How to Reduce Expenses in Business: 7 Proven Strategies

July 20, 2025

Small Business Financial Reporting Tips for Success

July 25, 2025Understanding Profit Margins: The Small Business Reality

Profit margin isn’t just about the money you make; it’s about the money you keep. It’s the lifeblood of any thriving small business, revealing its financial health beyond just revenue. Many entrepreneurs focus on impressive sales, sometimes overlooking the crucial difference between revenue and profitability. This oversight can hide underlying issues that prevent long-term success.

Decoding the Three Key Profit Margins

To truly understand your financial position, you need to understand the three core profit margin types: gross profit margin, operating profit margin, and net profit margin. Each provides a unique perspective on your business’s performance.

- Gross Profit Margin: This shows the profitability of your core products or services before overhead costs. Imagine you sell handmade soaps. Your gross profit margin calculates the profit from each soap sale after subtracting the direct costs of ingredients and packaging, but before accounting for rent, utilities, or marketing.

- Operating Profit Margin: This metric expands on the gross profit margin by including your operating expenses. Continuing with the soap example, your operating profit margin includes expenses like rent, utilities, and employee salaries. This provides a clearer view of your day-to-day operational efficiency.

- Net Profit Margin: This is the ultimate bottom-line metric. It considers all expenses, including taxes and interest, to reveal the actual profit remaining from each dollar of sales. This number truly reflects your overall profitability and financial health. For your soap business, this means factoring in everything from loan payments to advertising costs to get a complete picture of your financial success.

The Reality of Profit Margins for Small Businesses

Understanding these different margins is critical for accurate financial assessment. A high gross profit margin might look good, but a low net profit margin could indicate excessive overhead costs. This means focusing only on sales volume isn’t enough; you must manage costs effectively to improve your bottom line.

The average profit margin for small businesses varies across industries and regions. Generally, a healthy margin is around 10%, with more successful businesses reaching 20%. In the software industry, for example, small businesses often achieve a net profit margin of approximately 20%.

Understanding profit margins empowers you to make smart decisions about pricing, cost control, and growth strategies, leading to sustained financial success.

The Profit Landscape: Industry Benchmarks That Matter

Understanding profit margins is crucial for small business success. However, comparing your margins to businesses in vastly different industries can be misleading. Profitability varies significantly across sectors due to factors like overhead, competition, and market demand. A “healthy” margin in one industry might be unsustainable in another. For example, software companies often have high margins due to lower production costs than, say, a restaurant with ingredient and staffing expenses.

Industry Insights: Where Do You Stand?

