New Zealand Foreign Superannuation Tax Rules: What You Need to Know

December 17, 2025

9 Proven Ways to Improve Workplace Efficiency

December 28, 2025Solve Small Business Cash Flow Problems Easily

Let’s get one thing straight: cash flow problems happen when more money is going out than coming in over a certain time. This creates a painful cash gap, making it tough to pay your bills—even if your business looks profitable on paper.

Why Cash Flow Is Your Business’s Lifeline

I know, “cash flow” sounds like stuffy accountant-speak. But try thinking of it as the oxygen for your business. You can have a game-changing product and customers who love you, but without cash, the whole operation suffocates and grinds to a halt.

It’s the real, spendable money you need for everything that keeps the lights on.

This is the cash that covers your most critical operating expenses, like:

- Rent for your shop or office space

- Salaries for your awesome team

- Payments to suppliers for the inventory you need to sell

- All those little things like utility bills and software subscriptions

The Critical Difference Between Profit and Cash

It’s one of the most common and dangerous mistakes a business owner can make: confusing profit with cash flow. They are not the same thing. Not even close.

Profit is what’s left over after you subtract your total expenses from your total revenue. It’s a fantastic long-term health metric for your business. But cash flow is all about the timing of when money actually hits your bank account versus when it leaves.

A business can be wildly profitable on paper and still go under because it has no cash.

Think about it this way: imagine you run a small construction company and you just finished a huge, profitable job. You send the client a big invoice, but they have 60 days to pay you. That profit looks great in your accounting software, but in the meantime, you have to pay your crew this Friday and buy materials for the next project today. If you don’t have the cash on hand to cover those immediate costs, that “profit” won’t save you.

This exact cash timing trap is shockingly common. In fact, poor cash flow management is the number one reason why 82% of small businesses fail, according to a U.S. Bank study. It’s a silent killer, even for businesses with strong sales.

To make this crystal clear, here’s a quick breakdown of the two concepts.

Profit vs. Cash Flow At a Glance

| Concept | What It Measures | Timing | Example |

|---|---|---|---|

| Profit | Your company’s financial success over time (Revenue – Expenses). | Looks at a longer period, like a quarter or a year. | You sell a product for $100 that cost you $60 to make. Your profit is $40. |

| Cash Flow | The actual movement of money in and out of your bank account. | Tracks money in real-time, focusing on “right now.” | You sold the $100 product, but the customer won’t pay for 30 days. Your cash flow is -$60 until they pay. |

Understanding this distinction is the first and most important step toward building real financial stability. Once you get a handle on the dynamics of your small business cash flow, you can stop worrying and start building a truly sustainable business.

Uncovering the Sneaky Causes of Cash Flow Gaps

Cash flow problems almost never show up overnight. They’re more like a slow, quiet leak—a series of small issues that, over time, drain your bank account dry. The first step to fixing them for good is to put on your detective hat and figure out exactly where the money is going.

So, let’s investigate the usual suspects behind those frustrating cash gaps.

The most notorious culprit? Slow-paying clients. You’ve done the work, you’ve sent the invoice, and now… crickets. When customers treat your payment terms like a friendly suggestion, it’s your business that feels the squeeze. This is easily one of the biggest headaches for small business owners everywhere.

Think about the freelance web developer in Auckland who landed a dream project with a big local brand. The profit looked amazing on paper, but the contract had “Net 90” terms. That meant she wouldn’t see a dime for three whole months. Two months in, she was digging into her personal savings just to pay for rent and software subscriptions. What should have been a huge win turned into a nightmare of financial stress.

This story is all too common. We see clients consistently stretching payments to 60 or even 90 days, which puts an incredible strain on a small business’s ability to operate. You can dig deeper into why this happens by checking out these insights into 2025 cash flow issues at capflowfunding.com.

Beyond Late Payments

While chasing invoices is a massive part of the battle, it’s not the only thing that can trip you up. Sometimes, the problem is hiding in plain sight within your own operations.

A big one is messy inventory management. Every single product gathering dust on your shelves is cash you can’t spend. If you’re overstocked on items that just aren’t moving, you’ve effectively tied up your money in cardboard boxes. This is a real danger zone for businesses selling seasonal or trendy products, where that inventory can become worthless almost overnight.

