How to Measure Business Success Beyond Revenue & Profit

January 20, 20269 Proven Ways to Save Money in Business

Running a small or medium-sized business is a constant balancing act, especially when it comes to managing cash flow. Every dollar counts, and finding smart ways to save money in business isn’t just about survival. It’s about creating the financial freedom to grow, innovate, and thrive. You’re likely wearing many hats, from CEO to operations manager, and searching for practical strategies that go beyond the obvious “spend less” advice.

This guide is designed specifically for you. We’re cutting through the noise to bring you nine proven, actionable strategies that can significantly reduce your expenses without sacrificing quality or stunting growth. From harnessing automation to rethinking your supplier relationships, these aren’t just surface-level tips; they are strategic shifts that can redefine your bottom line. We will explore how to:

- Automate key business processes to save time and reduce errors.

- Negotiate more favorable terms with your suppliers.

- Outsource non-core functions to specialized experts.

- Embrace flexible work models to lower overheads.

Let’s dive into the methods that will help your business work smarter, not just harder, and strengthen your financial position for the years ahead.

1. Automate Business Processes

One of the most powerful ways to save money in business is by swapping out repetitive manual tasks for automated systems. Think about all the time your team spends on administrative work, like data entry, sending follow-up emails, or managing inventory lists. Automation takes over these jobs, freeing up your staff to focus on high-value activities that actually grow your business.

This isn’t just about saving time; it’s about cutting costs and boosting accuracy. Automated systems work around the clock without getting tired, which means fewer human errors that can cost you money down the line. For example, an automated invoicing system ensures you get paid faster and avoids embarrassing mistakes. Furthermore, consider how automating customer support with chatbots can handle common queries instantly, directly cutting down operational expenses on staffing.

