Managing and Clearing Inland Revenue Tax Debts: A Complete Guide

June 30, 2025

Understanding When You Can Claim Food as a Business Expense

July 5, 2025Calculate Monthly Recurring Revenue the Right Way

So, what exactly is monthly recurring revenue? At its core, it’s the sum of all the predictable, recurring revenue you get from your active subscriptions in a given month. You’re basically taking the total monthly value of what your customers have committed to pay you and normalizing it into a simple, monthly number.

Why MRR Is the North Star for Your Subscription Business

Monthly Recurring Revenue (MRR) isn’t just another vanity metric to stick on a dashboard. For a subscription business, it’s your financial pulse. Think of it as the predictable, stable income you can actually count on every single month. It strips away all the noise from one-time sales or complex contracts, giving you a crystal-clear picture of your company’s health.

For small businesses especially, getting a handle on your MRR is a game-changer. It helps you shift from making decisions based on guesswork to building a real, data-driven plan for the future.

From Gut-Feel to Growth Engine

Let’s imagine a small SaaS startup. They’re thinking about hiring a new engineer, which is a pretty big financial commitment. One wrong move could set them back for months. Instead of just going with their gut, they pull up their MRR trend from the last six months. What they see is steady, positive growth.

Boom. Suddenly, they have the confidence to make the hire, knowing their recurring revenue can support the new salary.

That’s the real power of MRR. It turns scary business decisions into smart, strategic investments. Once you truly understand this metric, you can:

- Forecast with Confidence: You can predict future revenue with far more accuracy than you ever could with lumpy, one-time sales.

- Secure Investor Trust: If you’re looking for funding, investors want to see predictable growth. A healthy, growing MRR is the clearest sign you have a stable business model.

- Fuel Sustainable Growth: You’ll know exactly when you can afford to pour more money into marketing, develop a new feature, or expand the team.

Understanding MRR in a Subscription World

The reason MRR has become so vital is because of a huge shift in how we do business. The subscription economy has absolutely exploded, growing by an incredible 435% over the last decade. Companies are moving away from one-off transactions and toward building long-term, recurring relationships with customers. You can read more about the subscription economy’s explosive growth and what it means for businesses.

The key word here is recurring. MRR deliberately leaves out one-time payments, like setup fees or consulting projects. This is intentional. Including them would create a false sense of security. An annual contract worth $1,200 is counted as $100 in MRR, giving you a standardized look at your monthly performance.

By focusing only on that predictable, repeatable income, you get an honest, unfiltered view of your business’s momentum. This clarity is the foundation for everything else, from calculating your growth rate to spotting risks before they snowball into serious problems.

How to Calculate Monthly Recurring Revenue (The Right Way)

Ready to get your hands dirty with the numbers? At its simplest, you can calculate your monthly recurring revenue by just multiplying your total active customers by their average monthly payment. It’s a quick and easy way to get a snapshot, but honestly, that number doesn’t tell you the whole story.

To really understand the health of your business, you have to look at all the moving parts. You need to know where your revenue is coming from, where it’s growing, and—just as importantly—where you’re losing it. This means tracking a few key components separately.

Think of it like this: your total MRR is the final destination, but understanding the journey there is what gives you the power to forecast and grow.