Then there are the unexpected or “creeping” expenses. Did your insurance premium jump this year? Have your suppliers been slowly bumping up their prices? These little increases might not seem like a big deal at first, but they add up, quietly siphoning more and more cash out of your business every month. If you’re not keeping a close eye on them, these costs can easily spiral.

Here are a few other common culprits to watch out for:

- No Cash Cushion: Without a “rainy day” fund, any surprise—like a critical piece of equipment breaking down—instantly becomes a full-blown crisis.

- Growing Too Fast: It sounds like a good problem to have, but over-investing in growth by hiring a bunch of new people or leasing a bigger office before the revenue is there to support it can burn through your cash reserves in a hurry.

- A Flawed Pricing Strategy: If your prices are too low, you might be busy, but you’ll never actually make enough from each sale to cover your costs, let alone turn a healthy profit.

Once you can pinpoint the specific issues, you’re no longer dealing with a vague sense of dread. You have a concrete problem, and concrete problems have real solutions.

Spotting the Early Warning Signs of Trouble

Long before a cash flow problem becomes a full-blown crisis, it whispers. These early warning signs are easy to dismiss, but they’re your business’s way of telling you something isn’t quite right.

Think of it like the check engine light on your car. You can ignore it for a while, but you know it’s just a matter of time before you’re stranded on the side of the road. Catching it early means a simple, affordable fix instead of a massive repair bill.

One of the most common red flags? You start delaying payments to your suppliers. It’s easy to rationalize this as “managing timing,” but if you’re constantly waiting for Client A to pay you so you can pay Vendor B, you’re looking at a classic cash gap.

The Sneaky Signs of Financial Stress

Beyond pushing back payables, other habits can creep in when cash gets tight. Be brutally honest with yourself—do any of these sound a little too familiar?

- The Bank Balance Sweat: You’re anxiously checking your business bank account multiple times a day, especially as payroll or a big rent payment looms.

- Borrowing from Yourself: You swipe your personal credit card for a business expense, telling yourself you’ll pay it back “as soon as that big invoice clears.”

- The “Big Sale” Relief: When a large payment finally hits your account, your first feeling isn’t excitement, it’s a wave of sheer relief. Now you can finally tackle that stack of overdue bills.

- Stagnant Bank Account: Your sales reports show revenue is climbing, but your bank balance is stuck in the mud. The money comes in, but it seems to vanish just as quickly.

It’s easy to see these moments as one-offs. Using a personal card “just this once” isn’t the end of the world. But when “just this once” becomes a regular thing, you’re no longer looking at a fluke—you’re looking at a systemic problem in your cash flow cycle.

These aren’t signs of failure; they’re your chance to get ahead of the problem. Spotting them early gives you the power to make small, smart adjustments now, long before things escalate into a real threat to your business.

Your Action Plan to Improve Cash Flow Now

Alright, you now understand what causes those dreaded cash flow problems small business owners lose sleep over. That’s a huge step. But knowing is only half the battle—now it’s time to roll up your sleeves and actually fix things.

Think of this as your practical toolkit for plugging the leaks and getting money moving back in the right direction. No fluff, just real strategies you can start using today. You don’t have to tackle everything at once. Just pick one or two areas that feel like the biggest wins and start there.

