strategies.

What is it?

This strategy isn’t just about tweaking what you already do; it’s about actively creating new sources of revenue and value. Instead of solely focusing on fixing the existing, potentially declining parts of your business, you dedicate resources (even if limited initially) to developing new products, services, customer experiences, or even entirely new business models. The goal is to build the next version of your business – one that can thrive long after the current challenges are overcome and potentially replace older, fading revenue streams.

Why is this Strategy Important in a Turnaround?

Sometimes, the market shifts, customer needs evolve, or competition intensifies to the point where your original business model is no longer viable for significant future growth. Simply fixing operational issues might keep the lights on temporarily, but it won’t necessarily build a thriving future. Innovation allows you to:

- Create New Demand: Tap into unmet customer needs or entirely new markets.

- Future-Proof Your Business: Position your company ahead of industry disruptions rather than reacting to them.

- Shift Perceptions: Move from being seen as a struggling business to an exciting, forward-thinking one, which can help with customer loyalty, attracting talent, and even securing investment or better supplier terms.

- Develop Higher Margin Offerings: New, unique offerings often command better pricing than established, commoditised ones.

How Does It Work? Key Features in Practice:

For a small Auckland business, implementing this doesn’t necessarily mean building a huge R&D lab. It involves activities like:

- New Product/Service Development: Brainstorming, developing, and launching offerings that cater to new customer needs or leverage your existing skills in novel ways. (e.g., A local Auckland cafe adding a specialised catering service for corporate events; a trade business developing a preventative maintenance subscription).

- Business Model Innovation: Changing how you create, deliver, or capture value. (e.g., A retail store transitioning to a primarily online model with unique virtual consultations; a consulting service offering scalable online courses alongside bespoke projects).

- Exploring Adjacent Opportunities: Using your core capabilities to enter slightly different markets. (e.g., A graphic designer specialising in branding for tradespeople expanding into website design specifically for that niche).

- Customer Experience Innovation: Finding new ways to delight customers and differentiate yourself beyond just the product/service itself. (e.g., A local tourism operator using virtual reality previews; a B2B supplier creating an exceptionally easy online ordering portal with personalised support).

- Capability Building: Investing time or resources in learning new skills or technologies that will be crucial for future offerings (e.g., learning digital marketing techniques, understanding sustainable practices relevant to your industry).

Potential Benefits (Pros):

- Significant Growth Potential: Can unlock entirely new revenue streams beyond your current market saturation.

- Enhanced Brand Image: Positions your company as innovative and adaptable.

- Attracts Talent: Creative and forward-thinking projects can attract motivated employees.

- Higher Margins: Unique offerings often face less direct price competition initially.

- Competitive Advantage: Can leapfrog competitors still focused on the old ways of doing business.

- Diversification: Reduces reliance on a single, potentially vulnerable, product or market.

Potential Challenges (Cons):

- Requires Investment: Needs time, money, and focus, which are often scarce during a turnaround.

- High Uncertainty & Risk: Innovation is inherently risky; not all ideas will succeed. Statistics show many new initiatives fail.

- Takes Time: Meaningful results often take months or even years to materialise, while turnaround pressures demand quick wins.

- Internal Conflict: Can create tension between resources allocated to fixing the core business versus building the new.

- Capability Gaps: Your current team may lack the skills needed for the new direction.

- Distraction: Can divert focus from critical operational fixes if not managed carefully.

When and Why to Use This Approach:

This strategy is most crucial when:

- Your core market is demonstrably shrinking or facing irreversible decline.

- Your existing business model is becoming obsolete due to technology or competition.

- You’ve achieved some initial stabilisation and have some capacity (even minimal) to look beyond immediate survival.

- You recognise that simply cutting costs won’t be enough for long-term viability.

It’s a forward-looking strategy that complements, rather than replaces, immediate stabilisation efforts. It’s about planting the seeds for future harvests while you’re busy repairing the current farm.

Examples of the Principle:

While examples like Netflix (DVDs -> Streaming -> Original Content) or Amazon (Books -> Everything Store -> AWS Cloud Services) are large scale, the principle applies to small businesses too:

- An Auckland bookstore facing online competition might start hosting paid author events, workshops, or offering curated book subscription boxes.

- A traditional printing company might invest in digital design services or large-format printing for events, moving beyond just flyers and documents.

- A restaurant struggling with evening trade might develop and heavily market a unique lunch menu targeting local office workers or launch a high-quality meal-kit delivery service based on their popular dishes.

Actionable Tips for Auckland Small Businesses:

- Start Small & Focused: You don’t need a huge budget. Dedicate a small amount of time each week or assign one person (even part-time) to explore new ideas.

- Use Lean Methods: Treat new ideas like experiments. Define assumptions, test them quickly and cheaply with real customers (e.g., surveys, landing pages, small pilot programs), learn, and adapt (pivot or persevere). Eric Ries’ Lean Startup methodology is valuable here.

- Talk to Your Customers: Understand their evolving needs, pain points, and aspirations. Your best new ideas might come directly from them.