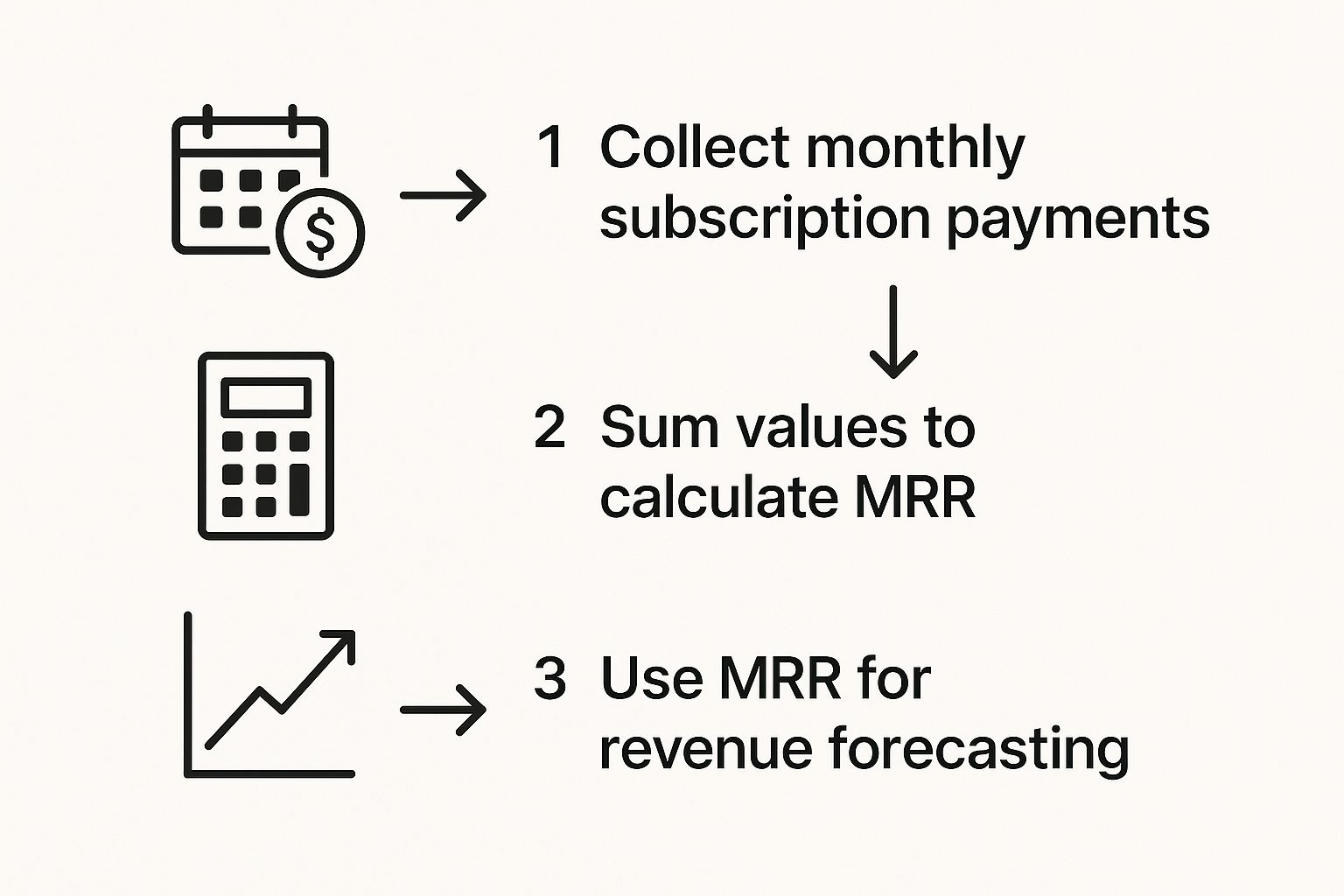

This process shows that MRR isn’t just about adding up payments. It’s about building a reliable metric you can use to project where your business is headed financially.

The Core MRR Components

To see this in action, let’s invent a software company called “SyncUp.” They offer three subscription tiers for their project management tool:

- Basic Plan: $20/month

- Pro Plan: $50/month

- Business Plan: $100/month

In August, the team at SyncUp wants to get a crystal-clear picture of their revenue by tracking three crucial elements.

New MRR

This one is straightforward: it’s all the new revenue you’ve gained from brand-new customers this month.

Let’s say SyncUp had a good month and signed up 10 new Basic Plan users and 5 new Pro Plan users.

- (10 customers × $20) + (5 customers × $50) = $450 in New MRR

This number tells you if your marketing and sales efforts are paying off. It’s the lifeblood of growth.

Expansion MRR

Also known as upgrade MRR, this is the additional revenue from your existing customers. I love this metric because it’s a fantastic sign of health—it shows that your customers are getting so much value from your service that they’re willing to pay more for it.

Suppose 4 of SyncUp’s existing Basic customers decided to upgrade to the Pro Plan. The key here is to only count the additional monthly revenue from them.

- 4 customers × ($50 Pro Plan – $20 Basic Plan) = $120 in Expansion MRR

This metric is often seen as pure profit from your existing customer base. It’s almost always cheaper to get an existing customer to upgrade than it is to acquire a brand new one, making this a powerful and cost-effective growth lever.