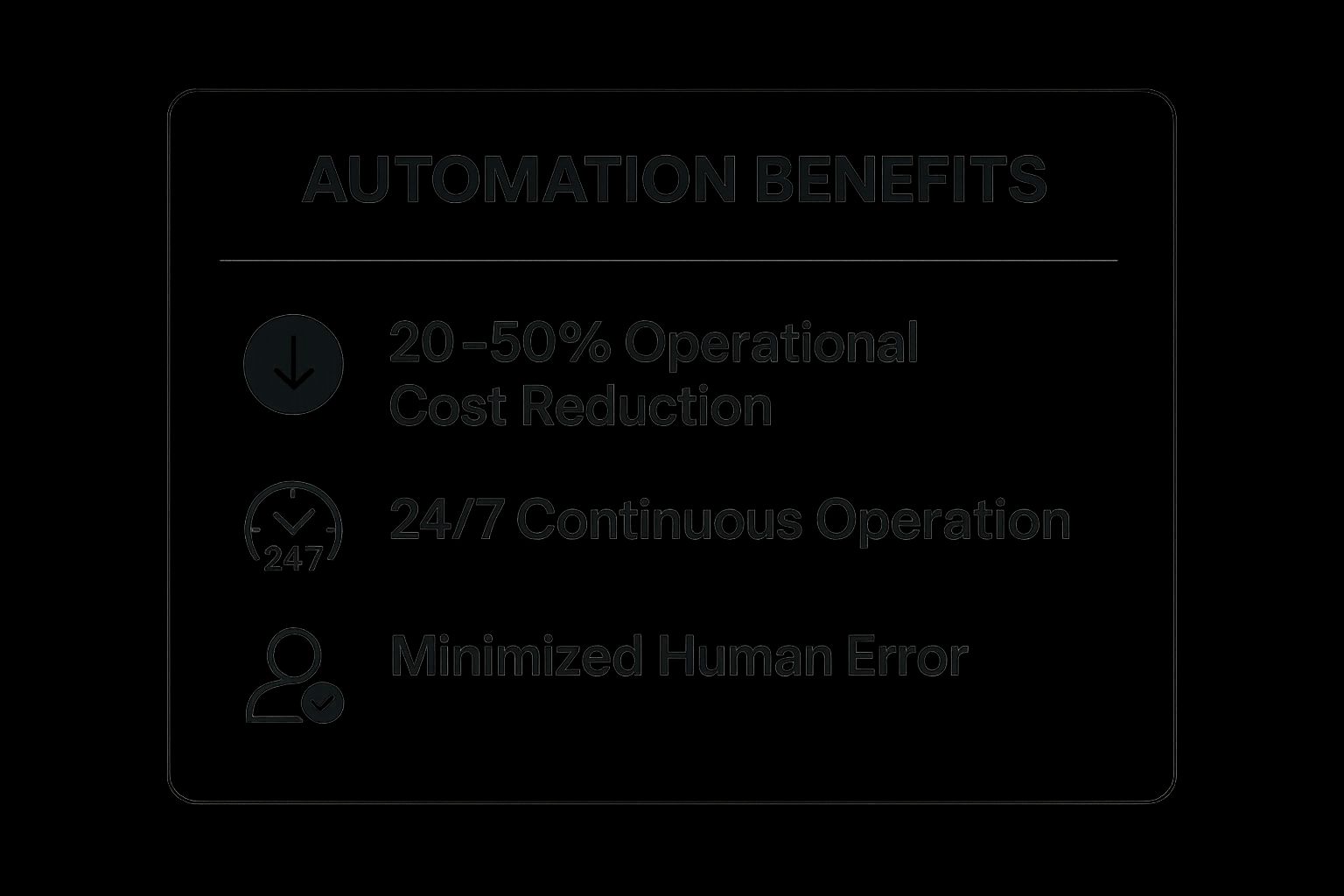

Key Benefits of Automation

To see just how impactful this can be, check out this quick summary of automation’s core advantages.

These figures show that automation isn’t a minor tweak; it’s a strategic move that delivers significant operational cost savings while ensuring your business runs 24/7 with minimal mistakes.

How to Get Started

Diving into automation doesn’t have to be complicated. Start small by identifying the most time-consuming, repetitive tasks in your daily operations. A great first step is often automating your social media scheduling or setting up an email autoresponder.

Here are a few actionable tips:

- Start with Simple Tasks: Don’t try to automate everything at once. Pick one or two simple processes, like data entry or basic customer service responses, to learn the ropes.

- Calculate the ROI: Before investing in expensive software, calculate its potential return on investment. How much time and money will it save you per month?

- Train Your Team: Ensure everyone knows how to use the new tools. Proper training prevents confusion and helps your team embrace the change.

By strategically implementing automated systems, you not only reduce labor costs but also create a more efficient, scalable, and error-free operation.

To dive deeper into setting up these kinds of efficiencies, you can learn more about how to create effective business systems through targeted training.

2. Negotiate Better Supplier Terms

One of the most direct ways to save money in business is by looking at your outgoing costs, and supplier contracts are often a goldmine for potential savings. Don’t just accept the first price you’re given. Actively negotiating with your suppliers for better rates, more favorable payment terms, or improved conditions can significantly reduce your overheads and boost your bottom line.

This is more than just haggling over price; it’s about building strong, mutually beneficial partnerships. When you show a supplier you’re a reliable, long-term partner, they’re often more willing to offer you a better deal. Think of it like the bulk-buying power of giants like Walmart, but on a scale that works for your business. Even small businesses can form buying groups or cooperatives to increase their leverage and secure discounts typically reserved for larger companies.

Key Benefits of Negotiation

Smart negotiation directly impacts your profitability and cash flow. Here’s a quick look at why this is a crucial strategy.

- Immediate Cost Reduction: Securing a lower price per unit or a discount on services instantly decreases your cost of goods sold (COGS).

- Improved Cash Flow: Negotiating longer payment terms, like moving from 30 to 60 days, gives you more working capital to run your business.

- Stronger Supplier Relationships: Approaching negotiations as a partnership fosters loyalty and can lead to better service and priority treatment.

