9 Proven Ways to Improve Workplace Efficiency

December 28, 2025

How to Create a Business Budget: Quick Tips Guide

January 2, 2026What is business equity? Learn how it boosts value

Let’s break down what business equity really means, in plain English.

Think about your own home. You have its market value, but you also have a mortgage. The difference between what your house is worth and what you still owe the bank is your home equity. It’s the part you truly own.

Business equity is exactly the same principle, just for your company. It’s what would be left over for you, the owner, if you sold all your business assets and paid off all your debts. It’s the true measure of your stake in the business.

The Simple Maths Behind Your Business Equity

When you see the word “equity” on a financial report, it can feel a bit like accountant-speak. But don’t let the jargon fool you; the idea is actually quite simple. It’s the ultimate measure of your business’s net worth at any given moment.

The calculation itself is incredibly straightforward:

Assets – Liabilities = Equity

This isn’t just a handy tip; it’s the core of the accounting equation that every balance sheet is built on. Your assets are everything the business owns (cash, equipment, stock), and your liabilities are everything it owes (loans, supplier bills). The difference is your equity.

To get a real feel for this, it helps to understand how these numbers are presented. You can find out more by learning how to read a balance sheet, which is where your equity figure lives.

So, Why Should You Care About Equity?

Okay, so it’s a number on a report. Why does it matter so much?

Because your business equity tells you the real story of your company’s financial health. A positive, growing equity figure is a clear sign that you’re on the right track—building a valuable, sustainable business. A declining figure, on the other hand, is an early warning sign that things might need a closer look.

This single number has a huge impact on critical business decisions:

- Borrowing Power: Banks and lenders look directly at your equity. A strong equity position shows you have skin in the game and makes them far more comfortable lending you money.

- Business Valuation: Thinking of selling one day? Or bringing on a partner? Your equity is the starting point for calculating what your business is actually worth.

- Investor Interest: Potential investors scrutinise your equity to gauge the health of your business and what their potential return might be.

Understanding your funding options is also part of the equity picture. For instance, exploring methods like non-dilutive funding can help you secure capital without having to give away a slice of your hard-earned ownership.

At Business Like NZ Ltd, we’re a team of affordable, down-to-earth chartered accountants supporting Auckland businesses and property investors. We take the confusion out of the numbers so you can focus on making smart, confident decisions that drive real growth.

The Building Blocks of Your Business Equity

To really get a handle on equity, it helps to break it down into its core parts. Think of them as the ingredients in a recipe – each one adds something different, but together they create the final result: your ownership stake.

Your business’s equity is built from a few key components:

- Contributed Capital: This is the cash that you and any other owners put in to get the whole thing off the ground. For instance, if you transferred $20,000 from your personal savings to the business account to start up, that’s your contributed capital. It’s the initial seed money.

- Retained Earnings: This is all the profit your company has made over the years that you’ve kept in the business instead of paying out as dividends or drawings. For example, if your plumbing company made a $50,000 profit last year and you decided to keep $30,000 in the business to buy a new van, that $30,000 is added to your retained earnings.

The Power of Reinvestment

Retained earnings are the engine room of your equity growth. They build value from the inside, showing that your business can stand on its own two feet and fund its own expansion.

Every dollar of profit you keep in the company directly increases your equity. It’s a powerful signal to lenders and investors that your business is not just surviving, but thriving.

By consistently reinvesting profits, you’re building a more resilient and valuable asset for the future. It proves you’re in it for the long haul.

Getting your head around this concept is a game-changer. We go into much more detail on what retained earnings in NZ mean for your business in our dedicated guide. Together, the capital you put in and the profits you keep in form the bedrock of your company’s net worth.

How to Calculate Your Business Equity

Alright, let’s get down to the numbers. Figuring out your business equity boils down to a simple but incredibly powerful formula—it’s the core of all accounting.

Total Assets – Total Liabilities = Equity

This equation is the heart of your balance sheet. To work it out, you’ll first need to list everything your business owns. These are your assets.

Defining Your Assets and Liabilities

Your assets are much more than just the cash in your bank account. They’re all the valuable resources your business controls. Think about things like:

- Physical Items: Your work ute, tools, computers, and office furniture.

- Money Owed to You: All those unpaid customer invoices (also known as accounts receivable).

- Stock: Any inventory you’re holding onto to sell.

Next, you need to tally up everything your business owes to others. These are your liabilities. This includes:

- Loans: Any bank loans or vehicle finance.

- Bills: Unpaid invoices from your suppliers (accounts payable).

- Tax Obligations: GST or income tax you’ve collected but haven’t yet paid to the IRD.