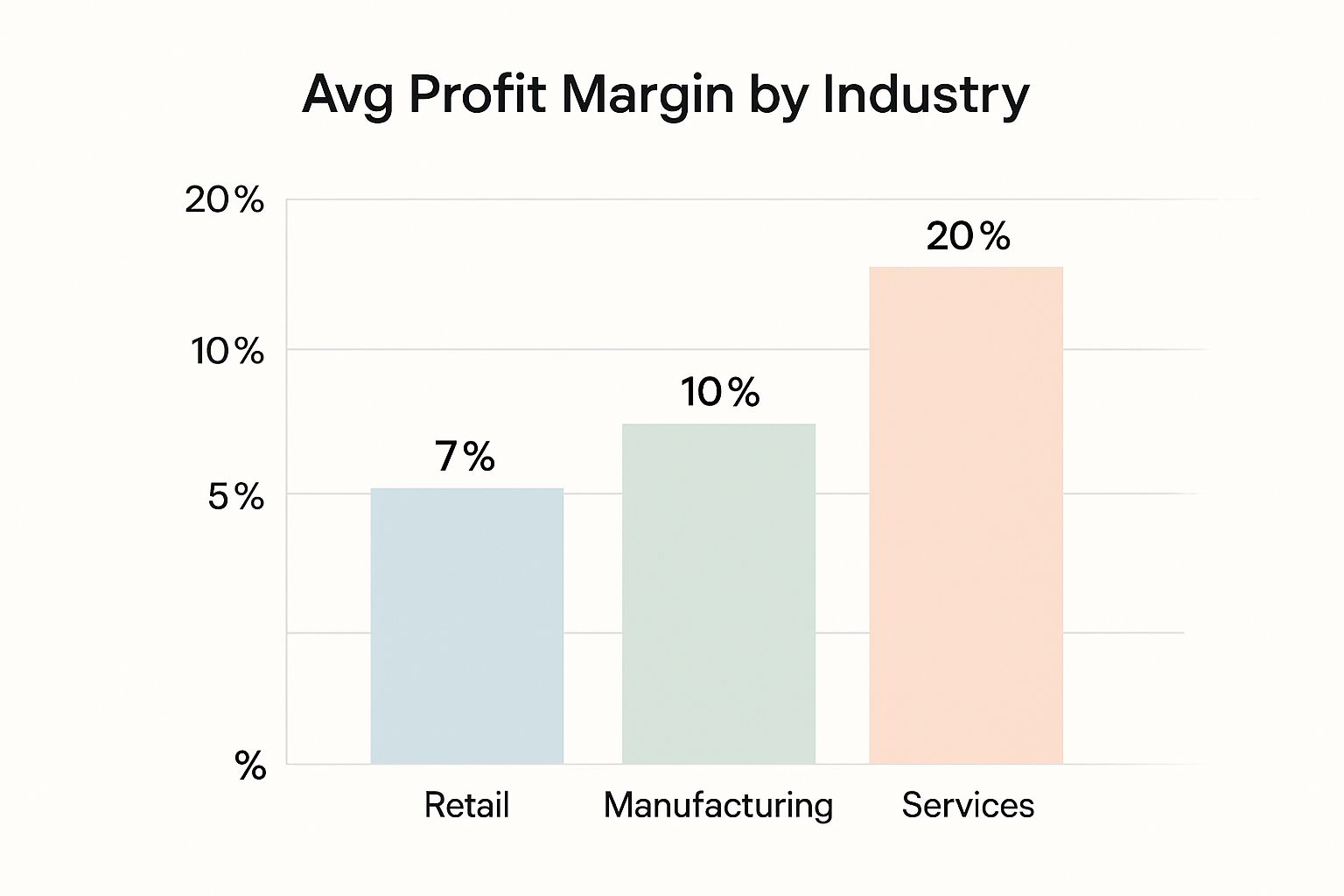

To get a realistic view of your business’s performance, you need to benchmark against competitors in your specific field. Let’s explore some industry-specific average profit margins for small businesses. The infographic below visualizes average profit margins across three key sectors: Retail, Manufacturing, and Services.

As the infographic shows, the Services sector enjoys the highest average profit margin at 20%. Manufacturing follows at 10%, and finally, Retail at 7%. This difference highlights the impact of industry dynamics on profitability. Retail businesses often operate with slimmer margins due to higher competition and price-sensitive consumers. Service-based businesses, particularly those with specialized expertise, can charge higher prices and achieve higher margins.

| Industry | Average Gross Margin | Average Net Profit Margin | Notes |

|---|---|---|---|

| Software | 70-80% | 20-25% | High due to low production costs |

| Restaurants | 55-65% | 5-10% | Fluctuating food costs and high staff turnover affect margins |

| Podcast Production | N/A | 39.1% | Low startup costs and high demand contribute to high profitability |

| Retail (General) | 40-50% | 3.09% | High competition and price sensitivity contribute to lower margins |

| Manufacturing (General) | 40-50% | 10% | Varies greatly depending on the specific type of manufacturing |

| Services (General) | 50-60% | 20% | Specialized services can command premium prices |

As this table shows, the specific type of business within a larger sector significantly impacts profitability. While software enjoys high margins, restaurants face different challenges. Podcast production emerges as a highly profitable venture thanks to low startup costs and high demand. This contrasts sharply with the challenges faced by traditional retail businesses.