These benefits demonstrate that taking the time to negotiate is a high-return activity that strengthens your business financially and operationally.

How to Get Started

Effective negotiation starts with preparation. You can’t walk into a discussion blind and expect to get the best deal. Arm yourself with information and a clear strategy.

Here are a few actionable tips:

- Research Market Rates: Before you talk to your current supplier, know what their competitors are charging. This gives you a powerful benchmark and leverage.

- Bundle Your Purchases: If you buy multiple products or services from one supplier, ask for a bundled discount. Consolidating your spending gives you more power.

- Offer Longer-Term Contracts: Suppliers value stability. Offering to sign a longer contract in exchange for a locked-in lower rate can be a win-win for both parties.

- Always Have a Backup: Let your primary supplier know you have other options. Having a backup identified (and even getting a quote from them) is your strongest negotiating tool.

By approaching your supplier relationships strategically, you can unlock significant savings and find better ways to save money in business without sacrificing quality.

3. Implement Energy Efficiency Measures

A surprisingly large portion of your operating budget can disappear into utility bills, but this is also one of the easiest areas to find significant savings. Implementing energy efficiency measures means actively reducing your business’s energy consumption. This goes beyond just turning off lights; it involves strategic upgrades like installing modern LED lighting, improving building insulation, and using smart thermostats to optimize heating and cooling.

This strategy is one of the most effective long-term ways to save money in business because it cuts recurring costs month after month. For example, Google slashed energy use in its data centers by 50% through efficiency, and countless small restaurants have cut electricity bills by up to 30% just by upgrading to LEDs. A significant area for cost reduction is energy consumption. Implementing a comprehensive systems-based approach outlined in a detailed skylight energy efficiency guide can provide actionable steps to cut your business’s energy bills.

You may be eligible for a green loan: Unlocking Financial Benefits: How Green Loans Can Help You Save Money

Key Benefits of Energy Efficiency

The impact of reducing energy use goes straight to your bottom line while also boosting your brand’s reputation as an environmentally conscious organization.

- Drastically Lower Utility Bills: The most direct benefit is a significant, ongoing reduction in your monthly electricity and gas expenses.

- Access to Incentives: Many governments and utility providers offer tax credits, rebates, and grants for energy-efficient upgrades, reducing the upfront investment.

- Improved Work Environment: Better lighting and stable temperatures from efficient systems can improve employee comfort and productivity.

- Enhanced Brand Image: Demonstrating a commitment to sustainability can attract environmentally conscious customers and talent.

How to Get Started

You don’t need a massive budget to begin making a difference. Small, strategic changes can lead to substantial savings over time.

Here are a few actionable tips:

- Conduct an Energy Audit: Hire a professional or use an online tool to identify where your business is wasting the most energy. This gives you a clear roadmap for improvements.

- Target Low-Cost Wins: Start with high-impact, low-cost changes like switching to LED bulbs, sealing drafts around windows and doors, and installing programmable thermostats.

- Train Your Staff: Create a culture of conservation by encouraging employees to turn off lights and equipment when not in use. Simple habits add up.

- Research Rebates: Before any major upgrade, investigate local and federal incentives. You might get a significant portion of your investment back.

By systematically tackling energy waste, you not only reduce operational costs but also build a more resilient and sustainable business for the future.

4. Outsource Non-Core Functions

Another powerful way to save money in business is to outsource functions that aren’t central to your core product or service. Instead of building and funding in-house departments for everything, you can delegate tasks like IT support, accounting, or digital marketing to specialized external providers. This strategy allows you to tap into expert skills without the high overhead costs of full-time salaries, benefits, and training.

This isn’t just about cutting payroll; it’s about gaining efficiency and expertise. For instance, a small business might use a virtual assistant for administrative tasks or hire a managed service provider for IT support. By doing this, you convert fixed labor costs into flexible variable expenses, paying only for the services you need. This approach lets you focus your internal resources on what truly drives revenue and growth, giving you a competitive edge.