Getting these figures right is absolutely crucial. To calculate your equity accurately, you need to know how to read a balance sheet, as this is where all the key numbers live. While the balance sheet gives you a snapshot of your business’s net worth right now, you can see how it’s performing over time by looking at your profit and loss statement.

Need a hand getting these numbers straight? Business Like NZ Ltd offers affordable, down-to-earth chartered accountant services supporting Auckland businesses and property investors. We can help make sense of your financials.

Why Business Equity Is a Bigger Deal Than You Think

Watching your business equity isn’t just a box-ticking exercise for your accountant. It’s one of the most powerful numbers you can track, giving you a crystal-clear picture of your company’s real financial health and future potential. Think of it as your business’s ultimate scorecard.

A strong equity position sends a clear message of stability, especially to lenders. When a bank sees you have plenty of skin in the game, they feel far more confident about your ability to handle debt. That confidence makes it much easier to get the nod for a business loan when you need to fund a new piece of equipment or jump on an expansion opportunity.

Your Foundation for Growth and Valuation

But it’s about more than just borrowing. Your equity is the bedrock of your business’s valuation. If you’re thinking of selling one day, bringing in investors, or even taking on a partner, your equity is the starting line for figuring out what your company is actually worth. It’s the hard proof of the value you’ve painstakingly built over the years.

This isn’t just small stuff; it’s a massive part of the wider economy. The NZX Main Board, our main stock market, has a combined market capitalisation of over NZ$236 billion, which shows the incredible value tied up in Kiwi businesses. Digging into New Zealand’s equity market trends can give you a sense of the bigger picture.

Understanding and growing your equity is about building a saleable asset. It’s the difference between having a job and owning a valuable, independent entity.

Finally, your equity directly shapes how you can reward yourself and your fellow shareholders. The retained earnings component—all that profit you’ve ploughed back into the business—is what determines how much cash you can actually pay out as dividends. Keeping a close eye on this helps you make smart calls about whether to reinvest for growth or take a well-earned distribution.

Struggling to see the big picture for your business? At Business Like NZ Ltd, we’re affordable, down-to-earth chartered accountants supporting Auckland businesses and property investors. We help you understand your numbers so you can make confident decisions.

Actionable Steps to Grow Your Business Equity

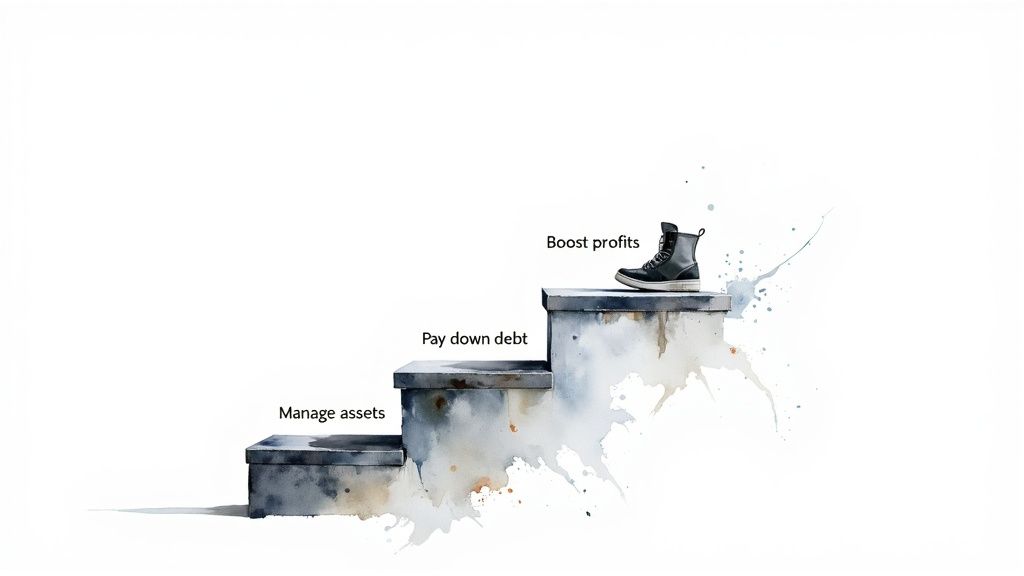

Your business equity isn’t just a number that sits on a balance sheet. Think of it as a living measure of your company’s value—one you can actively build and grow. By taking deliberate steps to improve your equity, you’re not just crunching numbers; you’re building a stronger, more resilient business that lenders and investors will take seriously.