The Importance of Context

While industry averages offer a helpful benchmark, they aren’t the only factors determining your potential profitability. Your location, operational efficiency, and even your business’s age can significantly impact your margins. A business in a high-rent city, for instance, will likely face different cost pressures than a similar business in a smaller town. This means understanding your particular business environment is as important as understanding industry trends.

Hidden Factors Shaping Your Small Business Margins

While industry benchmarks offer helpful context, your profit margins are also shaped by several often-overlooked factors. Understanding these hidden dynamics can be the key to unlocking your business’s full profit potential. These factors contribute to what’s unique to your business—its own “profit fingerprint.”

Location, Location, Location: Impact on Profit

Location plays a crucial role in your business’s cost structure, and this directly impacts profit margins. Businesses located in busy city centers often face higher rents and wages than those in smaller towns.

This difference in operating costs can significantly impact net profit margins, even if two businesses share the same gross profit margin. When setting prices and managing expenses, factoring in location-specific costs is crucial for accurate financial projections.

Business Age: A Factor in Profitability

The age of your business also plays a role in your average profit margin. Startups often begin with leaner structures and lower overhead, potentially leading to higher initial profit margins.

However, growth and expansion usually bring increased expenses in staffing, infrastructure, and marketing. These added costs can put downward pressure on margins. Understanding the typical margin trajectory for similar businesses at different stages of growth is essential for realistic financial planning.

Operational Efficiency: A Key to Higher Margins

Operational efficiency, how effectively a business uses its resources to generate revenue, is another critical factor. Businesses with streamlined processes and minimal waste tend to achieve higher profit margins.

For example, a manufacturing business implementing just-in-time inventory management can reduce storage costs and minimize waste, directly improving its bottom line. Continuously evaluating and optimizing operational processes is key to maximizing efficiency and profits.

Competitive Landscape: Influence on Pricing and Profit

Your industry’s competitive landscape also significantly impacts profit margins. In highly competitive markets, businesses may have less pricing flexibility, potentially leading to thinner margins. Conversely, operating in a niche market with less competition might afford more pricing power.

External factors like inflation and market conditions also impact profitability. Inflation in 2024 posed a challenge for many small businesses struggling to maintain profit margins. Yet, some sectors thrived. Adapting to economic conditions and using innovative technologies can greatly influence a small business’s profit margin and overall success. Understanding your competitive environment and crafting strategies to differentiate your offerings is essential for maintaining healthy profit margins.

Calculating Your True Profit Margin: Beyond Basic Math

Forget those simple online profit margin calculators. Accurately assessing your profit margin involves more than just basic subtraction. It requires a thorough understanding of your financials, going beyond just revenue. This deeper dive will give you a clearer picture of your business’s financial health and allow you to make informed, data-driven decisions.

Why Accurate Calculation Matters

Profit margin isn’t just a number; it’s a vital indicator of your business’s well-being. Calculating your profit margin accurately helps you in several key ways:

- Identify Profit Leaks: Find those areas where costs are creeping higher than they should be.

- Price Strategically: Set prices that not only cover your costs but also achieve your desired profit levels.

- Track Progress Over Time: Monitor your margin’s trend to quickly spot potential problems or celebrate successes.

Three Key Margins: Gross, Operating, and Net

Understanding profit margins means understanding three key metrics: gross profit margin, operating profit margin, and net profit margin.

- Gross Profit Margin: This shows the profitability of your core products or services after subtracting the direct costs of production. It isolates the profit earned from creating and selling your offerings.

- Operating Profit Margin: This builds on the gross profit margin by including your operating expenses, such as rent, salaries, and marketing. This metric provides valuable insight into the efficiency of your day-to-day operations.

- Net Profit Margin: This is the ultimate bottom-line metric, showing the profit left over after all expenses are paid, including taxes and interest. This represents the percentage of revenue that truly belongs to your business.

Let’s illustrate these margins with a simple example. Imagine you sell a product for $100, and it costs $60 to produce. Your gross profit margin is 40%. If your operating expenses add up to $20, your operating profit margin becomes 20%. Finally, after accounting for $5 in taxes and interest, your net profit margin is 15%.