Churned MRR

This is the painful one. Churned MRR represents the revenue you’ve lost from customers who cancel or downgrade their subscriptions. It’s a direct hit to your bottom line and something you need to watch like a hawk.

This month at SyncUp:

- 2 Pro customers and 1 Business customer canceled completely.

- 3 Business customers downgraded to the Pro plan.

Here’s how that breaks down:

- Cancellations: (2 × $50) + (1 × $100) = $200

- Downgrades: 3 × ($100 – $50) = $150

- Total Churned MRR = $350

To help you keep these straight, here’s a quick-reference table that breaks down each component.

MRR Calculation Components Explained

| MRR Component | What It Measures | Example Scenario |

|---|---|---|

| New MRR | Revenue from brand-new customers in a given month. | Your marketing campaign attracts 20 new subscribers to your $10/month plan, adding $200 in New MRR. |

| Expansion MRR | Additional revenue from existing customers who upgrade or add services. | 5 customers upgrade from a $10 plan to a $25 plan, adding $75 in Expansion MRR. |

| Churned MRR | Revenue lost from customers who cancel or downgrade their plans. | 2 customers on your $50 plan cancel, and 1 downgrades to the $25 plan, resulting in $125 in Churned MRR. |

Understanding these individual pieces gives you a much richer story than a single, flat MRR number ever could. It tells you if your acquisition efforts are working, if your product is sticky enough to encourage upgrades, and where you might have retention problems.

These components are essential building blocks for sustaining your revenue. In fact, understanding the customer retention rate formula goes hand-in-hand with tracking churn and is just as crucial for long-term success.

What Counts Toward Your MRR (And What Doesn’t)

When you’re calculating your monthly recurring revenue, getting the details right is what makes it a reliable metric instead of a misleading one. The whole point of MRR is predictability. If a stream of revenue is committed and shows up consistently every month, it probably belongs in your MRR calculation.

This is exactly where so many businesses trip up. They accidentally toss in lumpy, one-time payments that create artificial spikes in their data. It’s like trying to measure your average running speed but including the time you spent driving your car—it completely skews the results.

What to Include in Your MRR

To keep your MRR number clean and trustworthy, you should only include revenue that’s genuinely recurring. These are the non-negotiables for your calculation:

- All Recurring Subscription Fees: This is the big one. It’s the fixed monthly fee your customers pay for your different subscription tiers—think Basic, Pro, and Business plans.

- Mandatory Recurring Add-ons: Does a customer pay for an add-on or an extra seat every single month as part of their plan? That revenue counts. The keyword here is recurring.

- Discounts and Coupons: Always factor in discounts! You have to subtract the value of any coupons or special offers from the customer’s monthly fee. Your MRR should reflect what you actually collect, not the sticker price.

This kind of discipline is what gives you a true picture of your committed revenue. And it’s a healthy picture across the board—Monthly Recurring Revenue showed a solid 7% increase across all subscription businesses in 2023. While the subscription model is clearly thriving, you’ll see different trends depending on the industry. You can dive deeper into the numbers by checking out this full subscription statistics report.

What to Exclude from Your MRR

Knowing what to leave out is just as important. Excluding the right things is critical for accuracy and stops you from making bad decisions based on inflated numbers.

My two cents: If it’s not predictable and recurring, it doesn’t belong in your MRR. Period. Including one-off payments creates a false sense of security and wrecks your ability to forecast accurately.

Here’s a clear list of what to keep out of your MRR math:

- One-Time Setup Fees: That initial fee you charge for setting up an account or onboarding a new client? It’s a one-and-done deal.

- Consulting or Training Fees: Any fees for professional services, like a one-off training session or a custom implementation project, don’t belong here.

- Variable Usage Charges: Fees based on consumption—like charges per email sent or per gigabyte of data used—are just too unpredictable for MRR.

- One-Off Purchases: Any hardware sales or single-purchase digital products are definitely out.

Just imagine you charged a client a $5,000 one-time consulting fee and mistakenly added it to your MRR. The next month, that revenue is gone. It creates a massive, artificial dip in your numbers that makes it look like your business is shrinking. Keeping your MRR clean helps you avoid that kind of financial whiplash.