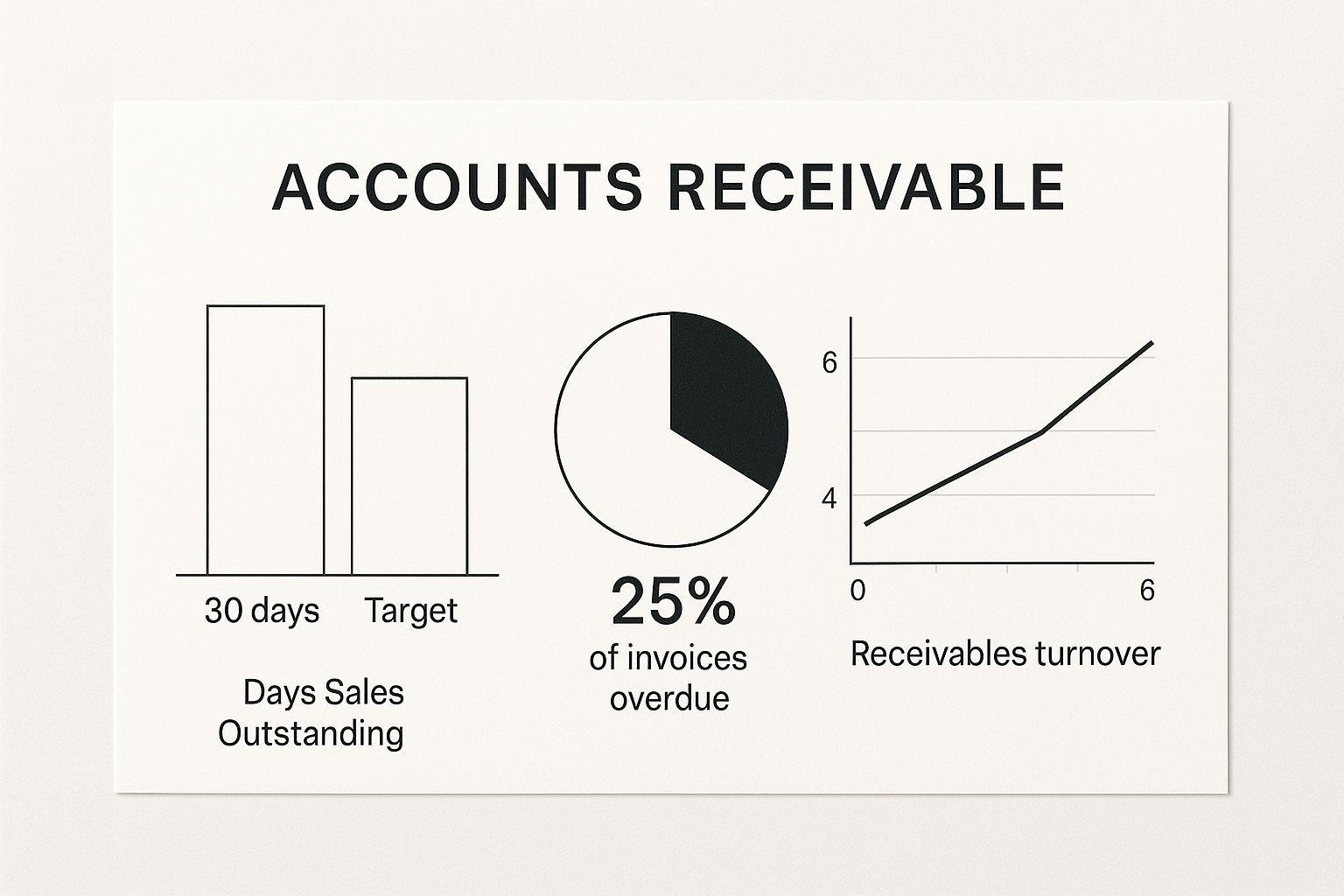

The image above really drives the point home. When you start tracking key numbers like how quickly your invoices get paid (receivables turnover), you can see exactly where to focus your energy for the biggest impact.

Tighten Up Your Invoicing

If there’s one thing you can do to immediately improve your cash flow, it’s this: get paid faster. Your invoicing process shouldn’t be a chore you put off until Friday afternoon. It needs to be a well-oiled machine designed to get cash in the door.

Make it a habit to send invoices the moment a job is finished or a product is shipped. Don’t wait. The sooner that invoice lands in your client’s inbox, the sooner their payment clock starts ticking.

Here are a few simple tactics you can put into action right away:

- Offer Early Payment Incentives: A small discount, like 2% off for paying within 10 days instead of the usual 30, can work wonders. It’s a win-win that encourages speedy payments.

- Enforce Late Payment Penalties: Don’t be shy about this. Clearly state your late fee policy on every invoice. It sets a professional tone and discourages clients from letting your invoice gather dust.

- Make Paying Easy: The fewer hoops a customer has to jump through, the faster you’ll see the money. Offer multiple ways to pay, like credit cards, online portals, or direct bank transfers.