To further clarify the calculation of these crucial metrics, let’s take a look at the formulas used to derive them. The table below breaks down each type of profit margin, providing the formula, an example calculation, and an explanation of what the results tell you about your business.

Profit Margin Calculation Formulas: Essential formulas for calculating different types of profit margins with examples

| Profit Margin Type | Formula | Example Calculation | What It Tells You |

|---|---|---|---|

| Gross Profit Margin | (Revenue – Cost of Goods Sold) / Revenue | ($100 – $60) / $100 = 40% | Profitability of your core product/service before overhead |

| Operating Profit Margin | (Revenue – Cost of Goods Sold – Operating Expenses) / Revenue | ($100 – $60 – $20) / $100 = 20% | Profitability of your day-to-day operations |

| Net Profit Margin | (Net Income) / Revenue | $15 / $100 = 15% | Overall profitability of your entire business after all expenses |

As you can see, each profit margin provides a different perspective on your business’s profitability. Understanding these differences is crucial for making informed decisions.

Using Margin Tracking for Strategic Decision-Making

Knowing how to calculate these margins is only the first step. The real power comes from using this information to make strategic decisions. Regularly tracking your profit margins can reveal important trends and patterns. For example, a declining net profit margin could indicate rising operating costs or ineffective pricing strategies. If you have a strong, steady gross profit margin but a lower net profit margin, this might point to inefficiencies in your operations or excessive overhead. This knowledge can guide your decision-making around cost control, pricing adjustments, or even expansion plans. By regularly calculating and analyzing your profit margins, you transform a simple calculation into a powerful business tool.

Profit Margin Transformation: Strategies That Work

Knowing how to calculate your average profit margin is the first step. The real key is knowing how to improve it. This requires a broad approach, affecting everything from pricing strategies to daily operations.

Value-Based Pricing: Focusing on Value

One of the most effective strategies is value-based pricing. This means focusing on the value you deliver to customers, not just your costs. This lets you charge more while increasing customer satisfaction.

For example, if your software saves businesses time and money, price it based on that value, not just development costs. Clearly communicating this value justifies higher prices and builds customer loyalty. This creates a win-win for you and your customers.

Adjusting Your Product/Service Mix

Another effective way to boost margins is adjusting your product or service mix. Analyze your offerings and identify which ones generate the highest profits. Then, focus your efforts there.

Imagine you own a bakery. If custom cakes have a 30% profit margin, while cookies only have 10%, shifting resources towards cakes can significantly boost your overall profits. You might even discontinue low-margin items to free up resources.

Operational Efficiency: Streamlining for Success

Operational efficiency is essential for improving profit margins. This involves streamlining processes, reducing waste, and making the most of your resources. Even small changes can add up.

For instance, a more efficient inventory system can reduce storage costs and minimize losses. Accurate record-keeping is vital for understanding your profit margins.

Outsourcing and Technology

Strategic outsourcing and technology can also improve your average profit margin. Outsourcing tasks like payroll or customer service can lower labor costs. It also lets internal teams focus on core business functions.

Investing in automation software for accounting or marketing can boost efficiency and reduce expenses. These strategic moves can have a big impact on your bottom line.

Implementation and Timelines

Putting these strategies into action takes time and careful planning. For startups, focusing on value-based pricing and operational efficiency is often the best first step. Established companies might find product/service mix adjustments and technology implementation more beneficial. You might be interested in: How to master business growth. Set realistic timelines and track your progress. Improving profit margins is an ongoing process. Small, consistent improvements can lead to big, long-term gains.

Avoiding the Profit Killers: Common Margin Mistakes

Even seasoned business owners can make mistakes that impact their average profit margin for small businesses. These often go unnoticed until they become a serious problem. Let’s explore some of these common profit killers and how to avoid them.