Key Benefits of Outsourcing

Outsourcing offers a strategic path to cost reduction and operational excellence. Here’s a quick look at its main advantages.

These numbers highlight how outsourcing provides access to specialized talent and significantly cuts down on operational and labor costs, freeing up capital for growth-focused initiatives.

How to Get Started

Getting started with outsourcing doesn’t mean giving up control. The key is to begin with specific, non-critical tasks to test the waters and build a solid relationship with your chosen provider.

Here are a few actionable tips:

- Start with Non-Critical Tasks: Begin by outsourcing functions like bookkeeping or social media management. This low-risk approach helps you understand the process before moving to more vital operations.

- Define Clear Agreements: Create a detailed service level agreement (SLA) that outlines expectations, deliverables, deadlines, and communication protocols. Clarity is crucial for success.

- Choose Reputable Providers: Do your homework. Look for providers with strong track records, positive client testimonials, and relevant experience in your industry. Don’t be afraid to ask for references.

By strategically outsourcing, you can streamline your operations, reduce overhead, and access a level of expertise that would be too costly to maintain in-house.

To learn more about structuring your business for maximum efficiency, explore how to build robust business systems with expert coaching.

5. Optimize Inventory Management

One of the most effective ways to save money in business is by optimizing your inventory management. Holding onto excess stock ties up cash, increases storage costs, and risks products becoming obsolete or expiring. The goal is to strike a perfect balance, having just enough inventory to meet customer demand without overstocking.

This strategy isn’t just about cutting expenses; it’s about improving cash flow and reducing waste. By implementing a system like just-in-time (JIT) inventory, pioneered by Toyota, you order goods only as you need them. This approach minimizes carrying costs and ensures your capital isn’t sitting idle on a shelf. Similarly, accurate demand forecasting helps prevent the costly mistake of over-or-under ordering, directly impacting your bottom line.

Key Benefits of Optimized Inventory

To understand the financial impact, let’s look at the core advantages of smart inventory control.

Quote: “Poor inventory management is like driving with the handbrake on. You’re working twice as hard to move forward and burning through resources unnecessarily.” – Business Like

Efficient inventory control unlocks significant savings. It directly reduces storage fees, insurance costs, and losses from spoilage or obsolescence, freeing up cash for growth.

How to Get Started

You don’t need a massive warehouse to benefit from better inventory practices. The key is to be strategic and data-driven, no matter your business size.

Here are a few actionable tips:

- Analyze Sales Data: Use historical sales data to forecast future demand accurately. Identify seasonal trends and best-selling products to inform your ordering cycles.

- Implement Software: Use inventory management software to automate tracking, set reorder points, and get real-time visibility into your stock levels.

- Establish Strong Supplier Relationships: Work with reliable suppliers who can deliver goods quickly. This reduces the need to hold large amounts of safety stock.

By fine-tuning how you manage your stock, you can create a lean, efficient operation that directly boosts profitability.

6. Embrace Remote Work and Flexible Arrangements

One of the biggest shifts in the modern workplace offers one of the most significant ways to save money in business: moving away from a traditional, full-time office. By embracing remote work, hybrid models, or flexible schedules, you can drastically reduce your overheads. Think about it: a smaller office, or no office at all, means cutting down on rent, utilities, insurance, and other facility-related expenses that eat into your budget.

This strategy was famously adopted by companies like Shopify, which went fully remote and saved millions in real estate. It’s not just for big tech firms, though. Countless small businesses have successfully downsized their physical footprint, sometimes by 50-75%, reinvesting those savings into growth. This approach isn’t just a cost-cutting measure; it’s a strategic move to attract and retain top talent who value flexibility.

Key Benefits of Remote Work

The financial argument for flexible work is compelling. Beyond just rent, the ripple effect of savings can transform your bottom line.

A distributed workforce allows you to tap into a wider talent pool without geographical limitations, often leading to better hires at competitive salaries. Reduced commuting for employees also translates to higher morale and productivity, as they get to reclaim hours from their day.