How to Sidestep Common MRR Calculation Traps

The idea of Monthly Recurring Revenue seems simple enough on the surface, but a few hidden traps can quietly throw your numbers way off. Think of this as your field guide to dodging the common mistakes that inflate your MRR and lead you to make some bad decisions.

Once you know what to look for, keeping your data clean and trustworthy becomes second nature. A classic blunder I see all the time is confusing a booking with actual revenue. A booking is just a signed contract—it’s the promise of future money. It doesn’t become MRR until you’re actually providing the service and recognizing that revenue month by month.

Don’t Let Annual Contracts Inflate Your Numbers

Annual contracts are a godsend for cash flow, but they’re notorious for messing with MRR calculations if you’re not careful. Let’s say a customer pays you $1,200 upfront for a year. It’s incredibly tempting to log that as a big win for the month. But your MRR for that customer isn’t $1,200; it’s $100.

To calculate monthly recurring revenue correctly, you have to normalize that annual figure.

- Actionable Tip: Just take the total contract value and divide it by the term length (usually 12 months). This simple move keeps you from seeing a massive, artificial spike in the month you close the deal, followed by a painful drop-off.

Getting this right keeps your growth trends smooth and realistic. You’ll avoid the financial whiplash that comes from one-off cash injections pretending to be predictable income.

Watch Out for Discounts and Prorated Payments

Another easy mistake is forgetting about discounts. Your MRR should always reflect the cash you actually expect to collect, not the sticker price of your plan. If your $50/month plan has a 20% discount, the MRR from that customer is $40, plain and simple. It’s a small detail that can add up to a huge discrepancy across your entire customer base.

And what about customers who sign up in the middle of a billing cycle? Those initial prorated payments can also muddy the waters.

Key Takeaway: The best practice is to start counting the full MRR for a new customer in their first full month of service. That initial prorated charge? Treat it as a one-time payment and leave it out of your MRR calculation to keep your data pure.

The Problem of Serial Churners

Dealing with churn is already a headache, but it gets even trickier with “serial churners”—customers who cancel and then pop back up a short time later. This on-again, off-again behavior is on the rise, especially with younger consumers. In fact, some studies show that up to 20% of churners return within six months, which can really mess with your projections if you aren’t tracking it properly. You can find more on this in a great piece about how subscription trends are changing.

To handle this, you need a clear policy in place:

- Reactivation MRR: When a former customer comes back, count their revenue as ‘Reactivation MRR,’ not ‘New MRR.’

- Clear Timelines: Decide on a timeframe. For instance, a customer returning within 90 days is a reactivation. One who comes back after a year? You can probably count them as new.

Separating these customers gives you a much clearer picture of both your churn rate and your true new customer growth. By sidestepping these common traps, you can be confident that the number you use to calculate monthly recurring revenue is a real, reliable indicator of your business’s health.

Turning Your MRR Data into Smarter Decisions

Getting your monthly recurring revenue numbers right is a huge step, but it’s really just the beginning. The real magic happens when you start using that data to guide your business. Your MRR isn’t just a number on a spreadsheet; it’s a living, breathing indicator of your company’s health.

Once you have a reliable MRR figure, you can finally stop guessing and start strategizing. It tells you when you’ve got the cash flow to take calculated risks, like investing in a new marketing campaign or hiring that developer you desperately need. It turns a gut feeling into a data-backed move.

For example, seeing a consistent 10% month-over-month MRR growth might be the green light you need to confidently increase your ad spend. On the flip side, if that growth suddenly flattens out, it’s a blaring alarm bell telling you to figure out why before you pour any more money down the drain.

Creating Reliable Forecasts and Setting Targets

Honestly, one of the most powerful things you can do with your MRR is build solid revenue forecasts. By looking at your historical trends—your new business, your upgrades, and your churn—you can project where you’ll be in three, six, or even twelve months with a surprising degree of accuracy.

This isn’t just about predicting your bank balance. It’s about setting realistic goals that your team can actually get behind. With a clear forecast in hand, you can set sales quotas and marketing targets that make sense. No more plucking numbers out of thin air and hoping for the best.

Key Insight: When your sales team knows that hitting a specific New MRR target directly contributes to a company-wide bonus or the next big product feature, their goals suddenly feel a lot more meaningful. It connects what they do every day to the bigger picture.