Proactively Chase Overdue Payments

Hoping and waiting for late payments to magically appear is not a strategy. You need a system. A consistent, polite follow-up process is key, and sometimes, you just have to pick up the phone. A quick call is much harder to ignore than another email.

Pro Tip: Your follow-up calls should be friendly and helpful, not confrontational. Try something like, “Hi [Client Name], I’m just calling to follow up on invoice #123. Wanted to make sure you received it and see if you had any questions. Can you give me a quick update on when we can expect payment?”

This approach is professional, keeps the relationship positive, and gets you the answer you need. For a deeper look at other effective methods, check out these great strategies to improve your business cash flow.

Trim Expenses and Build a Buffer

Once you’ve streamlined your incoming cash, it’s time to look at what’s going out. Regularly scan your expenses for “cash leaks.” Are you still paying for software subscriptions you haven’t touched in months? Could you get a better deal from a supplier by consolidating your orders?

Every dollar you save by cutting non-essential costs is a dollar you can put toward a cash reserve. Your goal should be to build a buffer that can cover three to six months of operating expenses. This safety net is what turns a potential disaster into just a bump in the road.

Even with all these benefits, it’s surprising how many small business owners are hesitant to use digital tools to help. Many worry about the cost or complexity, but automation is often the key. If you have immediate cash needs tied to outstanding invoices, you can also look into ways to simplify cash flow management through contract factoring.

Cash Flow Improvement Action Plan

To help you get started, here’s a quick table breaking down some of the most effective strategies. Use it to decide where you can get the biggest bang for your buck without a ton of effort.

| Strategy | Impact Level (High/Medium/Low) | Effort Level (High/Medium/Low) | Quick Win Potential |

|---|---|---|---|

| Speed Up Invoicing | High | Low | Yes |

| Chase Overdue Payments | High | Medium | Yes |

| Offer Early Payment Discounts | Medium | Low | Yes |

| Cut Unnecessary Expenses | Medium | Medium | Maybe |

| Build a Cash Reserve | High | High | No |

| Negotiate Supplier Terms | Medium | Medium | Maybe |

This isn’t an exhaustive list, but it’s a fantastic starting point. Focus on the “High Impact, Low Effort” items first to build momentum and see immediate results in your bank account.

How to Build a Simple Cash Flow Forecast

The term “cash flow forecast” can sound a bit intimidating, but it’s really just a roadmap for your money. Think of it like a weather forecast for your bank account. It won’t predict the future with 100% accuracy, but it gives you a solid idea of what’s coming so you can grab an umbrella before it starts to rain.

Building a forecast is probably the single most powerful thing you can do to get ahead of your finances. It helps you stop reacting to cash flow problems and start managing them proactively. The best part? You don’t need fancy software. A simple spreadsheet you already have will do the trick.

Step 1: Gather Your Information

First things first, you need a clear picture of where your money is actually coming from and where it’s going. This isn’t about educated guesses; it’s about digging into the hard numbers.

Go ahead and pull up your bank statements and accounting records for the last three to six months. You’re looking for two key categories of information:

- Cash Inflows: This is all the money coming into your business. Think client payments, direct sales, loan funds—any cash hitting your account.

- Cash Outflows: This covers everything you spend money on. We’re talking rent, payroll, payments to suppliers, marketing costs, software subscriptions, you name it.

Looking at your recent history gives you a realistic baseline for what an average month looks like. This data is the bedrock of a good forecast.

Step 2: Set Up Your Spreadsheet

Alright, time to open up a new spreadsheet. Let’s keep it simple. Create columns for the next three to six months—say, July, August, and September. Then, you’ll create rows for all your different cash categories.

Your basic layout should look something like this:

Cash In (Income)

- Customer Payments

- Sales Revenue

- Other Income

Cash Out (Expenses)

- Rent/Mortgage

- Payroll & Salaries

- Supplier Invoices

- Marketing & Ads

- Utilities

This straightforward structure gives you a clean, at-a-glance view of how money will move through your business over the coming months.

Step 3: Project Your Future Cash Flow

Now that your spreadsheet is set up, it’s time to start plugging in the numbers. The very first thing you should enter is your starting cash balance—the actual amount of money sitting in your bank account right now, at the start of the first month.