How to Get Started

Transitioning to a remote or hybrid model requires careful planning to maintain productivity and company culture. Success hinges on trust and clear systems.

Here are a few actionable tips:

- Establish Clear Policies: Create a formal remote work policy that outlines expectations for communication, working hours, and availability.

- Invest in the Right Tech: Reliable communication tools are non-negotiable. Use platforms like Slack, Zoom, and project management software like Asana to keep everyone connected and on task.

- Measure by Results, Not Hours: Shift your management focus from tracking time spent at a desk to evaluating the quality and completion of work.

- Maintain Company Culture: Schedule regular virtual team-building events, coffee chats, and all-hands meetings to keep your team’s spirit alive and well.

By strategically adopting flexible work arrangements, you can unlock substantial savings while building a more resilient, modern, and employee-centric business.

7. Implement Preventive Maintenance Programs

Waiting for essential equipment to break down before fixing it is a reactive approach that costs businesses dearly in both downtime and expensive emergency repairs. One of the smartest ways to save money in business is by implementing a preventive maintenance program. This strategy involves scheduled, routine check-ups on your equipment, vehicles, and facilities to keep them in optimal condition, preventing major failures before they happen.

This proactive mindset is about extending the lifespan of your most valuable assets and ensuring they run efficiently. Think of it like the regular service for your car; you do it to avoid a catastrophic engine failure on the motorway. For instance, a manufacturing plant using predictive sensors can replace a failing part during scheduled downtime instead of having the entire production line grind to a halt. This approach directly reduces surprise expenses and keeps your operations smooth.

Key Benefits of Preventive Maintenance

Adopting a maintenance schedule isn’t just about avoiding breakdowns; it’s a strategic financial decision. Here’s a look at the core advantages.

- Reduced Repair Costs: Proactive servicing is significantly cheaper than emergency repairs.

- Minimized Downtime: Scheduled maintenance prevents unexpected operational interruptions, which protects revenue.

- Improved Asset Lifespan: Well-maintained equipment lasts longer, delaying costly replacements.

- Enhanced Safety: Regular checks ensure equipment operates safely, reducing the risk of accidents and liability.

These benefits demonstrate that investing a small amount in regular upkeep delivers a substantial return by preventing far greater costs down the line.

How to Get Started

You don’t need to be a large industrial company to benefit from preventive maintenance. Even a small cafe can create a schedule for its coffee machine and refrigeration units.

Here are a few actionable tips:

- Create a Detailed Schedule: Identify all critical assets and create a checklist and timetable for routine inspections and servicing based on manufacturer recommendations.

- Use Management Software: Use a simple spreadsheet or dedicated maintenance management software to track tasks, log repairs, and monitor costs. This also helps with warranty claims.

- Train Your Team: Teach your staff how to perform basic daily checks and report any unusual noises or performance issues immediately.

- Analyze Performance Data: Keep records of maintenance costs and equipment performance. This data will help you decide when an asset is no longer economical to repair and needs replacement.

By shifting from a “fix it when it breaks” mentality to a proactive maintenance culture, you will drastically cut unexpected expenses and improve overall operational stability.

8. Bulk Purchasing and Strategic Buying

One of the most classic ways to save money in business is by embracing the power of buying in bulk. Leveraging economies of scale means purchasing larger quantities of your frequently used supplies at a lower per-unit cost. Think about items you use constantly, like office supplies, raw materials, or even coffee for the breakroom. Buying these in larger volumes directly translates to significant savings over time.

This strategy isn’t just about buying more; it’s about buying smarter. Strategic buying involves timing your purchases to align with seasonal discounts or supplier sales cycles. Warehouse clubs like Costco have built entire business models on this principle, offering lower prices for volume purchases. Similarly, restaurant chains drastically reduce their food costs by procuring ingredients for multiple locations at once, a practice that small businesses can replicate by joining buying cooperatives.