Pairing MRR with Other Key Metrics

While MRR is your North Star metric, it doesn’t tell the whole story on its own. To get a truly complete picture of your business’s health, you need to see how it plays with other crucial numbers.

Two of the most important metrics to watch alongside your MRR are:

- Customer Acquisition Cost (CAC): This is what you spend, on average, to get a new paying customer in the door.

- Customer Lifetime Value (LTV): This is the total amount of money you expect to earn from a single customer over their entire time with you.

When you put these together, you get the LTV-to-CAC ratio, which is a fantastic indicator of your long-term profitability. A healthy ratio, often cited as 3:1 or higher, means you’re not just acquiring customers, you’re acquiring them profitably. Looking at these alongside other key product-led growth metrics will give you a well-rounded view of how you’re really doing.

A Real-World Case Study

Think about a small online course platform. For a long time, they just looked at their total MRR, and things looked great—it was growing steadily. But then they decided to dig a little deeper and segment their MRR by customer type: individual learners vs. small business teams.

What they found was a game-changer. They saw that while individual learners made up 70% of their customer base, the business teams had a much higher expansion MRR (they were buying more seats) and a significantly lower churn rate.

This one insight completely changed their direction. They started building features specifically for teams and shifted their marketing budget to attract more business clients. It’s a perfect example of the practical business growth strategies for small businesses that good data can unlock. They didn’t just grow; they grew smarter.

Still Have Questions About Calculating MRR?

Even after you’ve got the basics down for how to calculate monthly recurring revenue, a few tricky situations always seem to pop up. These are the details that can throw a wrench in your calculations and leave you second-guessing your numbers.

Let’s clear up some of the most common head-scratchers I see with business owners. Getting these right is what turns MRR from a vanity metric into a reliable number you can actually use to make smart decisions.

How Should I Handle Annual Contracts in My MRR?

This one comes up all the time. A customer pays you $2,400 upfront for a full year of service. It’s fantastic for your bank account, but it can completely distort your MRR if you don’t handle it correctly.

Here’s the golden rule: you have to normalize it.

Don’t ever count the full $2,400 in the month the cash hits your account. Instead, you spread it out. Just divide the total contract value by the number of months in the term (which is usually 12). So, that $2,400 contract becomes $200 in MRR from that customer, recognized each month for the next year. This simple step keeps your revenue projections smooth, predictable, and honest.

Should Discounts and Coupons Be Factored into MRR?

Yes. 100%. This isn’t optional if you want an accurate picture of your business.

Your MRR should always reflect the cash you actually expect to collect from a customer on a recurring basis, not your sticker price.

Let’s say your standard plan is $100/month, but a new customer signed up with a 25% off coupon. The MRR you book for that customer is $75, not $100. If you ignore discounts, you’re just inflating your numbers and fooling yourself. Across hundreds of customers, this small oversight can lead to a massive overstatement of your true revenue.

Key takeaway: The whole point of MRR is to track committed recurring revenue. A discount is your commitment to charge less, so it has to be reflected in the final number. No exceptions.

What Is the Real Difference Between MRR and Cash Flow?

Understanding this distinction is absolutely crucial. They’re related, but they tell you two completely different—and equally important—stories about your business’s health.

- MRR (Monthly Recurring Revenue): Think of this as your momentum metric. It shows the predictable, recurring revenue your subscriptions generate, smoothed out into a monthly figure. It answers the question, “How fast is my subscription engine growing?”

- Cash Flow: This is your liquidity metric. It’s the raw cash moving in and out of your bank account. It includes everything—one-time setup fees, those big annual contract payments, payroll, rent, you name it. It answers the question, “Do I have enough money to pay the bills this month?”

You can easily have a business with a beautiful, growing MRR that is teetering on the edge of a cash crisis. Maybe all your bills are due on the 1st, but your big annual contract payments don’t land until the 30th. You need to track both metrics religiously. MRR tells you where you’re going; cash flow tells you if you have enough gas in the tank to get there.

At Business Like NZ Ltd, we’re experts at helping small businesses in Auckland go beyond the spreadsheets to build real, sustainable growth. If you’re tired of guessing and want to get true clarity on your financials, we’re here to help you build a solid plan for the future. Contact us today for business advisory services that make a real difference.