From there, start forecasting your income and expenses for each month. Be honest with yourself. Use your historical data as a guide, but also factor in what you know is coming up. Got a big project payment landing in August? Slot it in. Know that business always gets quiet in January? Adjust your income projection to reflect that reality.

A forecast is a living document, not a set-it-and-forget-it task. The goal isn’t perfection on day one. It’s to create a working model you can tweak as you go. When a client pays early or an unexpected repair bill pops up, you simply update the forecast.

This simple tool completely changes the game. You’ll move from guessing to knowing, which helps you make much smarter decisions about when it’s safe to hire, buy new equipment, or double down on your marketing.

Smart Ways to Use External Funding

Look, even the best-run businesses hit a patch where the money just isn’t flowing right. Sometimes, you need a financial bridge to get from point A to point B. Thinking about external funding isn’t a sign of failure; it can actually be a savvy, strategic move to kickstart growth or just smooth out a temporary rough spot.

But here’s the thing: not all funding is the same. The real trick is picking the right tool for the right job.

Key Funding Options to Consider

If you’re dealing with a short-term cash crunch because clients are dragging their feet on payments, something like invoice factoring can be a lifesaver. Essentially, a company advances you most of the money from your unpaid invoices, so you get the cash you’ve already earned without the wait.

Another fantastic, flexible option is a business line of credit. It works a lot like a credit card for your business, but usually with a much friendlier interest rate. You can tap into it when you need to cover payroll during a slow month, and you only pay interest on the money you actually use. It’s perfect for handling those unexpected dips in income.

For companies that own significant physical assets, especially real estate, digging into a solid Property Strategy can reveal ways to unlock capital you didn’t even know you had.

The golden rule of borrowing is this: make sure you’re fixing the cause of the problem, not just slapping a bandage on the symptom. Before you sign on any dotted line, ask yourself, “Will this money help me solve the underlying issue, or is it just going to become another bill I have to stress over?”

Before you even think about talking to a lender, get your story straight. They’re going to care way more about your cash flow forecasts and your plan for repayment than your personal credit score. You need to walk in ready to show them exactly how this funding will help you generate more revenue and get your business on solid footing. When you do that, a loan stops being a burden and becomes a stepping stone.

Got Questions About Cash Flow? We’ve Got Answers.

Even the most seasoned business owners have questions about money—it just comes with the territory. Getting your head around these common queries is a fantastic way to feel more in control of your finances day-to-day.

Let’s dive into some of the questions we hear all the time.

How Often Should I Be Looking at My Cash Flow?

For most small businesses, a weekly review is the sweet spot. It’s frequent enough to spot trouble before it snowballs into a full-blown crisis, but not so often that it becomes a chore you dread.

Of course, this isn’t a one-size-fits-all rule. If you run a seasonal business or you’re in a period of major growth, you might want to peek at it daily. On the flip side, a thorough review should, at the absolute minimum, be a non-negotiable part of your monthly financial check-in.

Wait, Can My Business Be Losing Money but Still Have Positive Cash Flow?

Absolutely, and it’s a classic trap that can give you a false sense of security. It’s a short-term illusion that usually happens when a big chunk of cash lands in your account all at once. Think about a large business loan or a client paying a hefty deposit upfront.

That sudden injection of money makes your bank balance look fantastic, creating a wave of positive cash flow. But if your regular expenses are still higher than what you’re earning from sales, you’re technically unprofitable. This is exactly why you can’t just look at one report; you need your cash flow statement and your profit & loss statement side-by-side to see the whole story.

What’s the Quickest Fix for a Cash Flow Crisis?

When you’re in a real cash crunch, you need to act fast. Your focus should be on two simple things: getting money in faster and slowing money down from going out.

Your first move? Get on the phone and politely but firmly chase your largest and oldest unpaid invoices. At the same time, be proactive and talk to your key suppliers. A quick, honest conversation explaining the situation and asking for a temporary payment extension can work wonders. These are just short-term patches, but they can give you the breathing room you desperately need.

Managing your cash flow is the difference between simply surviving and truly building financial freedom through your business. At Business Like NZ Ltd, we’re all about helping Auckland business owners like you make that leap.

If you’re ready to take firm control of your finances, reach out to us today for some expert advice.