It all comes back to that simple formula: Assets – Liabilities = Equity. Every move you make to either grow what you own or shrink what you owe directly adds to your equity. It’s a clear and powerful game plan for creating long-term business wealth.

Practical Strategies for Building Equity

So, where do you start? Here are three straightforward ways to begin increasing your business’s net worth today.

- Boost Profits and Reinvest: The most direct path to growing equity is by beefing up your retained earnings. Get focused on improving your profit margins. For example, a local cafe might renegotiate with its coffee bean supplier for a better price, cutting costs and increasing profit on every flat white sold. The key is to then plough those profits back into the business.

- Strategically Pay Down Debt: This one is beautifully simple. Every loan repayment you make shrinks your liabilities, which automatically gives your equity a lift. To get the most bang for your buck, prioritise paying down any high-interest debt first, like a credit card used for initial stock purchases. A business with less debt is not only more valuable, it’s also less risky.

- Manage Assets Efficiently: Make sure every asset you own is pulling its weight. Is there old equipment gathering dust in a corner? Sell it and turn a fixed asset into cash. Are your invoices taking too long to get paid? Tighten up your collections process to improve your cash flow and strengthen your asset position.

By focusing on these areas, you transform equity from a passive number into an active goal. You are taking direct control over building a more valuable business.

This hands-on approach is exactly what attracts outside investment. In New Zealand, private equity and venture capital funds pumped around NZ$16.1 billion into local companies between 2013 and 2024, demonstrating a clear appetite for healthy, growing businesses. You can dig deeper into NZ’s private capital investment trends on ey.com.

At Business Like NZ Ltd, we’re affordable, down-to-earth chartered accountants supporting Auckland businesses and property investors. We can help you build a clear strategy to grow your equity and hit your financial goals.

When to Call in the Experts

Keeping an eye on your business equity is a fantastic start, but you don’t have to go it alone. Some financial moments are just too important to handle without a second, more experienced, set of eyes.

Think about getting professional advice if you’re:

- Gearing up to sell your business and need a rock-solid valuation.

- Applying for a significant loan and want to put your best foot forward with the bank.

- Thinking about restructuring or bringing new shareholders into the mix.

- Wrestling with complex tax questions that could have a big impact on your equity.

These aren’t everyday decisions; they have long-term consequences for your business’s future. It’s also worth remembering that in New Zealand, the investment landscape is shaped by major players. Government-backed entities like the NZ Super Fund, which manages over NZ$76 billion, have a significant influence on our capital markets. An expert can help you make sense of this bigger picture. You can get a deeper understanding of New Zealand’s capital markets at pwc.co.nz.

Getting a clear picture of your financial health is the first step toward building a strategy for sustainable growth. Professional advice makes this process accessible and easy to understand.

At Business Like NZ Ltd, we’re a team of affordable, down-to-earth chartered accountants supporting Auckland businesses and property investors. If you want to get real clarity on your business equity, reach out for a friendly chat.

Got Questions? We’ve Got Answers

Let’s clear up a few common questions that pop up when talking about business equity.

Can a business actually have negative equity?

Yes, it absolutely can, and it’s a serious red flag you need to pay attention to. This happens when your total liabilities (what you owe) become greater than your total assets (what you own).

Think of it this way: if you sold off every single thing the business owns, you still wouldn’t have enough cash to pay off all your debts. For a brand-new startup that’s just taken out some hefty initial loans, a temporary dip into negative equity might be part of the plan. But for an established company, it signals real financial trouble and screams for a solid turnaround strategy.

What’s the difference between business equity and profit?

This is a great question, and it’s easy to get the two mixed up. Profit is what you see on your Profit and Loss report – it tells you how your business performed over a specific period, like a month or a year.

Equity, on the other hand, is from your Balance Sheet. It’s a snapshot of your business’s net worth on a single day. The two are linked – your profits (after tax) can be kept in the business as retained earnings, which boosts your equity. But they aren’t the same. You could have a hugely profitable month but still have low equity if the business is carrying a mountain of debt.

Do my owner’s drawings affect the business’s equity?

They certainly do. When you take drawings, you’re pulling cash (an asset) out of the business for your own use. This directly lowers your owner’s equity because you’re essentially withdrawing some of the capital you’ve invested. It’s why keeping an eye on your drawings is so important for maintaining a healthy equity position.

Getting your head around business equity is one of the most powerful things you can do to build a stronger, more valuable company. If you’re looking at your numbers and feeling a bit lost, the team at Business Like NZ Ltd are affordable, down-to-earth chartered accountants supporting Auckland businesses and property investors. Get in touch today for a friendly chat.