- Balance Your Bets: Don’t put all your innovation eggs in one basket. Consider a mix of small improvements to existing offerings (incremental innovation), expanding into related areas (adjacent innovation), and perhaps one or two bigger, bolder ideas (transformational innovation).

- Protect the Initiative: Ensure leadership buys into the importance of innovation. Shield these small, exploratory efforts from short-term budget cuts where possible – view it as R&D for the future.

- Measure Differently: Don’t expect immediate profitability from new ventures. Use metrics like customer feedback, learning velocity, prototype testing results, and early adopter uptake.

- Look for Synergies: How can new ideas leverage your existing strengths, customer base, or resources in Auckland?

- Consider Partnerships: Can you collaborate with another local business to launch something new?

In Conclusion:

While demanding, incorporating Innovation and New Growth Engine Development into your business turnaround strategies shifts the narrative from merely surviving to actively building a brighter, more resilient future for your Auckland business. It requires vision, discipline, and a willingness to experiment, but it can be the key to unlocking long-term sustainable success beyond the current crisis.

Business Turnaround Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Cost Reduction and Efficiency Optimization | Medium – process reengineering, audits | Moderate – staff, financial analysis | Quick financial stabilization, improved cash flow (1-2 quarters) | Companies needing immediate cash flow improvement and expense control | Fast cash flow impact, financial stability, clear stakeholder signaling |

| Strategic Repositioning and Market Refocus | High – deep market analysis, portfolio changes | High – market research, investment | Sustainable competitive advantage, new growth avenues | Businesses needing fundamental strategic change and new market positioning | Addresses core strategy, opens growth, premium pricing potential |

| Financial Restructuring and Debt Management | High – legal negotiations, complex finance | High – expert advisors, legal support | Debt reduction, liquidity improvement, solvency restoration | Firms facing insolvency, excessive debt, or capital structure challenges | Prevents failure, improves cash flow, strengthens capital base |

| Leadership and Cultural Transformation | Very High – long-term change management | High – leadership investment, training | Sustainable performance foundation, improved execution | Organizations with deep-rooted cultural or leadership dysfunction | Addresses root causes, boosts employee engagement, improves initiative execution |

| Digital Transformation and Technology Modernization | High – technology upgrades, agile adoption | High – IT investment, skill development | New revenue streams, operational efficiency, enhanced customer experience | Companies needing modernization, digital competitiveness, innovation | Creates new business models, improves data-driven decisions, operational gains |

| Core Business Revitalization | Medium – targeted operational improvements | Moderate – operational focus, marketing | Quicker operational improvements, customer experience enhancement | Businesses aiming to strengthen existing core without radical pivots | Leverages existing strengths, faster results, lower investment |

| Mergers, Acquisitions, and Strategic Partnerships | Very High – complex integration and legal processes | High – capital, due diligence, management time | Rapid capability gains, scale economies, market expansion | Companies seeking fast strategic repositioning or capability acquisition | Access to new markets/capabilities, scale benefits, investor signaling |

| Innovation and New Growth Engine Development | Very High – uncertain outcomes, long timelines | High – R&D, talent, incubation resources | Potential significant new revenues, long-term growth paths | Firms aiming for future growth and industry leadership through innovation | Drives new growth, attracts talent, positions for disruption |

Turning Strategy into Sustainable Success

We’ve explored a range of powerful business turnaround strategies throughout this article, covering everything from critical cost reductions and financial restructuring to strategic repositioning, leadership changes, and embracing digital innovation. Understanding these options – whether it’s revitalising your core offering or seeking growth through partnerships – provides a vital toolkit for navigating challenging times.

The most important takeaway, however, isn’t just knowing these strategies exist. True success hinges on correctly diagnosing your business’s specific issues, selecting the most appropriate business turnaround strategies, and executing them with discipline and clear focus. Effective implementation requires strong leadership, careful planning, and often, specialist knowledge, particularly when tackling complex financial or operational changes.

For small businesses here in Auckland, mastering these concepts is invaluable. It’s the difference between merely surviving and building a more resilient, efficient, and ultimately more profitable business for the future. Taking decisive action based on sound strategy can lead not just to recovery, but to renewed growth and long-term financial stability.

Your actionable next steps should involve:

- Honestly assessing your current business health and identifying the root causes of any issues.

- Prioritising which turnaround strategies offer the most impact for your specific situation.

- Developing a clear, phased implementation plan with measurable goals.

Remember, turning a business around is a significant undertaking, but it’s absolutely achievable. View this challenge as an opportunity to refine your operations, strengthen your market position, and build a foundation for lasting success.

For Auckland small businesses seeking expert guidance to navigate the complexities of financial management and implement effective business turnaround strategies, consider reaching out to local specialists. The experienced chartered accountants and business advisors at Business Like NZ Ltd, based in Manukau, offer tailored taxation and advisory support. They specialise in helping businesses like yours achieve financial stability and move towards sustainable growth and financial freedom.