The Discounting Dilemma

Discounting can seem like a quick win, but it can create long-term issues. Occasional promotions are fine, but constant discounts train customers to expect lower prices. This can damage your brand’s perceived value and make it hard to charge full price. Instead of relying on discounts, focus on building value and highlighting the benefits of your offerings.

Cost-Cutting in the Wrong Areas

Controlling costs is crucial, but cutting costs in the wrong areas can actually hurt profits. For example, reducing customer service staff might save money initially, but lead to lost sales from unhappy customers. Neglecting equipment maintenance can cause expensive breakdowns and disruptions down the line. Smart cost-cutting eliminates waste without sacrificing quality or customer satisfaction.

The Revenue Trap

Focusing only on revenue growth can be a trap if you’re not paying attention to profit margins. A business can increase revenue and still lose money if expenses grow faster than sales. Aggressive marketing can boost sales, but might not be profitable if the customer acquisition cost is too high. Always balance revenue growth with profitability. Track both your top-line (revenue) and bottom-line (profit) metrics.

Neglecting the Details

Small things, like incomplete expense tracking or poor inventory management, can hurt your margins over time. Not tracking all your expenses makes it impossible to know your true profitability. Poor inventory management can lead to overstocking, spoilage, or running out of product – all of which affect your average profit margin for small businesses. Make sure you have systems in place to track expenses, manage inventory, and allocate resources effectively.

Recognizing the Warning Signs

Watch out for early signs of margin compression. A consistently declining gross profit margin could indicate rising production costs or poor pricing strategies. A shrinking operating profit margin might mean increasing operating expenses or inefficiencies. A falling net profit margin signals overall profitability problems. Regularly review your key margin metrics to catch these issues early. By understanding and avoiding these common mistakes, you can protect and improve your average profit margin, ensuring your business’s financial health and success.

Building Your Margin-Focused Business Framework

To consistently achieve a healthy average profit margin for small businesses, you need more than just individual strategies. You need a unified framework that incorporates margin-focused thinking into every facet of your operations. This framework helps you analyze your current financial position, project future profitability, and make proactive adjustments.

Implementing Regular Financial Analysis

Regular financial analysis is key to understanding your average profit margin, but it doesn’t need to be complicated. Focus on key metrics like your gross, operating, and net profit margins. Track these regularly, maybe monthly or quarterly, to identify trends and potential problems early. Use tools like spreadsheets or accounting software to automate calculations and visualize your data, making analysis faster and more insightful.

Making Margin-Conscious Decisions

Every business decision impacts your profit margins. This includes everything from pricing and marketing to hiring. Before making any big decision, consider its potential effect on your margins. For example, if considering a new marketing campaign, estimate the potential sales increase and compare it to the campaign cost. This lets you prioritize initiatives with the highest potential return on investment.

Balancing Short-Term Profitability with Long-Term Growth

While immediate profits are crucial, don’t sacrifice future growth for short-term gains. Investing in research and development, employee training, or expanding your product line might initially reduce your average profit margin. However, these investments can build a competitive edge and drive sustainable growth down the line. It’s about balancing current profitability with preparing your business for future success.

Utilizing Dashboard Metrics for Visibility

Create a financial dashboard to visually track your key margin metrics and other crucial financial indicators. This gives you a quick overview of your financial health and highlights areas needing attention. Using data visualization tools can help you track progress toward margin improvement goals.

Setting Realistic Improvement Targets

Based on industry benchmarks and your business objectives, set achievable margin improvement targets. These targets should be specific, measurable, attainable, relevant, and time-bound (SMART). This approach provides clear direction and motivates you to implement necessary improvement strategies. Regularly review and adjust these targets as your business changes.

By using this framework, you’ll change how you approach profitability, building a business that’s profitable today and set for sustainable growth tomorrow. This structure helps you make data-driven decisions and navigate the business world confidently. Ready to take your Auckland-based small business further? Business Like NZ Ltd provides expert chartered accountancy services for small to medium businesses. We offer taxation and business advisory services to help you achieve financial freedom. Visit us at https://businesslike.co.nz to learn more.