Key Benefits of Bulk Buying

To see how impactful this approach can be, here’s a quick summary of its core advantages.

- Reduced Per-Unit Cost: The primary benefit is paying less for each individual item, which directly lowers your cost of goods sold and operational expenses.

- Fewer Purchase Orders: Buying in larger quantities means you place orders less frequently, saving administrative time and reducing shipping costs.

- Supply Stability: Having more stock on hand protects your business from unexpected supply chain disruptions or sudden price hikes, ensuring operational continuity.

These advantages show that strategic purchasing is a powerful lever for improving your bottom line and making your operations more resilient.

How to Get Started

Diving into bulk purchasing requires a bit of planning to avoid waste. Start by identifying the non-perishable items with the highest and most consistent usage rates in your business. This is where you’ll see the biggest and quickest return on investment.

Here are a few actionable tips:

- Analyze Usage Patterns: Before you buy a pallet of paper, track how much you actually use per month. This prevents overstocking and tying up cash in unneeded inventory.

- Check Storage and Shelf Life: Ensure you have adequate, secure storage space. Also, be mindful of product expiration dates or the risk of obsolescence, especially with tech items.

- Join a Buying Group: Small businesses can gain the purchasing power of large corporations by joining industry-specific buying groups or cooperatives.

- Negotiate Better Terms: When placing a large order, use it as leverage to negotiate better payment terms or even free shipping with your suppliers.

By strategically buying in bulk, you can substantially cut down on recurring expenses and improve your overall profitability.

9. Technology Consolidation and Cloud Migration

Your tech stack can either be a powerful asset or a significant drain on your resources. One of the most effective ways to save money in business is by consolidating your technology and migrating to the cloud. This means ditching redundant software licenses, moving away from expensive on-premise servers, and streamlining your entire IT infrastructure into a more cohesive, cost-effective system.

This isn’t just about saving on hardware; it’s a strategic shift that boosts scalability and security. Migrating to the cloud, like many businesses do with platforms like AWS or Google Workspace, eliminates the need for costly server maintenance and upgrades. Instead of managing multiple disparate tools, you can use integrated platforms that handle everything from communication to project management, reducing subscription costs and simplifying operations.

Key Benefits of Cloud Migration

Moving your operations to the cloud offers a powerful set of advantages that directly impact your bottom line.

These numbers highlight how cloud migration delivers significant savings on IT spending while boosting efficiency and providing the flexibility to scale your business on demand.

How to Get Started

Consolidating your tech stack and moving to the cloud doesn’t have to be an overwhelming project. A phased, strategic approach is the key to a smooth transition. For small businesses, exploring the various options is a critical first step. You can find a great breakdown of the Top Cloud Services for Small Business to see how different providers can cut infrastructure costs and improve scalability.

Here are a few actionable tips:

- Conduct a Tech Audit: Start by listing every piece of software and hardware you currently use. Identify overlaps, redundancies, and underutilized tools that are safe to cut.

- Plan a Phased Migration: Don’t move everything at once. Begin with less critical functions, like file storage or internal communications, to learn the process before migrating core systems.

- Prioritize Staff Training: Ensure your team is comfortable with the new cloud-based systems. Proper training will maximize adoption and prevent productivity dips during the transition.

By streamlining your technology, you not only slash direct IT costs but also build a more agile, secure, and future-proof foundation for your business.

9 Business Money-Saving Strategies Comparison

| Strategy | Implementation Complexity 🔄 | Resource Requirements 🔄 | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ / ⚡ |

|---|---|---|---|---|---|

| Automate Business Processes | High 🔄🔄 | High technical expertise & investment | 20-50% operational cost reduction 📊 | Repetitive/manual tasks; scalable operations | Consistent quality ⭐; 24/7 operation ⚡; cost savings ⭐ |

| Negotiate Better Supplier Terms | Medium 🔄 | Time and negotiation skills | 5-25% supply cost reduction 📊 | Procurement-heavy businesses; supplier-heavy | Direct cost reduction ⭐; improved cash flow ⚡ |

| Implement Energy Efficiency Measures | Medium-High 🔄🔄 | High upfront investment; maintenance | 20-40% energy cost reduction 📊 | Facilities with high energy consumption | Long-term cost savings ⭐; tax incentives 💡; sustainability ⭐ |

| Outsource Non-Core Functions | Medium 🔄 | Cost of external providers | 15-30% operational cost reduction 📊 | Non-core activities needing expertise | Access to expertise ⭐; cost saving ⚡; flexibility ⭐ |

| Optimize Inventory Management | High 🔄🔄 | Inventory systems & supplier coordination | 10-30% inventory cost reduction 📊 | Businesses managing physical stock | Reduced waste ⭐; better cash flow ⚡; demand accuracy ⭐ |

| Embrace Remote Work & Flexible Arrangements | Medium 🔄 | Technology infrastructure; management | 25-50% facility cost reduction 📊 | Office-based teams; knowledge workers | Facility savings ⭐; talent access ⭐; productivity ⚡ |

| Preventive Maintenance Programs | Medium 🔄 | Maintenance staff & tech tools | 12-18% maintenance cost reduction 📊 | Asset-heavy industries | Reduced downtime ⭐; extended equipment life ⭐ |

| Bulk Purchasing & Strategic Buying | Medium 🔄 | Storage space; upfront capital | 8-20% material cost reduction 📊 | High volume consumables; predictable demand | Lower unit cost ⭐; price stability ⚡; supplier relations ⭐ |

| Technology Consolidation & Cloud Migration | High 🔄🔄 | IT resources; training | 20-40% IT cost reduction 📊 | Companies with complex IT infrastructure | Scalability ⭐; cost reduction ⚡; enhanced security ⭐ |

Turn Your Savings into Sustainable Growth

Whew, that was a lot to take in! But navigating the world of business finance doesn’t have to be overwhelming. We’ve journeyed through a powerful arsenal of strategies, from the tech-savvy approach of automating processes and migrating to the cloud, to the logistical genius of optimizing your inventory and negotiating better deals with suppliers. Each of these aren’t just one-off tricks; they are fundamental shifts in how you operate.

Finding effective ways to save money in business is less about frantic cost-cutting and more about building a smarter, more efficient, and resilient operation. Think of it like tuning a high-performance engine. By implementing preventive maintenance, embracing remote work, or consolidating your tech stack, you’re not just reducing expenses. You’re eliminating friction, freeing up resources, and positioning your Auckland business for long-term, sustainable growth.

From Small Changes to Big Wins

The true power of these ideas lies in their cumulative effect. Individually, switching to energy-efficient light bulbs or renegotiating a single supplier contract might seem minor. But when you combine these efforts, the impact snowballs.

- Start Small: Don’t try to overhaul your entire business overnight. Pick one or two strategies from this list that feel most achievable and relevant to your current situation. Maybe that’s finally tackling that overflowing stockroom or outsourcing your bookkeeping.

- Measure Everything: Track your progress. How much did you save by switching to a new software subscription? What’s the ROI on your new automated invoicing system? Concrete data will fuel your motivation and help you make even better decisions down the road.

- Reinvest Wisely: This is the most exciting part. Every dollar saved is a dollar you can put back into what truly matters. This could mean investing in a new marketing campaign to reach more customers, hiring a key team member, or simply building a robust cash reserve to weather any storm.

Ultimately, mastering your business’s finances is about creating freedom. It’s the freedom to innovate without fear, the freedom to invest in your team, and the freedom to build a business that not only survives but thrives, right here in our vibrant Auckland community. The journey to financial strength starts with a single, deliberate step. The key is to take that step today.

Ready to transform these savings strategies from ideas on a page into real, tangible results for your business? The team at Business Like NZ Ltd provides expert taxation and business advisory services tailored for Auckland businesses, helping you identify opportunities and build a more profitable future. Let’s build a smarter, more resilient business together.